Transcription of 2021 Renters’ Tax Credit Application RTC-1 Form Filing ...

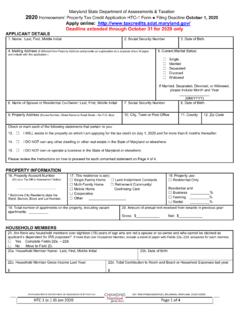

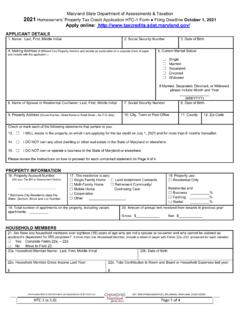

1 Maryland State Department of Assessments & Taxation 2021 renters tax credit application rtc -1 Form Filing Deadline October 1, 2021 Apply online RTC-1 ( ) Page 1 of 4 APPLICANT DETAILS 1. Name: Last, First, Middle Security Number3. Date of Address (If different from Property Address and provide an explanation on a separate sheet of paper and include with this Application .)5. Current Marital Status: Single Married Separated Divorced WidowedIf Married, Separated, Divorced, or Widowed, please include Month and Year _____ (MM/YYYY) 6. Name of Spouse or Residential Co-Tenant: Last, First, Middle Initial7.

2 Social Security Number8. Date of Address (Include Apartment Number No Box)10. City, Town or Post Office11. County12. Zip Code13. Applicant Status: Age Sixty (60) or Over Totally Disabled (Submit Proof) Under Age Sixty (60) with Dependent(s)14. Check one of the following which describes your rented residence: Apartment Building Unit Single Family House Mobile Home Other (Specify)_____15. Address from Previous Year (Include Apartment Number No Box)16. City, Town or Post Office17. County18. Zip Code19. Di d you reside in public housing in the previous year?

3 No you receive any rental assistance/subsidy? No Yes From whom _____21. Do you own any real estate in the State of Maryland or elsewhere? No Yes22. Do you rent from a person related to you, including In-Laws? No Yes Name and relationship _____RENTAL INFORMATION 23. Enter the amount of rent applicant paid each month in 2020:$_____ $_____ $_____ $_____ $_____ $_____ TOTAL RENT PAID 2020: January FebruaryMarch April May June $_____ $_____ $_____ $_____ $_____ $_____ $_____ JulyAugust September October November December 24.

4 Mark which utilities and/or services were included in the monthly rent:Utilities: None Electric (other than for heat) Heat Gas (other than for heat)Services: None Meals Pet Fee Housecleaning Parking Garage Fee Other _____25. Management Company or person (Landlord) to whom the applicant paid rent for at least six months in 2020:Name: _____ Address: _____ 26. Current Management Company or person (Landlord) to whom the applicant is now paying rent:Name: _____ Address: _____ HOUSEHOLD MEMBERS 27.

5 List all household residents who lived with you in 2019 below. If none, please check this box: 27a. Dependent? No Yes 27c. Date of Birth 27d. Social Security Number 27e. 2020 Gross Income $_____ Maryland State Department of Assessments & Taxation 2021 renters tax credit application rtc -1 Form Filing Deadline October 1, 2021 Apply online RTC-1 ( ) Page 1 of 4 2020 WAGES & INCOME 28. All accompanying schedules and documents MUST be submitted with this Application . DO NOT SEND ORIGINALS.

6 Applicant Spouse/Resident Co-Tenant Household Member(s) Office Use Only Wages, Salary, Tips, Bonuses, Commissions, Fees $ $ $ $ Interest & Dividends (Includes both taxable and non-taxable) $ $ $ $ Capital Gains (Includes non-taxed gains) $ $ $ $ Rental Income (Net) $ $ $ $ Business Income (Net) $ $ $ $ Room & Board paid to you by a nondependent household member, see instructions for Fields 27a-27e $ $ $ $ Workers Compensation $ $ $ $ Unemployment Insurance $ $ $ $ Alimony and/or Spousal Support $ $ $ $ Public Assistance Grants (Include copy of AIMS) $ $ $ $ Social Security (Include copy of 2020 Form SSA-1099) $ $ $ $ Benefits for 2020 (Include Proof) $ $ $ $ Railroad Retirement (Include copy of 2020 Verification or Rate Letter) $ $ $ $ Other Federal Pensions (Not including VA Benefits) per year $ $ $ $ Veterans Benefits per year $ $ $ $ Pensions and Annuities (If a rollover, include proof) $ $ $ $ IRAs (If a rollover, include proof) $ $ $ $ Deferred Compensation (Include W-2 Statement)

7 $ $ $ $ Gifts over $ $ $ $ $ Expenses Paid by Others $ $ $ $ Inheritances $ $ $ $ All other monies received last year not reported above $ $ $ $ TOTAL HOUSEHOLD INCOME FOR 2020 $ $ $ $ 29. Did you, and/or your spouse, file a Federal Income Tax Return for 2020? Yes No If yes, a copy of your return (and if married & Filing separately, a copy of your spouse s return) with all accompanying schedules MUST be submitted with this Application CERTIFICATION I declare under the penalties of perjury, pursuant to Sec. 1-201 of the Maryland Tax-Property Code Ann.

8 , that this Application (including any accompanying forms and statements) has been examined by me and the information contained herein, to the best of my knowledge and belief, is true, correct and complete, that I have reported all monies received, that I have a legal interest in this property, that this dwelling will be my principal residence for the prescribed period, and that my net worth is less than $200,000 excluding the value of the subject dwelling and homesite, IRAs and qualified retirement savings plans. I understand that the Department may request at a later date additional information to verify the statements reported on this form, and that independent verifications of the information reported may be made.

9 Further, I hereby authorize the Social Security Administration, Comptroller of the Treasury, Internal Revenue Service, the Income Maintenance Administration, Unemployment Insurance, the State Department of Human Resources, and Credit Bureaus to release to the Department of Assessments and Taxation any and all information concerning the income or benefits received. Applicant s Signature Date Applicant s Email Address Applicant s Daytime Telephone Number ( ) Spouse s or Resident Co-Owner s Signature Date RETURN TO: Department of Assessments and Taxation renters Tax Credit Program Box 49006 Baltimore, Maryland 21297 FOR IMMEDIATE INFORMATION: Email: Telephone.

10 Baltimore Area Toll Free Maryland State Department of Assessments & Taxation 2021 renters tax credit application rtc -1 Form Filing Deadline October 1, 2021 Apply online RTC-1 ( ) Page 3 of 4 INFORMATION The State of Maryland provides a direct check payment of up to $ a year for renters who paid rent in the State of Maryland and who meet certain eligibility requirements. For more information, please visit our website at Requirements A new Application must be filed every year if applicant wishes to be considered for a tax Credit .