Transcription of A GUIDE TO YOUR ACCOUNT - Chase Online | Chase.com

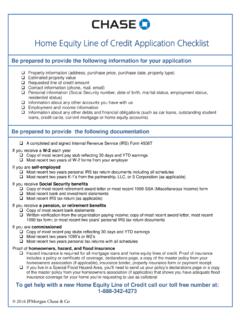

1 HAVE QUESTIONS? CALL US AT 1-800-935-9935 (WE ACCEPT OPERATOR RELAY CALLS) WANT MORE INFO? SEE THE DEPOSIT ACCOUNT AGREEMENT1 Chase total CHECKING A GUIDE TO YOUR ACCOUNT It s important that you understand how your Chase total Checking ACCOUNT works. We ve created this GUIDE to explain the fees and some key terms of your personal SERVICE FEEM onthly Service Fee$12 How to Avoid the Monthly Service Fee During Each Monthly Statement Period$0 Monthly Service Fee when you have any ONE of the following: electronic deposits made into this ACCOUNT totaling $500 or more, such as payments from payroll providers or government benefit providers, by using (i) the ACH network, (ii) the Real Time Payment network, or (iii) third party services that facilitate payments to your debit card using the Visa or Mastercard network OR, a balance at the beginning of each day of $1,500 or more in this ACCOUNT OR, an average beginning day balance of $5,000 or more in any combination of this ACCOUNT and linked qualifying deposits1/investments2 ATM FEESNon- Chase ATM (Avoid these fees by using a Chase ATM)$ for any inquiries, transfers or withdrawals while using a non- Chase ATM in the , Puerto Rico and the Virgin Islands.

2 Fees from the ATM owner/network still apply.$5 per withdrawal and $ for any transfers or inquiries at ATMs outside the , Puerto Rico and the Virgin Islands. Fees from the ATM owner/network still for using your ACCOUNT when you don t have enough money in it or it s already overdrawnOVERDRAFT FEESI nsufficient Funds: Chase pays an item when your ACCOUNT does not have enough moneyReturned Item: Chase returns an item presented for payment when your ACCOUNT does not haveenough money$34 fee for each item (maximum of 3 Overdraft Fees per day, for a total of $102). We will not charge an Insufficient Funds Fee if your ACCOUNT balance at the end of the business day is overdrawn by $5 or less We will not charge these fees for any item that is $5 or less, even if your ACCOUNT balance at the end of the business day is overdrawn We will not charge an Insufficient Funds Fee on a debit card transaction if your available balance was sufficient at the time it was authorized, even if your ACCOUNT balance is overdrawn at the time the transaction is presented for payment The same check or ACH item submitted multiple times by a merchant may result in both a Returned Item Fee and an Insufficient Funds Fee.

3 If we return one of these items, we will only charge you one Returned Item Fee for that item within a 30-day period Insufficient Funds Fees do not apply to withdrawals made at an ATMYou can avoid overdrawing your ACCOUNT by making a deposit or transferring funds to cover the overdraft before the business day ends. If you deposit a check, this assumes we do not place a hold and the check is not returned. Here are the cutoff times for some ways of making a deposit or transferring funds from another Chase ACCOUNT : At a branch before it closes At an ATM before 11 Eastern Time (8 Pacific Time) When transferring money on or Chase Mobile or using Chase QuickPay with Zelle before 11 Eastern Time (8 Pacific Time)Additional cutoff times apply to other transfers, including transfers from non- Chase accounts.

4 Please visit or Chase Mobile for more information and service agreements. For the complete terms governing your ACCOUNT , please consult the Deposit ACCOUNT Agreement. The terms of the ACCOUNT , including any fees or features, may Qualifying personal deposits include Chase First CheckingSM accounts, personal Chase savings accounts (excluding Chase Premier SavingsSM and Chase Private Client SavingsSM), CDs, certain Chase Retirement CDs, and certain Chase Retirement Money Market Qualifying personal investments include balances in investment and annuity products offered through JPMorgan Chase & Co. and its affiliates and agencies. For most products, we use daily balances to calculate the average beginning day balance for such investment and annuity products. Some third party providers report balances on a weekly, not daily, basis and we will use the most current balance reported.

