Search results with tag "Health savings accounts"

2022 guidelines for health savings accounts (HSA)

www.uhc.comThe UnitedHealthcare plan with Health Savings Account (HSA) is a high deductible health plan (HDHP) that is designed to comply with IRS requirements so eligible enrollees may open a Health Savings Account (HSA) ... including but not limited to restrictions on distributions for qualified medical expenses set forth in section 213(d) of the ...

Leaving Us: Involuntary terminations - U.S. Bank

www.usbank.comMedical, dental, vision, Health Savings Account (HSA), 401(k), etc. • Transit plans or Metropass • Flexible spendingaccounts You must continue to review and update your beneficiaries by visiting Your Total Rewards. What to know about continuing your coverag . e Coverage Details . Medical, dental, vision, term life and healthcare flexible ...

Understanding Contribution Reporting for Your Health ...

www.fidelity.comUnderstanding Contribution Reporting for Your Health Savings Account (HSA) Fidelity Investments is committed to providing concise, detailed information so that you can complete your income tax returns and manage your accounts. The 5498-SA Tax Form is not required to report your HSA contributions so Fidelity no longer issues a

ACTIVE NOTICE OF ELECTION (NOE) - South Carolina

www.peba.sc.govHealth Savings Account. (Additional forms will be required to establish your HSA. Refer to your . Tax-Favored Accounts Guide. for more information.) If you would also like to enroll in a. limited-used Medical Spending Account. for eligible dental and vision expenses, complete . Section D.

CASH SUPPLEMENT TO HEALTH SAVINGS ACCOUNT …

resources.healthequity.comtier of HSA cash held in federally insured deposit accounts; such top five HSA providers is determined based upon HSA assets under custody as conclusively set forth in the annual Devenir Research Year-End HSA Market Statistics & Trends report (the “Annual Market Survey”) or, if not published, such other third-party HSA market report selected

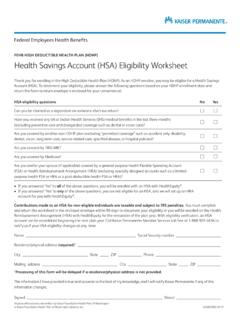

Federal Employees Health Benefits | Health Savings Account ...

wa.kaiserpermanente.orgHealth Savings Account (HSA) Eligibility Worksheet LG0001892-50-17 Thank you for enrolling in the High Deductible Health Plan (HDHP). As an HDHP enrollee, you may be eligible for a Health Savings ... Federal Employees Health Benefits. Kaiser Permanente Nondiscrimination Notice

2021 Faculty & Staff Benefits Summary

hr.psu.eduAutomatic enrollment in a Health Savings Account (HSA) Health Savings Account (HSA) If you elect the PPO Savings Plan, a Health Savings Account (HSA) will be opened . automatically. The plan includes a debit card for easier access to funds and is administered by HealthEquity. Penn State will contribute funds to the account based

2022 EMPLOYEE BENEFITS GUIDE

www.phoenix.govHealth Clinic 14 Eligibility 15 Health Plans 18 Choosing Your Health Plan – Things to Think About 19 BCBS Saver’s Choice Plan with HSA 20 BlueCare Anywhere Virtual Health Visits 21 Health Savings Account (HSA) 22 Banner | Aetna HMO 24 98point6 Virtual Health Visits 25 BCBS PPO 26 Health Plans at a Glance 28 Pharmacy Benefits 30

What's a Health Savings Account? - Centers for Medicare ...

marketplace.cms.govHealth Savings Account? A Health Savings Account (HSA) is a type of personal savings account you can set up to pay certain health care costs. An HSA allows you to put money away and withdraw tax free, as long as you use it for qualified medical expenses, like deductibles, copayments, coinsurance, and more. You’re eligible to

FastFacts High Deductible Health Plans - OPM.gov

www.opm.govA High Deductible Health Plan (HDHP) is a health plan product that combines a Health Savings Account (HSA) or a Health Reimbursement Arrangement (HRA), traditional medical coverage and a tax-advantaged way to help save for future medical expenses while providing flexibility and discretion over how you use your health care dollars today.

