Transcription of 77.+ND 0./3 I Return of Private Foundation PF

1 EXTENDED TO NOVEMBER 15, 2016 Return of Private Foundation form 990- PF I or Section 4947(a)(1) Trust Treated as Private Foundation | Do not enter social security numbers on this fo r m as it may be made public. Department of t h e Treasury Internal Revenue Service I | Information about form 990-PF and its separate instructions is at OMB No. 1545-0052 2015nto PublicInspect For calendar year 2015 or tax year Name of Foundation NEWMAN' S OWN Foundation Number and street (or box number if mail is not delivered to street address) ONE MORNINGSIDE DRIVE NORTH City or town, state or province, country, and ZIP or foreign postal code WESTPORT, CT 06880 and en Employer identification number 06-16 0658 8 Room/suite B Telephone number 203-222-0136 C If exemption application is pending, check here.

2 | G Check all that apply: Initial Return Initial Return of a former public charity Final Return Amended Return H Check type of organization: X Section 501(c)(3) exempt Private Foundation O iiidRdiAEttterpxeveenenunpsmaenarasgvnes I Fair market value of all assets at end of year J Accounting method: Cash (from Part II, col. (c), line 16) Other (specify) |$ 231, 096, 299. (Part I, column (d) must be on cash Part I Analysis of Revenue and Expenses ( a)Revenue and (The total of amounts in columns (b), (c), and (d)may not necessarily equal the amounts in column (a).) expenses per books 1 Contributions, gifts, grants, etc.)

3 , received .. 0. 2 Check | X if the Foundation is not required to attach Sch. B Interest on savings and temporary 3 cash investments .. 19, 844. 4 Dividends and interest from securities .. 35 3, 421. 5a Gross rents .. b Net rental income or (loss) 6a Net gain or(loss) from sale of assets not on line 10 .. 2 9 3, 5 1 1. Gross sales price for all b , 346 assets on line 6a .. 4 4 2 . 7 Capital gain net income (from Part IV, line 2) .. 8 Net short-term capital gain .. 9 Income modifications .. Gross sales less returns 1 0a and allowances .. b Less: Cost of goods sold .. c Gross profit or (loss).

4 11 Other income .. 34,583, 822. 12 Total. Add lines 1 through 11 35, 250, 598. 13 Compensation of officers, directors, trustees, etc.. 577, 082. 14 Other employee salaries and 1, 037, 087. 15 Pension plans, employee benefits .. 28 7, 945. 16a .. 341,719. b Accounting fees .. 47, 255. c Other professional fees .. 885, 748. 17 Interest .. 18 .. 405,454. 19 Depreciation and depletion .. 38,574. 20 Occupancy .. 195, 011. 21 Travel, conferences, and meetings .. 265, 33 6. 22 Printing and publications .. 19, 408. 23 Otherexpenses .. 391, 868. 24 Total operating and administrative expenses.

5 Add lines 13through23 .. 4,492,487. 25 Contributions, gifts, grants paid .. 23, 164, 927. 26 Total expenses and disbursements. Add lines 24and 25 27, 657,414. 27 Subtract line 26 from line 12: a Excess of revenue over expenses and disbursements .. 7, 5 9 3, 1 8 4. b Net investment income (if negative, enter-0-) .._____ - c Adjusted net income (if negative, enter-0-) _____523501 11-24-15 LHA For Paperwork Reduction Act Notice, see instructions. D 1. Foreign organizations, check | 2. Foreign organizations meeting the 85% test, check here and attach computation .. | E If Private Foundation status was terminated under section 507(b)(1)(A), check here.

