Search results with tag "Low income housing tax"

An Introduction to the Low-Income Housing Tax Credit

fas.orgJan 26, 2021 · An Introduction to the Low-Income Housing Tax Credit The low-income housing tax credit (LIHTC) program is the federal government’s primary policy tool for encouraging the development and rehabilitation of affordable rental housing. The program awards developers federal tax credits to offset construction costs in exchange for

2022 Tax Exempt Request for Proposals - phfa.org

www.phfa.orgPlease be reminded that eligibility for tax exempt bond financing does not ensure qualification or eligibility under the 2022 Allocation Plan for Low Income Housing Tax Credits (“Allocation Plan”) for applicants seeking federal Low-Income Housing Tax Credits (“Tax Credits”) for a portion of the development financing.

An Introduction to the Low-Income Housing Tax Credit

sgp.fas.orgJan 26, 2021 · Certainty and Disaster Tax Relief Act of 2020, enacted as Division EE of the Consolidated Appropriations Act, 2021 (P.L. 116-260), sets a minimum credit (or “floor”) of 4% for the housing tax credit typically used for the rehabilitation of affordable housing. In other words, the effective rehabilitation credit rate cannot fall below 4%.

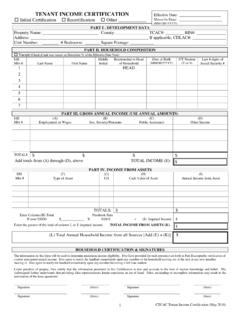

Tenant Income Certification

www.treasurer.ca.govand Economic Recovery Act (HERA) of 2008, which requires all Low Income Housing Tax Credit (LIHTC) properties to collect and submit to the U.S. Department of Housing and Urban Development (HUD), certain demographic and economic information on tenants residing in LIHTC financed properties.

2022 Annual Funding Round Timeline - novoco.com

www.novoco.comThe Delaware State Housing Authority (DSHA) is pleased to announce that it will be authorizing the allocation of Delaware's Low Income Housing Tax Credits (LIHTC). Delaware's share of per capita plus returned and carry forward components of LIHTC is estimated to total $2,975,000.

Tenants’ Rights: After Jan. 1, 2021 During Governor’s ...

www.dhcd.virginia.govHUD, USDA, and Treasury (Low Income Housing Tax Credit), and properties with federally backed mortgages (e.g., FHA, Fannie Mae, and Freddie Mac). Your public housing authority or landlord must give you 30 days notice before proceeding with an evictions filing. They will need to: