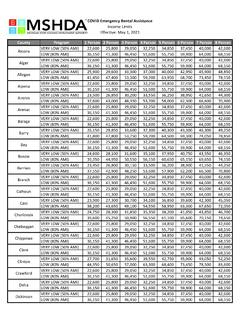

Transcription of 2021 ARIZONA INCOME LIMITS State of Arizona -- State ...

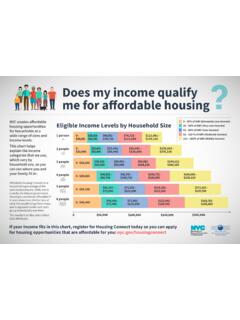

1 2021 ARIZONA INCOME LIMITSE ffective June 1, 2021 SHF FY2021 ARIZONA INCOME LimitsARIZONA COUNTIES6/1/2021 1 PERSON2 PERSON3 PERSON4 PERSON5 PERSON6 PERSON7 PERSON8 PERSON + Flagstaff, AZ Coconino County30%1615018450207502305024900267502 860030450 MEDIAN HOUSEHOLD50% (Very Low- INCOME )26900307503460038400415004455 0476505070060%32280369004152046080498005 3460571806084080% (Low- INCOME )4305049200553506145066400713 007620081150 Lake Havasu City-Kingman, AZ 30%1170013400150501670018050194002075022 050 Mohave County 50% (Very Low- INCOME )19500223002510027850301003235 03455036800 MEDIAN HOUSEHOLD60%2340026760301203342036120388 20414604416080% (Low- INCOME )3120035650401004455048150517 005525058850 Phoenix-Mesa-Glendale, AZ30%16600190002135023700256002750029400 31300 Maricopa - Pinal Counties50% (Very Low- INCOME )27650316003555039500427004585 04900052150 MEDIAN HOUSEHOLD60%3318037920426604740051240550 20588006258080% (Low- INCOME )4425050600569006320068300733 507840083450 Prescott, AZ Yavapai County30%1345015350172501915020700222502 375025300 MEDIAN HOUSEHOLD50% (Very Low- INCOME )22350255502875031900345003705 0396004215060%26820306603450038280414004 4460475205058080% (Low- INCOME )3575040850459505105055150592 506335067400 Tucson, AZ Pima County30%1445016500185502060022250239002 555027200 MEDIAN HOUSEHOLD50% (Very Low- INCOME )24050274503090034300370503980 0425504530060%28860329403708041160444604 7760510605436080% (Low- INCOME )3845043950494505490059300637 006810072500 Yuma, AZ Yuma County30%1135013000146001620017500188002 010021400 MEDIAN HOUSEHOLD50% (Very Low- INCOME )18900216002430027000292003135 0335003565060%22680259202916032400350403 7620402004278080% (Low- INCOME )3025034600389004320046700501 505360057050.

2 Apache County30%1085012400139501550016750180001 925020500 MEDIAN HOUSEHOLD50% (Very Low- INCOME )18100207002330025850279503000 0321003415060%21720248402796031020335403 6000385204098080% (Low- INCOME )2895033100372504135044700480 005130054600 : Cochise County30%1320015100170001885020400219002 340024900 MEDIAN HOUSEHOLD50% (Very Low- INCOME )22000251502830031400339503645 0389504145060%26400301803396037680407404 3740467404974080% (Low- INCOME )3520040200452505025054300583 006235066350 State of ARIZONA -- State housing Fund and CDBG ProgramsHOME, HOPWA, State HTF, NSP and CDBG Program INCOME LIMITS 2021 ARIZONA INCOME LIMITSE ffective June 1, 2021 SHF FY2021 ARIZONA INCOME LimitsARIZONA COUNTIES6/1/2021 1 PERSON2 PERSON3 PERSON4 PERSON5 PERSON6 PERSON7 PERSON8 PERSON + State of ARIZONA -- State housing Fund and CDBG ProgramsHOME, HOPWA, State HTF, NSP and CDBG Program INCOME LIMITS : Gila County30%1175013400151001675018100194502 080022150 MEDIAN HOUSEHOLD50% (Very Low- INCOME )19600224002520027950302003245 0347003690060%23520268803024033540362403 8940416404428080% (Low- INCOME )3130035800402504470048300519 005545059050 : Graham County30%1350015400173501925020800223502 390025450 MEDIAN HOUSEHOLD50% (Very Low- INCOME )22450256502885032050346503720 0397504235060%26940307803462038460415804 4640477005082080% (Low- INCOME )3595041050462005130055450595 506365067750 : Greenlee County30%1400016000180001995021550231502 475026350 MEDIAN HOUSEHOLD50% (Very Low- INCOME )23300266002995033250359503860 0412504390060%27960319203594039900431404 6320495005268080% (Low- INCOME )3725042600479005320057500617 506600070250.

3 La Paz County30%1105012600142001575017050183001 955020800 MEDIAN HOUSEHOLD50% (Very Low- INCOME )18400210002365026250283503045 0325503465060%22080252002838031500340203 6540390604158080% (Low- INCOME )2940033600378004200045400487 505210055450 : Navajo County30%1090012450140001555016800180501 930020550 MEDIAN HOUSEHOLD50% (Very Low- INCOME )18200208002340025950280503015 0322003430060%21840249602808031140336603 6180386404116080% (Low- INCOME )2905033200373504150044850481 505150054800 : Santa Cruz County30%1085012400139501550016750180001 925020500 MEDIAN HOUSEHOLD50% (Very Low- INCOME )18100207002330025850279503000 0321003415060%21720248402796031020335403 6000385204098080% (Low- INCOME )2895033100372504135044700480 005130054600