Search results with tag "Division of taxation"

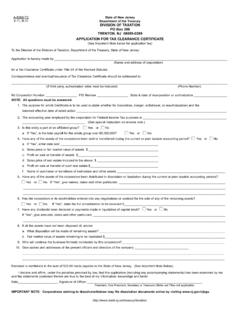

A-5088-TC State of New Jersey Department of the Treasury ...

www.state.nj.usTo the Director of the Division of Taxation, Department of the Treasury, State of New Jersey: Application is hereby made by _____ (Name and address of corporation) for a Tax Clearance Certificate under Title 54 of the Revised Statutes. Correspondence and eventual issuance of Tax Clearance Certificate should be addressed to: ...

STATE OF NEW JERSEY DEPARTMENT OF …

www.state.nj.usSTATE OF NEW JERSEY DEPARTMENT OF TREASURY DIVISION OF TAXATION NEW PROCEDURES FOR DISSOLUTION, WITHDRAWAL, OR SURRENDER IMPORTANT NOTE: The Division of Taxation in ...

ST-3NR (3-17) State of New Jersey DIVISION OF TAXATION ...

www.nj.govDIVISION OF TAXATION SALES TAX Form ST-3NR RESALE CERTIFICATE FOR NON-NEW JERSEY SELLERS For use ONLY by out-of-state sellers not required to be registered in New Jersey [THIS FORM IS NOT VALID UNLESS FULLY COMPLETED] Please read and comply with instructions on both sides of this certificate. SELLER Name Address New Jersey Tax …

New Jersey Division of Taxation Minimum Legal Price on ...

www.state.nj.usnew jersey division of taxation minimum legal prices on cigarettes as of october 01, 2018 by virtue of the authority granted by c247, laws of 1952, it is hereby declared, subject to subsequent change, that the minimum prices at which

Motor Vehicle Purchases/Leases - Government of New Jersey

www.nj.gov• Actual costs imposed by the New Jersey Motor Vehicle Commission for title and registration. 20. Can the dealership incorporate the Sales Tax due at the beginning of a long- ... from the dealership or from the Division of Taxation. The lessee may request a refund from the Division of Taxation by filing a Claim for Refund (Form A -3730). The ...

NOTICE - State of Rhode Island: Division of Taxation:

www.tax.ri.govProposed Regulation CT 15-04 - Redline Draft 2 REDLINE DRAFT for PUBLIC CONVENIENCE – NOT FOR PUBLIC RELIANCE State Of Rhode Island – Division Of Taxation Business Corporation Tax Regulation CT 04-04

NJ-W4 State of New Jersey - Division of Taxation Employee ...

www.nj.govYou must complete and submit a form each year certifying you have no New Jersey Gross Income Tax liability and claim exemption from withholding. If you have questions about eligibility, filing status, withholding rates, etc. when completing this form, call the Division of Taxation’s Customer Service Center at 609-292-6400. Instruction A ...

Real Estate Conveyance2 - State of Rhode Island: Division ...

www.tax.ri.govSTATE OF RHODE ISLAND AND PROVIDENCE PLANTATIONS Department of Revenue DIVISION OF TAXATION Excise Tax Section One Capitol Hill Providence, RI 02908-5800

New Jersey Tax Guide - Government of New Jersey

nj.govNew Jersey Business & Industry Association (NJBIA), has provided members with information and services as well as a number of other benefits to help New Jersey businesses prosper since 1910. The Division of Taxation has a list of . publications, including: • About New Jersey Taxes Bulletins (ANJs), which focus primarily on the Sales and Use

STATE AND LOCAL SALES/USE TAX RATE CHANGES

ksrevenue.govwebsite 60 days in advance (see EDU-96). For a current listingof the sales tax rates, visit the Kansas Department of Revenue website at: ksrevenue. gov /salesratechanges.html. EDU-96 Rev. 7-21. DIVISION OF TAXATION. 120 SE 10. th. Ave. PO BOX 3506. TOPEKA, KS 66601 -3506 PHONE: 785-368-8222 FAX: 785-296-2073 www.ksrevenue.gov

NJ-W4 State of New Jersey - Division of Taxation Employee ...

www.state.nj.usRATE TABLES FOR WAGE CHART The rate tables listed below correspond to the letters in the Wage Chart on the front page. Use these to estimate the amount of withholding

Cut Along Dotted Line - State

www.state.nj.usJun 15, 2021 · Division of Taxation Revenue Processing Center PO Box 222 Trenton, NJ 08646-0222 Enter amount of payment here: $, , . NJ-1040-ES 2021 Be sure to include your Social Security number on your check or money order to ensure proper credit for this payment. If you are a married/civil union couple, filing jointly, be sure that

2021 Composite Return Instructions - State

www.state.nj.usDivision of Taxation Revenue Processing Center PO Box 188 Trenton, New Jersey 08646-0188 Estimated Tax If the filing entity has filed a composite return in the pre-vious years and the amount estimated to be the total In-come Tax liability for the composite return for the current tax year exceeds $400, the filing entity must make quar-

Reg-1E, Application for ST- 5 Exempt Organization Certificate

www.myfoleyinc.comrequest the Division of Taxation's Technical Bulletin 46. Note: New Jersey and federal government agencies should not complete the REG-1E application. They are not issued an ST-5 certificate. They may contact the Regulatory Services Branch to request a letter confirming the agency's exempt status.

Similar queries

State, New Jersey, Division of Taxation, Application, DIVISION OF TAXATION NEW PROCEDURES FOR DISSOLUTION, WITHDRAWAL, OR, IMPORTANT, RESALE CERTIFICATE FOR NON, Government of New Jersey, Jersey, RHODE ISLAND, REDLINE DRAFT, New Jersey - Division of Taxation, Real Estate Conveyance2, Division, New Jersey Tax Guide, Kansas Department of Revenue