Transcription of 2018 Bonitas Broker Cover - afhealth.co.za

1 Section A: Why BonitasFact sheet 3 How our plans work 4 Our plans 5 Savings 6 Contribution table 7 Section B: Contact detailsQueries and escalations 10 General 10 BonCap 10 Pharmacy Direct 11 Find a service provider 12 Section C: Membership and adminIndividual underwriting 14 Group underwriting 16 Application process 17 Network service providers 18GP referral process 19 PMB treatment plan 20 How to claim 21 Hospital pre-authorisation 22 Hospital networks 25 Locate a provider 35 Exclusions 36 Section D: Benefits and programmesChronic medicine 43 Register with Pharmacy Direct 45 Over-the-counter and acute medicine 46 Maternity benefits 47 Childcare benefits 48 Optical benefits 50 Dental benefits 52 Radiology benefits 55 Cancer programme 56 HIV/AIDS programme 58 Diabetes management programme 60 Back and neck programme 62 Hip and knee programme 63 Wellness benefits 64 Preventative care benefits 65 International travel benefit 66 Emergency medical services 67 INDEXINDEXP lease note: Product rules, limits, terms and conditions apply.

2 Where there is a discrepancy between the content provided in this brochure, the website and the Scheme Rules, the Scheme Rules will prevail. The Scheme Rules are available on request. Benefits are subject to approval from the Council for Medical SchemesSECTION A:WHY BONITASWHY BONITASPage 3 All claims are paid at the Bonitas Rate, unless otherwise stated. All benefits and limits are per calendar year, unless otherwise stated. Managed Care protocols apply. Benefits are subject to approval from the Council for Medical Schemes. SHEETOUR MEMBERS753 514 Principal membersTo t a l b e n e fi c i a r i e s348 08833 Average benefi ciary age46per memberAverage family rate (%) ageNumber of dependantsWHY BONITASA ffordable, quality healthcare for all South AfricansLargest GP network and a specialist network to give more value for moneyA wide range of plans including savings, traditional, income based and hospital options Cover for up to 60 chronic conditions and free medicine deliveryPartnerships with quality service providers and healthcare professionalsPreventative care and wellness benefits paid from risk so benefits last longerAdditional benefits for maternity and children, including access to 24/7 paediatric telephonic advice, 365 days a year Managed Care programmes to help members manage a range of conditions including cancer, mental health, HIV/AIDS and diabetesSeparate benefits for dentistry and optometry on several options, paid from riskSimple.

3 Easy to use benefits Affordable, quality healthcare for all South AfricansLargest GP network and a specialist network to give more value for moneyA wide range of plans including savings, traditional, income based and hospital options Cover for up to 60 chronic conditions and free medicine deliveryPartnerships with quality service providers and healthcare professionalsPreventative care and wellness benefits paid from risk so benefits last longerAdditional benefits for maternity and children, including access to 24/7 paediatric telephonic advice, 365 days a year Managed Care programmes to help members manage a range of conditions including cancer, mental health, HIV/AIDS and diabetesSeparate benefits for dentistry and optometry on several options, paid from riskSimple, easy to use benefits ratio OUR FINANCES*RRRbillion in expenditure 985call centre calls answered in 2016claims processed per day32 034 calls a month54 832hospital admissions authorisedper day447 OUR HIGHLIGHTS91%of claims paid within 5 days334 Wellnessdays held last year*As per the audited 2016 Annual Financial SHEETPage 4 All claims are paid at the Bonitas Rate, unless otherwise stated.