5 Balances in 529 plans and certain retirement plan investment accounts do not qualify. Investment products and related services are only available in English. Investment products and services are offered through Morgan Securities LLC (JPMS), a registered broker-dealer and investment advisor, member of FINRA and SIPC. Annuities are made available through Chase Insurance Agency, Inc. (CIA), a licensed insurance agency, doing business as Chase Insurance Agency Services, Inc. in Florida. JPMS, CIA and JPMorgan Chase Bank, are affiliated companies under the common control of JPMorgan Chase & Co. Products not available in all AND INSURANCE PRODUCTS: NOT A DEPOSIT NOT FDIC INSURED NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY NO BANK GUARANTEE MAY LOSE VALUEHAVE QUESTIONS? CALL US AT 1-800-935-9935 (WE ACCEPT OPERATOR RELAY CALLS) WANT MORE INFO?

6 SEE THE DEPOSIT ACCOUNT AGREEMENTCHASE total CHECKING 2 Chase DEBIT card COVERAGE SM AND FEES 3(Please visit for additional details.) Chase Debit card Coverage: You can choose how we treat your everyday (not recurring) debit card transactions when you don t have enough money available. Please note: Regardless of which option you choose for Chase Debit card Coverage, you may also want to sign up for Overdraft Protection if you are eligible. Please visit for more details, including terms and #1 (YES): You ask us to add Chase Debit card CoverageThis means you want Chase to approve and pay your everyday debit card transactions, at our discretion, when you don t have enough money available (this includes available funds in your linked Overdraft Protection ACCOUNT , if enrolled). Fees may apply. You ll have until the end of the business day to transfer or deposit enough money to avoid an Insufficient Funds Fee on these Funds$34 fee for each everyday debit card purchase that overdraws your ACCOUNT (maximum of 3 Insufficient Funds Fees per day, for a total of $102).

7 We will not charge an Insufficient Funds Fee if your ACCOUNT balance at the end of the business day is overdrawn by $5 or less We will not charge these fees for any item that is $5 or less, even if your ACCOUNT balance at the end of the business day is overdrawn We will not charge an Insufficient Funds Fee on a debit card transaction if your available balance was sufficient at the time it was authorized, even if your ACCOUNT balance is overdrawn at the time the transaction is presented for payment Insufficient Funds Fees do not apply to withdrawals made at an ATMOPTION #2 (NO): No Chase Debit card Coverage (If you don t choose an option when you open your ACCOUNT , Option #2 (No) is automatically selected for you)This means you do not want Chase to approve and pay your everyday debit card transactions when you don t have enough money available (this includes available funds in your linked Overdraft Protection ACCOUNT , if enrolled).

8 Since everyday debit card transactions will be declined when there is not enough money available, you won t be charged an Insufficient Funds Fee for everyday debit card DEPOSITS AND WITHDRAWALS WORKThe Order in Which Withdrawals and Deposits Are ProcessedPosting order is the order in which we apply deposits and withdrawals to your ACCOUNT . We provide you with visibility into how transactions are posted and in what order to help you better manage your we transition from one business day to the next business day we post transactions to and from your ACCOUNT during our nightly processing. The order in which we generally post items during nightly processing for each business day is: First, we add deposits to your ACCOUNT . Second, we subtract debit card transactions, automatic payments, Online banking transactions, ATM withdrawals, teller cash withdrawals, checks you wrote or authorized that are either cashed or deposited by a Chase branch banker, and wire transfers in chronological order by using the date and time of when the transaction was shown as pending.

9 If we do not have date and time information for a particular transaction, then it is posted as if it was made at the end of the day. Multiple transactions without a date and time are posted in high to low order. Third, we subtract all other items, including automatic payments, checks you wrote or authorized, and recurring debit card transactions starting with those having the highest dollar amount and moving to the lowest. We reserve the right to use a different order in certain states, such as Nevada. Finally, fees are assessed the day, if you review your ACCOUNT , you will see that we show some transactions as pending. These transactions impact your available balance, but have not yet posted to your ACCOUNT and do not guarantee that we will pay these transactions to your ACCOUNT if you have a negative balance at that time.

10 We may still return a transaction unpaid if your balance has insufficient funds during that business day s nightly processing, even if it had been displayed as a pending transaction on a positive balance during the day. If a transaction that you made or authorized does not display as pending, you are still responsible for it and it may still be posted against your ACCOUNT during nightly Your Deposits Are Available (See Funds Availability Policy in the Deposit ACCOUNT Agreement for details) Cash deposit Same business day Direct deposit/wire transfer Same business day Check deposit Usually the next business day, but sometimes longer: - If we place a longer hold on a check, the first $225 will be available by the next business day -The date your deposit is expected to be available will be displayed on your receipt - In some situations, we may notify you at the time or after your deposit is made that your funds (including the first $225) will not be available for up to seven business daysA business day is a non-holiday weekday.