6 | F If the Foundation is in a 60-month termination under section 507(b)(1)(B), check here .. | (d) Disbursements for charitable purposes (cash basis only) STATEMENT 1 STATEMENT 2 STATEMENT 3 STATEMENT 4 250, 913. 987,564. 179,499. 333, 653. 54,595. 952, 056. 76,492. 192,125. 262, 832. 19,451. 309, 611. 3, 618, 791. 26, 667,700. 30,286,491. form 990-PF (2015) Accrual (b) Net investment (c) Adjusted net income income N/A 19, 844. 353,421. 442, 346. 34,583, 822. 35, 399,433. 0. 0. 0. 0. 0. 4,157. 0. 0. 0. 0. 0. 0. 4,157. _____ 4,157. _____ 35, 395,276. _____ N/A 1 15001026 147227 NEWMAN'S OWN Foundation 01379571 if the Foundation is not required to attach Sch.

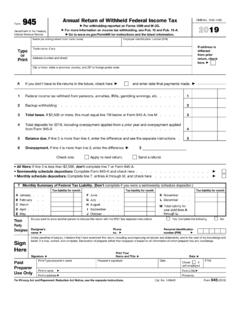

7 BOMB No. 1545-0052 Department of the TreasuryInternal Revenue ServiceOpen to Public InspectionNumber and street (or box number if mail is not delivered to street address)Room/suiteIf exemption application is pending, check hereForeign organizations meeting the 85% test,check here and attach computation(The total of amounts in columns (b), (c), and (d) may notnecessarily equal the amounts in column (a).)Disbursementsfor charitable purposes(cash basis only)CheckInterest on savings and temporarycash investmentsNet rental income or (loss)Net gain or (loss) from sale of assets not on line 10 Gross sales price for allassets on line 6aCapital gain net income (from Part IV, line 2)Gross sales less returnsand allowancesLess.

8 Cost of goods soldCompensation of officers, directors, trustees, of revenue over expenses and disbursements(if negative, enter -0-)(if negative, enter -0-)52350111-24-15or Section 4947(a)(1) Trust Treated as Private Foundation | Do not enter social security numbers on this form as it may be made public.| Information about form 990-PF and its separate instructions is at For calendar year 2015 or tax year beginning, and endingABCE mployer identification of Revenue and Expenses(d)(a)(b)(c) operating and expenses and disbursements. abcNet investment incomeAdjusted net incomeFor Paperwork Reduction Act Notice, see and Administrative Expenses(from Part II, col.)

9 (c), line 16)(Part I, column (d) must be on cash basis.)FormName of foundationTelephone numberCity or town, state or province, country, and ZIP or foreign postal code~|||||Check all that apply:Initial returnInitial Return of a former public charityForeign organizations, check here~~Final returnAmended returnAddress changeName change~~~~Check type of organization:Section 501(c)(3) exempt Private foundationIf Private Foundation status was terminatedunder section 507(b)(1)(A), check hereSection 4947(a)(1) nonexempt charitable trustOther taxable Private Foundation ~Fair market value of all assets at end of yearAccounting method.

10 CashAccrualIf the Foundation is in a 60-month terminationunder section 507(b)(1)(B), check hereOther (specify)~$| Revenue and expenses per books Net investmentincome Adjusted netincomeContributions, gifts, grants, etc., received~~~|~~~~~~~~~~~~~~Dividends and interest from securitiesGross rents~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~Net short-term capital gainIncome modifications~~~~~~~~~~~~~~~~~~~~~~~~~~G ross profit or (loss)Other income~~~~~~~~~~~~~~~~~~~~~~~~~~~ Add lines 1 through 11 ~~~Other employee salaries and wagesPension plans, employee benefits~~~~~~~~~~~~Legal feesAccounting fees~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~Other professional fees~~~~~~~~~~~InterestTaxes~~~~~~~~~~~~ ~~~~~~~~~~~~~~~~~~~~~~~~~Depreciation and depletion~~~~~~~~~OccupancyTravel, conferences, and meetingsPrinting and publicationsOther expenses~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~ ~~~~~~~~~~~~~~ Add lines 13 through 23~~~~~Contributions, gifts, grants paid~~~~~~~Add lines 24 and 25 Subtract line 26 from line 12.