4 All benefits and limits are per calendar year, unless otherwise stated. Managed Care protocols apply. Benefits are subject to approval from the Council for Medical Schemes. OUR PLANS WORKHOW OUR PLANS WORKBONITAS TRADITIONAL OPTION Standard and Primary - No hospital network Standard Select - Hospital networkBONITAS TRADITIONAL OPTIONS tandard and Primary - No hospital networkTRADITIONAL OPTIONOUT-OF-HOSPITALDay-to-day benefitsSet benefit limits for daily medical expensesDoes not carry over each yearChronic benefits(including PMBs)NetworkNon-networkIN-HOSPITALU nlimited, at Bonitas RateBONITAS SAVINGS OPTION BonComprehensive, BonClassic, BonComplete and BonSave - No hospital network BonFit - Hospital network Above threshold benefit available on BonComprehensive and BonCompleteBONITAS TRADITIONAL OPTIONBONITAS SAVINGS OPTIONBonComprehensiveBonClassicBonCompl ete and BonSave - No hospital networkOUT-OF-HOSPITALDay-to-day medical expensesUse as you chooseCarry over each yearNetworkNon-networkIN-HOSPITALU nlimited, at Bonitas RateSelf-payment gapAbove threshold benefitsSAVINGS OPTIONA dditional benefits(giving you more value, does not affectother benefit limits or savings)- Maternity- Preventative care- Wellness- ChildcareChronic benefits(including PMBs) Bonitas INCOME BASED OPTION BonCap - Hospital networkPlease note.

5 Contributions for BonCap are income-based. Income will be verified once a year. BonComprehensive, BonClassic, BonComplete and BonSave - No hospital network BonFit - Hospital network Above threshold benefit available on BonComprehensive and BonCompleteBONITAS INCOME BASED OPTION BonCap - Hospital networkPlease note: Contributions for BonCap are income-based. Income will be verified once a benefit limits for daily medical expensesINCOME BASED OPTIONC hronic benefitsFor 27 PMBsNetworkIN-HOSPITALU nlimited, at Bonitas RateBONITAS HOSPITAL OPTION Hospital Plus, Hospital Standard and BonEssesntial - No hospital network Standard and Primary - No hospital network Standard Select - Hospital network Bonitas HOSPITAL OPTIONBONITAS HOSPITAL OPTION Hospital Plus, Hospital Standard and BonEssesntial - No hospital networkN/AHOSPITAL OPTIONC hronic benefitsFor 27 PMBsOUT-OF-HOSPITALOUT-OF-HOSPITALNon-ne tworkIN-HOSPITALU nlimited, at Bonitas RateAdditional benefits(giving you more value, does not affectother benefit limits or savings)

6 - Maternity- Preventative care- Wellness- ChildcareAdditional benefits(giving you more value, does not affectother benefit limits or savings)- Maternity- Preventative care- Wellness- ChildcareAdditional benefits(giving you more value, does not affectother benefit limits or savings)- Maternity- Preventative care- Wellness- ChildcarePage 5 All claims are paid at the Bonitas Rate, unless otherwise stated. All benefits and limits are per calendar year, unless otherwise stated. Managed Care protocols apply. Benefits are subject to approval from the Council for Medical Schemes. offer a range of 12 products that are simple to understand, easy to use and give our members more value for first-class savings plan offers ample savings, an above threshold benefit and extensive hospital memberAdult dependantChild dependantR5 7 7 4R5 446R1 1 7 5 This generous savings option offers a wide range of medical benefits, in and out of memberAdult dependantChild dependantR4 009R3 4 4 2R 990 This savings option offers generous savings.

7 An above threshold benefit and rich hospital memberAdult dependantChild dependantR3 2 1 2R2 572R 8 7 3 This savings option offers savings to use as you choose for medical expenses and extensive hospital memberAdult dependantChild dependantR2 3 0 4R1 785R 6 9 0 This savings plan offers basic Cover for day-to-day medical needs and essential hospital memberAdult dependantChild dependantR1 9 3 0R1 495R 5 7 8 This traditional option offers rich day-to-day benefits and comprehensive hospital memberAdult dependantChild dependantR3 265R2 8 3 1R 9 5 8 This traditional option uses a quality provider network to offer rich day-to-day benefits and hospital SELECTMain memberAdult dependantChild dependantR2 828R2 447R 828 This traditional option offers simple day-to-day benefits and hospital memberAdult dependantChild dependantR2 076R1 6 2 4R 6 6 1 This hospital plan offers comprehensive hospital benefits with some value-added PLUSMain memberAdult dependantChild dependantR2 8 9 7R2 607R 9 3 7 This hospital plan offers extensive hospital benefits with some value-added STANDARDMain memberAdult dependantChild dependantR1 830R1 5 4 3R 6 9 6 This hospital plan offers rich hospital benefits with some value-added memberAdult dependantChild dependantR1 604R1 2 2 7R 4 7 0 This traditional entry-level plan offers basic day-to-day benefits and hospital Cover using a network of doctors.