Health Savings Account (HSA) FAQ — Participants

roberthalfbenefits.comHealth Savings Account (HSA) FAQ — Participants What is a Health Savings Account (HSA)? HSAs are individually owned accounts that work similar to

Health Saving Accounts What you can (and can’t) pay for ...

communications.fidelity.com• If age 65 or older, coverage for employer-sponsored health insurance, including the cost of retiree health insurance Only qualified medical expenses incurred after an HSA is established3 are eligible for payment or reimbursement from an HSA. To learn more about how a health savings account works, view a short video, “Using Your Health

Health Savings Accounts (HSAs) – Distribution Rules

www.haylor.comA Health Savings Account (HSA) is a trust or account used to pay medical expenses that a high deductible health plan (HDHP) does not pay. HSAs offer triple tax advantages to account owners, including tax exemptions for contributions, earnings and distributions. To obtain the last exemption, HSA holders must follow strict rules for spending HSA ...

UPMC Consumer Advantage health savings account

www.hr.pitt.eduNo wonder a health savings account (HSA) linked to a qualified high-deductible health plan is so popular. A UPMC Consumer Advantage HSA lets you save, invest, and spend funds for qualified medical expenses in a way that can lower your income taxes as well. HSA dollars that you put aside but don’t use rollover from year to year, making

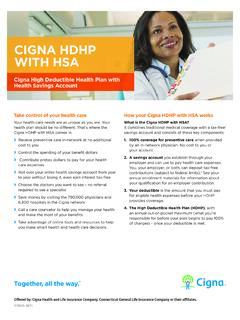

CIGNA HDHP WITH HSA

www.cigna.comYour 2015 Health Savings Account* (you can contribute up to the federal limit, inclusive of any employer contributions, if applicable) Individual $3,350 Family $6,650 Your deductible A deductible is the amount you must pay for eligible health expenses before your HDHP provides coverage. You can meet your deductible by using your health savings ...

The HSA for Life - Bank of America

healthaccounts.bankofamerica.comThe HSA for Life® About The HSA for Life A Health Savings Account (HSA) is a personal savings account that works in combination with an HSA-qualified health plan to let you set aside money on a pre-tax basis to help save for health care expenses.1 Your HSA can be used now, next year or even when you’re retired. How it works 1. Save it.

Saving money now and in the future PayFlex health savings ...

content.payflex.comSaving money now and in the future. PayFlex ® health savings account (HSA) Want to reduce your taxable income and increase your take-home pay? Enroll in an HSA today and start saving

HIGH DEDUCTIBLE HEALTH PLANS AND EXPENSES RELATED …

www.irs.govan individual covered by the HDHP will not be disqualified from being an eligible individual under section 223(c)(1) who may make tax-favored contributions to a health savings account (HSA). Part of the response to COVID-19 is removing barriers to testing for and treatment of COVID-19. Due to the nature of this public health emergency, and to avoid

A Consumer’s Guide to the Health Savings Account (HSA)

www.aetnafeds.com2004. It is an easy-to-understand guidebook that gives you the information you need to know about HSAs. Even with this information you need to review your own situation. Everything in here may not apply to you. You also need to decide if a Health Savings Account (HSA) is right for you. If you do have an HSA,

Kiplinger's Retirement Planning 2022

store.kiplinger.com94 Why You Should Save in an HSA A health savings account offers triple tax benefits when you use it to pay for health care expenses in retirement. LIVE WELL 96 Great Places to Retire We went searching for small, diverse cities with vibrant downtowns, lots of recre-ational activities and easily accessible health care. Other must-haves includ-

2021 County of San Diego Employee Benefits Guide

www.sandiegocounty.govSep 11, 2020 · for eligible employees and their dependents. You enroll in the benefits you want and waive ... • Any amounts over the Flex Credits is your out-of-pocket expense. *Based on 24 pay periods in the year/twice monthly deductions. ... Health Savings Account (HSA)1 Health Reimbursement Account (HRA)2 Health Care Flexible Spending Account (HCFSA)

