Transcription of 2018 Benefits Enrollment - About Schwab

1 TotalValue Plan it. Own it. Achieve it. 2018 Benefits Enrollment Guide When you enroll, you have important decisions to make to get the greatest value from your Benefits . What's Enrollment Checklist 1. Health and Wellness 2. Financial Programs 8 Welcome to Benefits Enrollment Work/Life Programs 10. Cost of Coverage 13. You are committed to improving our Contacts 14 client's lives every day. We want to do Legal Notices 15. the same for you. That's why we offer a valuable Benefits package designed to empower you to meet your needs today and help you plan for the future. Every benefit provides value. For example, medical helps you get and stay healthy, and disability provides a financial safety net if the unexpected happens. You get the total value from your Benefits when you understand them and how they can work together to support your health and financial well-being. When you enroll, you need to make some important decisions to help you get the greatest value from your Benefits in 2018 .

2 Plan it. Set aside time to review and select your Benefits . Think About the coverage you and your family will need. Own it. Invest time to use online resources to choose each benefit wisely. Selecting the right Benefits for your situation now can really add up in the long run. Achieve it. Make the most of your Benefits . For example, take advantage of preventive care checkups and special programs and resources to help you manage your health and expenses. This guide describes your benefit options and actions you need to take to enroll. Please review it carefully and share it with your family, because you can only enroll one time during the year, unless you experience a qualifying change in status (see page 1). Your Enrollment Checklist Complete this checklist, read the guide, When do you need to enroll? use online tools and resources on the Schweb to help you make decisions. Go During open Enrollment You can elect or make changes only one to jumpword: Benefits .

3 Time each year during open Enrollment , unless you experience a Understand how your health plan qualifying change in status. works. Do you have the right medical, As a new hire You must enroll within 31 days of your first day of dental and vision coverage? Learn more About the plans by reviewing employment with Charles Schwab . Your Benefits will take effect on the Summary Plan Description on the first day of the month following your date of hire. the Schweb. If you miss the deadline: Consider your costs. Review your During open Enrollment Your current Benefits will continue, except cost of coverage on page 13. for the Dependent Care Flexible Spending Account (FSA). If you want Consider disability, additional life to contribute to the FSA, or receive Schwab 's FSA contribution, you and AD&D coverage. Do you have the right coverage to help pay bills if you must re-enroll. become disabled or pass away? As a new hire You will only have life insurance equal to two times Take advantage of the spending your base salary.

4 You will have no medical, dental, vision, disability accounts. Health Savings and coverage or a dependent care Flexible Spending Account through Dependent Care Flexible Spending Schwab . Accounts allow you to set aside pre-tax money to help pay for eligible How to make changes during the year health care or day care expenses, respectively. During the year you can only make changes if you experience a qualifying Access Workday to enroll by the change in status ( , marriage, divorce, separation, birth or adoption, deadline. If you're a new hire, you change in residence or workplace, gain or loss of other coverage). have 31 days from your date of hire Remember, you must make benefit changes within 31 days of the to enroll. qualifying change in status event date or you will have to wait until Add or review your dependents'. the next open Enrollment period. For complete information, refer to the information in Workday. Provide or verify information: Summary Plan Description.

5 Make sure the information is complete and accurate. Confirm Social Security numbers: Social Security numbers are required, and names in Workday must match those on file with the Social Security Administration. Enroll in or review your 401(k). account and review other Benefits . 1. Health and Wellness Nothing is more important than your overall health and well-being. Add up the value: Save Health care Benefits , including medical, dental and vision coverage, time and money with UHC help keep you and your family healthy and provide protection in the UHC offers special programs event of illness or injury. such as the Optum NurseLine, enhanced care management, Medical Healthy Pregnancy Program Schwab 's medical plan offers comprehensive care through and virtual visits. Knowing UnitedHealthcare (UHC) or Kaiser in certain locations. By making About them will help you get smart decisions About how you use your medical Benefits , you can the greatest value from your achieve better health and manage your costs.

6 Benefits . UHC + HSA. Meet Jessica. She works UHC + HSA provides coverage for in-network and out-of-network care, at Schwab and has two so you can see any doctor. You will pay less out of pocket and a lower kids under age 8. Instead deductible when you use in-network doctors because UHC negotiates of going to the pediatrician lower rates and higher discounts with these providers. every time her kids have the sniffles, stomach ache or Kaiser + HSA. other minor concerns, she takes advantage of UHC's If you live in California or Colorado, you may enroll in a Kaiser medical virtual visits. She can see and plan. Kaiser requires you to use only their physicians, facilities, speak to a physician from any pharmacy, hospital and laboratories, except in an emergency. You mobile device or computer, and your covered family members each select a doctor from Kaiser's and the doctor can make a network of physicians to be your Primary Care Physician (PCP) and diagnosis and, if necessary, coordinate your care.

