Transcription of 26.99% - Synchrony

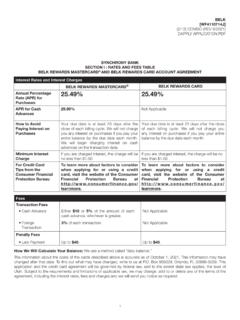

1 1 TJX[WF5505666JN](11/11) COMBO (REV 6/2022)DAPPLY APPLICATION PDFSYNCHRONY BANKSECTION I: RATES AND FEES TABLETJX REWARDS PLATINUM MASTERCARD AND TJX REWARDS CREDIT CARD ACCOUNT AGREEMENTI nterest Rates and Interest ChargesTJX REWARDS PLATINUM MASTERCARD TJX REWARDS CREDIT CARDA nnual PercentageRate (APR) for APR will vary with the market based on thePrime APR will vary with the market based on thePrime for Cash ApplicableHow to Avoid Paying Intereston PurchasesYour due date is at least 23 days after the closeof each billing cycle.

2 We will not charge youany interest on purchases if you pay your entirebalance by the due date each due date is at least 23 days after the closeof each billing cycle. We will not charge youany interest on purchases if you pay your entirebalance by the due date each Interest ChargeIf you are charged interest, the charge will be noless than $ you are charged interest, the charge will be noless than $ Credit Card Tips fromthe Consumer FinancialProtection BureauTo learn more about factors to considerwhen applying for or using a creditcard.

3 Visit the website of the ConsumerFinancial Protection Bureau at learn more about factors to considerwhen applying for or using a creditcard, visit the website of the ConsumerFinancial Protection Bureau at FeeslCash AdvanceEither $10 or 4% of the amount of each cashadvance, whichever is ApplicablePenalty FeeslLate PaymentUp to $ to $ We Will Calculate Your Balance: We use a method called daily balance. See your credit card account agreement below formore information about the costs of the card described above is accurate as of July 1, 2022.

4 This information may have changed afterthat date. To find out what may have changed, write to us at Box 965013, Orlando, FL 32896-5013. This application and the creditcard agreement will be governed by federal law, and to the extent state law applies, the laws of Utah. Subject to the requirements andlimitations of applicable law, we may change, add to or delete any of the terms of the agreement, including the interest rates, fees andcharges and we will send you notice as NOTICESCALIFORNIA RESIDENTS: If you are married, you may apply for a separate YORK RESIDENTS: A consumer credit report may be obtained in connection with evaluating your application and subsequently in connection with updates,renewals, or extensions of credit for which this application is made.

5 Upon your request, you will be informed whether a report was obtained, and if so, of the name andaddress of the consumer reporting RESIDENTS: The Ohio laws against discrimination require that all creditors make credit equally available to all creditworthy customers, and that credit reportingagencies maintain separate credit histories on each individual upon request. The Ohio Civil Rights Commission administers compliance with this RESIDENTS: No provision of a marital property agreement, a unilateral statement under sec.

6 , Wis. Stats., or a court decree under sec. ,Wis. Stats., adversely affects the interest of the creditor unless the creditor, prior to the time credit is granted, is furnished a copy of the agreement, statement or decreeor has actual knowledge of the adverse provision when the obligation to the creditor is incurred. Married residents of Wisconsin applying for an individual accountmust give us the name and address of their spouse if the spouse also is a Wisconsin resident, regardless of whether the spouse may use the card.

7 Pleaseprovide this information to us at Box 965013, Orlando, FL TO ELECTRONIC COMMUNICATIONSS cope. As a financial institution, we are required to provide certain disclosures to you, some of which are required to be in writing. With your consent, as laid out below,we may provide any communication, agreement, or disclosure, electronically for any Account you may have with By providing your consent to receive electronic communications (such as in connection with submitting an application or registering for online or mobile servicesfor an Account) you hereby consent that any communication, including Account agreements or Required Information, may be provided to you electronically.

8 You agreethat, in connection with your consent, your provision of any email address and/or mobile telephone number using your device or that of a third party demonstrates yourability to receive communications sent to that address and/or of Communications. You consent to receive any written communication relating to an Account or our services in electronic form that we may provide or makeavailable to you. The communications covered by your consent may include, but are not limited to, (i) the agreement governing your Account, (ii) any disclosure requiredby federal, state, or local law, (iii) Billing Statements, (iv) other disclosures, notices, or communications in connection with the application for, the opening of, terms of,maintenance of, or collection of an Account, and (v)

9 Any other agreements or other information relating to additional products or services you may elect to receive from of Communications. Electronic communications may be provided by any method for which you have demonstrated your ability to access communications( , by providing an email address and/or a mobile telephone number). Electronic communications may include your name and information about an Account and maybe viewed by any party with access to that Account, the email address or phone number you have provided to us for delivering communications, any mobile applicationwhere such Account may be accessed, or any hardware or software you use to view that Account or service-related Preferences.

10 You agree that if you apply for or use online servicing for an Account for which this consent applies, we may pre-set your communicationspreference to electronic delivery for any communications on such Account and any other Account you may have with us. You can withdraw this consent at any time bycalling the customer service number for such Account. Customer service can be contacted through the number on the back of your card, in the Contact Us sectionof an applicable Site, or on an Account Billing Statement, as applicable.

![[WF3620703J] COMBO PDF (REV 9/2021) DAPPLY …](/cache/preview/4/b/6/1/7/d/0/f/thumb-4b617d0fa7ec625704f6b357db619633.jpg)

![[WF3229060J] (3/17) PLCC DAPPLY APPLICATION PDF (REV …](/cache/preview/c/8/b/3/7/d/2/4/thumb-c8b37d24df714b5aad3c23adb5798bb7.jpg)

![GAP [WF4069911G] (1/12) COMBO (REV 7/2021) DAPPLY ...](/cache/preview/9/c/2/d/8/0/6/f/thumb-9c2d806f4bff6631cdec09b17bb2f9af.jpg)