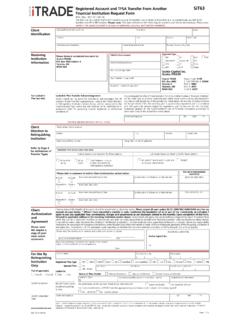

8 Providers and PLANS2018 Main memberAdult dependantChild dependantR0 to R7 500R 9 1 8R 870R 432R7 501 to R12 194R1 1 1 6R1 055R 5 1 2R12 195 to R16 659R1 820R1 620R 689R16 660+R2 235R1 990R 847 OUR PLANSPage 6 All claims are paid at the Bonitas Rate, unless otherwise stated. All benefits and limits are per calendar year, unless otherwise stated. Managed Care protocols apply. Benefits are subject to approval from the Council for Medical Schemes. amount payable towards the member s PERSONAL MEDICAL SAVINGS ACCOUNT which is included in the total monthly contribution payable by a memberAnnual savingsPlans%Main memberAdult dependantChild dependantBonComprehensive * 0 6 8R12 324R 2 6 8 0 4R 5 844R 1 680 BonComplete *15%R 5 7 7 2R 4 620R 1 572 BonSave16%R 4 428R 3 4 3 2R 1 332 BonFit15%R 3 480R 2 7 0 0R 1 044* These plans have an above threshold THE BALANCE OF YOUR PERSONAL MEDICAL SAVINGS IS USEDAny amount available in the Personal Medical Savings Account shall be utilised to provide benefits in respect of day-to-day medical expenses.

9 Provided there are actual funds available in a member s Personal Medical Savings Account, such funds may, in addition to providing for day-to-day benefits, be utilised to pay for services generally or specifically excluded from risk benefits or where the actual costs exceed the benefit payable or OF MEDICAL SAVINGS BENEFITSAt the beginning of each benefit year or on the date of joining the Scheme or this benefit option, each member shall be allocated a medical savings benefit for the year. This benefit shall be deemed to be an advance by the Scheme to the member and shall be equal to 12 (twelve) times the amount, pro-rated in respect of a member who joins the Scheme or this benefit option during the course of the member whose membership of the Scheme or of an option with a Personal Medical Savings Account is terminated during the course of a benefit year and whose claims exceeded the savings benefit advance.

10 Pro-rated on a monthly basis at the date of termination shall be liable to repay the excess / shortfall to the memberAdult dependantChild dependantSavingsR 1 3 0 6 8R 1 2 3 2 4R2 664 Self-payment gapR 3 810R 3 1 5 0R 1 4 5 0 Threshold levelR16 878R15 474R4 1 1 4 Above threshold benefitUnlimitedUnlimitedUnlimitedBONCOM PLETEMain memberAdult dependantChild dependantSavingsR5 772R4 620R1 572 Self-payment gapR 1 6 6 0R 1 4 0 0R 355 Threshold levelR7 432R6 020R1 927 Above threshold benefitR4 390R2 590R1 1 2 0 CLAIMS ACCUMULATE TO THE THRESHOLD AT 100% OF THE Bonitas RATEP lease refer to Annexure B of the Scheme Rules at for the full list of claims that accumulate to the 7 All claims are paid at the Bonitas Rate, unless otherwise stated. All benefits and limits are per calendar year, unless otherwise stated.