Search results with tag "Nebraska resale or exempt sale certificate"

Nebraska and County Lodging Tax Return 64 • MMPs must ...

revenue.nebraska.govbe collected if the exempt entity makes payment via any other charge card, even if a Nebraska Resale or Exempt Sale Certificate for Sales Tax Exemption, Form 13 is provided. Federal Purchases. Purchases by the U.S. Government or its agencies must be supported with either a federal certificate of exemption or payment with a U.S. Treasury warrant.

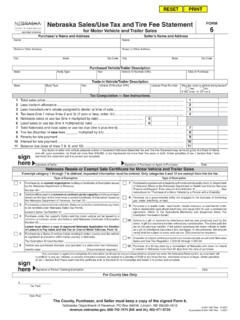

Nebraska Sales/Use Tax and Tire Fee Statement for Motor ...

revenue.nebraska.govNebraska Resale or Exempt Sale Certificate for Motor Vehicle and Trailer Sales. Nebraska Department of Revenue, PO Box 94818, Lincoln, NE 68509-4818. revenue.nebraska.gov, 800-742-7474 (NE and IA), 402-471-5729

Nebraska Resale or Exempt Sale Certificate FORM …

www.unmc.educertificate, purchasers must include: (1) identification of both the purchaser and seller, (2) a statement as to whether the certificate is for a single purchase or is a blanket certificate for future sales,