Changing Your Elected Health Savings Account (HSA) …

benefits.cat.comChanging Your Elected Health Savings Account (HSA) Payroll Contribution Amount ***Please Note: Any changes made to your elected HSA payroll contribution amount will take effect on the 1st day of the following month*** ***If you would like personal assistance with this process, please contact the Caterpillar

Common FSA eligible/ ineligible expenses - Optum

www.optum.comexpenses are qualified for reimbursement under your specific plan. If you are currently participating in a high-deductible health plan (HDHP) and are contributing to a health savings account (HSA), you may also participate in a limited purpose FSA (LPFSA). Eligible LPFSA expenses are limited to dental and vision. Common eligible health care ...

Health Savings Account (HSA) & Flexible Spending Accounts ...

www.tn.gov6 Growing your HSA funds for the future Once you have a minimum balance of $1,000 in your HSA, you can open an investment account and start investing your HSA dollars.

Table of Contents - CentraCare Health

www.centracare.comHealth Savings Account (HSA) / High Deductible Plan HSA ANNUAL EMPLOYER CONTRIBUTION = $1,000 SINGLE / $2,000 FAMILY – PRORATED FOR MID-YEAR ENROLLEES PHYSICIAN, PROFESSIONAL, AND RELATED OFFICE VISITS

Prepare Your 2020 Benefits - Elior North America

assets.elior-na.comHealth Savings Account (HSA) The company will fund your HSA account up to $500 for Employee Only coverage and $1,000 for all other tiers of coverage. The contributions will be made quarterly. Also, you can contribute pre-tax dollars from your paycheck to use for eligible healthcare expenses throughout the year. This has several advantages:

HSA, Archer MSA, or Medicare Advantage MSA Information 2

www.irs.govThis information is submitted to the IRS by the trustee of your health savings account (HSA), Archer medical savings account (MSA), or Medicare Advantage MSA (MA MSA). Generally, contributions you make to your Archer MSA are deductible. Employer contributions are excluded from your income and aren’t deductible by you.

MANY WAYS TO ACCESS YOUR HSA FUNDS. - Cigna

www.cigna.comYOUR HSA FUNDS. Choose what works best for you. Cigna offers many convenient, easy-to-use options to pay for eligible health care expenses from your Health Savings Account (HSA). Review the information below to decide which option best fits your needs. continued on back > ONLINE BILL PAY / ONLINE TRANSFER This option might be right for you if:

The Chase Health Savings Account (HSA) - Haverford College

www.haverford.eduContribution Limits The annual amount you can contribute to an HSA is set by federal regulations. For 2013, the maximum annual contribution is $3,250 for self-coverage and $6,450 for family contributions. If you're 55 or older, you can make catch-up contributions. Our contribution calculator can help you determine your individual maximum.

SAMPLE PLAN DOCUMENT SECTION 125 FLEXIBLE …

www.quitmanschools.orgHealth Savings Account on a pretax basis in accordance with Section X of the Plan and the following provisions: HSA Trustee – N/A Maximum Contribution – N/A Limitation on Eligible Medical Expenses – For purposes of the Medical Reimbursement Plan, Eligible Medical Expenses of a Participant that is eligible

Limited Purpose FSA Eligible Expense List

www.benstrat.comEligible Expense List IMPORTANT: An LP FSA covers eligible dental, orthodontia and vision expenses only and is intended for employees enrolled in a Health Savings Account (HSA). Eligible Dental & Orthodontia Expenses Dental care for non-cosmetic purposes, such as: • Cleanings and exams • Crowns and bridges • Dental reconstruction, implants

DXC 2022 Benefits Annual Enrollment

dxc.makeityoursource.comYou won’t have access to a Health Savings Account (HSA). If you had an HSA in 2021, it will move to a retail account (i.e., non-DXC-sponsored). Although you may be able to enroll in an HSA later, there are implications to waiting (see the …

A Consumer’s Guide to the Health Savings Account (HSA)

content.payflex.comHSA Road Rules has been a valuable resource for millions of Americans since 2004. It is an easy-to-understand guidebook that gives you the information you

2021–2022 Fiduciary Calendar

sponsor.fidelity.comHealth savings account (HSA) tax reporting Fidelity will mail the 1099-SA and 5498-SA forms as required. Distributions involving unitized stock Deadline to submit cash or in-kind distributions of unitized stock shares from plans that don’t offer a share-accounted fund. It must be done before markets close on this date.