7 Write prescriptions for a local pharmacy. This program offers Prescriptions the convenience of virtual When you enroll for medical coverage, you automatically receive visits from home and a lower prescription drug coverage, which is administered by CVS Caremark cost per visit (generally if you have UHC. Kaiser operates its own pharmacy plan that Kaiser $40 $50). Visit members must use. to take advantage of all With UHC, when you or your covered dependents need a prescription, the special programs and you can go to any pharmacy; however, the plan provides a higher level resources available to you. of coverage at in-network pharmacies and your deductible is waived for some preventive drugs. The Preventive Drug List is available on the Schweb, jumpword: Caremark. If you use an out-of-network pharmacy, you pay more out of pocket, and you must also pay the full cost of your prescription and then submit a claim for reimbursement. 2. MEDICAL PLANS AT A GLANCE.

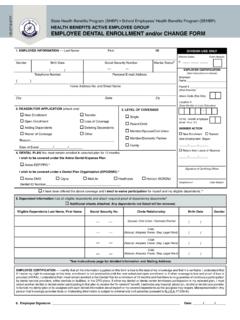

8 UHC + HSA KAISER + HSA 2. PLAN FEATURES IN-NETWORK1. (YOU PAY). (YOU PAY). Medical Tools and Annual Deductible Resources Individual/family $1,350/$2,700. Out-of-Pocket Maximum Take control of your costs and Individual/family $2,900/$5,800 manage your claims know Schwab Annual HSA Contribution before you go by using these $500/$1,000 tools and resources: Individual/family Additional $300 contribution3 for employees (UHC). with compensation4 =< $100k Medical Coverage Healthcare cost estimator Preventive Care/ Claims manager Screenings/ $0 Find a provider/doctor Immunizations Virtual visits Physician's Office and Access your HSA through Specialty Visits Optum Bank where you can: X-rays, Labs, Imaging, 15% coinsurance, after deductible (CT/PET scan, MRI). -- Find the receipt vault Urgent Care -- Check your balance, and Emergency Room 15% coinsurance, after 15% coinsurance, after -- Pay medical bills deductible deductible Access Outpatient Surgery for behavioral health services 15% coinsurance, after deductible Inpatient Hospital and EAP.

9 Chiropractic Care 15% coinsurance, after $15 per visit, after deductible up to 20 visits deductible, up to 20 visits (Kaiser). per year per calendar year Physical and 15% coinsurance, after 15% coinsurance, after E-visits Occupational Therapy deductible up to 60 deductible. Medically Video Visits combined visits necessary limit determined Chat online with a Kaiser by physician physician Speech Therapy Age 18 and over: 20 visits 15% coinsurance, after per calendar year deductible. Medically Access your HSA. Under age 18: 60 visits per necessary limit determined To access an ID card, look up calendar year by physician claims information, or find a Mental Health provider, download these mobile Outpatient 15% coinsurance, after deductible Inpatient 15% coinsurance, after 15% coinsurance, after apps: deductible. $500 penalty deductible Health4me (UHC). applies for non-notification Substance Abuse (Kaiser). Outpatient 15% coinsurance, after deductible Inpatient 15% coinsurance, after 15% coinsurance, after deductible.

10 $500 penalty deductible applies for non-notification Prescription Drugs Generic and 15% coinsurance, after deductible Preferred Rx Non-preferred Rx 25% coinsurance, after deductible 1. HC out-of-network medical coverage is available in the SPD. Jumpword: SPD. U. 2. K aiser + HSA is available to employees who live in CA and CO. Kaiser does not provide out-of-network coverage, except in cases of urgent care and emergency. 3. To receive the contribution, you must be enrolled in a Schwab medical + HSA plan as of Jan. 1, 2018 . Proration does not apply. 4. C ompensation is based on your Benefits Annual Rate (BAR) which is determined each October 1. See the Summary Plan Description for more information. 3. Health Savings Account (HSA). Schwab 's medical plans qualify as high-deductible health plans, giving you access to a tax-advantaged Health Savings Account (HSA). The HSA is a bank account that allows you to set aside pre-tax dollars. Schwab also contributes funds into the account that can be used to help you pay for eligible medical expenses now or later making the HSA.