BASIC PLAN DOCUMENT - Paychex

download.paychex.comAgreement, an HSA-Eligible Individual can make pretax salary reduction Contributions to a Health Savings Account (“HSA”) under section 223 of the Code. 1.02 Restatement of the Plan. If specified in Item II of the Adoption Agreement, this Plan is an amendment,

HSA Rollover or Transfer Request

www.optum.comHSA Rollover or Transfer Request . To expedite your health savings account (HSA) rollover or transfer, please work directly with the bank where your HSA funds are currently on deposit. Many banks require that you use their form, so please check with your current bank to be sure they will accept our form, before proceeding with this form.

FDIC-Insured Deposit Sweep Program Disclosure

www.fidelity.comFidelity SIMPLE IRAs (each an Individual Retirement Account, or IRA) and/or the Fidelity Health Savings Account (HSA) (each an “Account”). It is incorporated into and forms a part of the Customer Agreement governing your Account. If you have questions about an IRA, you can call a Fidelity Representative at 800-544-6666.

Health Savings Account Investment Options - Bank of …

healthaccounts.bankofamerica.comHealth Savings Account Core Investment Menu The following list of mutual funds represents the core investment menu for the Bank of America Health Savings Account. If you have an account through your employer, you may have different mutual fund options. Please login to the member website and select Manage Investments to view your fund lineup.

Health Savings Account (HSA) Custodial Agreement

www.viabenefitsaccounts.com“HSA”) has been approved and is established. You and the Custodian agree to be bound by the terms of this Health Savings Account Custodial Agreement (“Custodial Agreement” or “Agreement”) in connection with the administration of your HSA and understand this is a legal contract between you, as the Account Holder, and us, as the ...

HEALTH SAVINGS ACCOUNT (HSA) - TRI-AD

www.tri-ad.comWhat is the Mercer Marketplace 365 Health Savings Account (HSA)? The Mercer Marketplace 365 HSA is a tax-exempt plan that works in conjunction

Health Savings Account (HSA) user guide - Optum

www.optum.comdeductible health plan (HDHP) and open an HSA with Optum Financial. The best way to save is to make a plan — and stick to it. Opening an account • Go online and follow the directions to open an account. Have your high-deductible health plan information handy. • If you are opening an Optum Financial HSA at work, your employer

Health Savings Account (HSA) Investment Fund List

docs.payflex.cominherent to investing in each fund. Investors should always read the prospectus carefully before making any investment decision. System response and account access times may vary due to a variety of factors, including trading volumes, market conditions, system performance, and other factors. ©2020 PayFlex Systems USA, Inc. 69.03.478.1 G (1/20)

Similar queries

Health Savings Account, Qualified medical expenses, U.S. Bank, Contribution, Fidelity Investments, Devenir, End HSA, Federal Employees Health Benefits, Health, Health Savings Account HSA, Enrollment, GUIDE, Savings account, Expenses, Eligible, High Deductible Health, Health Savings Account (HSA) FAQ — Participants, Employer, Health Savings Accounts (HSAs) – Distribution Rules, Account, UPMC Consumer Advantage health savings account, CIGNA HDHP, Your, Your HDHP, Bank, Savings, Guidebook, Expense, Optum, Health Savings Account (HSA) & Flexible Spending Accounts, CentraCare Health, Elior, Your HSA, From your, Cigna, PLAN DOCUMENT SECTION 125 FLEXIBLE, Limited Purpose FSA Eligible Expense List, Eligible Expense, 1099, Distributions, Paychex, Bank of, Bank of America Health Savings Account, Administration, Health Savings Account (HSA) Investment Fund List, Investment, Performance