Transcription of Analyst Estimates ahead of USDA WASDE Report

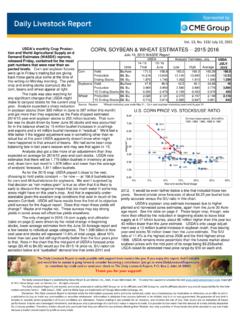

1 Vol. 13, No. 93 / May 12, 2015 Crop plan ngs are off to an excellent start this year and this has contributed to the steady decline in corn futures prices so far this spring. december 2015 corn futures were trading around $ in late March as producers were ge ng ready to plant the new crop. Today, corn futures are trading around $ , down about 10% from those March levels, with most of the decline happening in the last three weeks. USDA reported on Monday evening that corn plan ngs are now 75% complete, well above year ago and five year average levels (see chart).

2 Although past studies have showed very mixed results in using plan ngs to project final yields, at this point this is one tangible piece of evidence that market par- cipants can u lize in their forward projec ons . Timely plan ngs tend to reduce the number of acres that switch to beans or are abandoned. Also, by ge ng the crop in the ground early, it reaches maturity before the sum-mer heat has a chance to damage the crop. Plenty of weather can happen between now and August. However, for market par cipants, the early plan ngs are a posi ve sign that the new crop season is off to a good start.

3 USDA will provide its first es mate of the corn crop at noon ET today and the table to the right summarizes es mates from a number of analysts polled by Reuters. On average, analysts expect corn ending stocks for the 2015-16 marke ng year to be billion bushels, about 6% lower than a year ago. But as you can see, there is a very wide range of opinions regarding final ending stocks to be expected at the start of the growing window. What does the billion bushel number imply in terms of corn output and, ul mately, prices? According to the USDA plan ng in-ten ons survey, US corn farmers are expected to plant million acres with corn this year.

4 It is likely this is the number USDA will use in their balance table although private analysts likely have different numbers in their calcula ons based on how early the crop is planted and price differ-en als with soybeans. Using a harves ng ra o, we come up with a poten al million harvested acres. Everyone has an opinion on yields and it is expected that USDA will use some sort of trend yield in their es -mate. Some analysts, however, think a trend yield may be too high as past crops following a record year have failed to match trend.

5 Last year s yield was a record 171 bushels per acre. In February, USDA used a yield of bushels per acre. Using that yield and the harvested acres number above gives us a possible corn produc on es mate for 2015-16 of around billion bushels. Last year corn produc on was billion bushels but keep in mind that this year we will have an addi onal 600 million bushels in carryover stock than in 2014-15. Based on these calcula ons, we come up with around billion bushels of available supply for the new mar-ke ng year, this is almost exactly the same number we had in 2014-15.

6 The demand side of the balance sheet is also quite uncertain. Early USDA es mates for 2015-16 had feed use at around billion bushels, only slightly higher than in 2014-15. The average of analysts es mates would imply this number as well. However, we are seeing con nued expansion in the broiler and hog industry and this could help bolster feed use for the upcoming marke ng year. Export demand remains a wild card. A strong US dollar and good harvests in other markets could limit US exports. At this point, it seems many analysts are using a billion bushel figure.

7 Adding up these numbers we can visualize a corn balance table that yields a billion bushel ending stocks figure. The stocks to use ra o comes up as , only slightly lower than in 2014-15 and implying a corn price in the $4 per bushel range. But the season is young and summer weather is ahead of us. Be ng on trend or above trend yields is always a risky propo-si on, especially a er the record number we got last year. Sponsored by The Daily Livestock Report is published by Steve Meyer & Len Steiner, Inc., Adel, IA and Merrimack, NH. To subscribe, support or unsubscribe visit Copyright 2014 Steve Meyer and Len Steiner, Inc.

8 All rights reserved. The Daily Livestock Report is not owned, controlled, endorsed or sold by CME Group Inc. or its affiliates and CME Group Inc. and its affiliates disclaim any and all responsibility for the informa on contained herein. CME Group , CME and the Globe logo are trademarks of Chicago Mercan le Exchange, Inc. Disclaimer: The Daily Livestock Report is intended solely for informa on purposes and is not to be construed, under any circumstances, by implica on or otherwise, as an offer to sell or a solicita- on to buy or trade any commodi es or securi es whatsoever. Informa on is obtained from sources believed to be reliable, but is in no way guaranteed.

9 No guarantee of any kind is implied or possible where projec ons of future condi ons are a empted. Futures trading is not suitable for all investors, and involves the risk of loss. Past results are no indica on of future performance. Futures are a leveraged investment, and because only a percentage of a contract s value is require to trade, it is possible to lose more than the amount of money ini ally deposited for a futures posi on. Therefore, traders should only use funds that they can afford to lose without affec ng their lifestyle. And only a por on of those funds should be devoted to any one trade because a trader cannot expect to profit on every trade.

10 The Daily Livestock Report is made possible with support from readers like you. If you enjoy this Report , find it valuable and would like to sustain it going forward, consider becoming a contributor. Just go to to contribute by credit card or send your check to The Daily Livestock Report , Box 2, Adel, IA 50003. Thank you for your support! 0102030405060708090100wk 14 wk 15 wk 16 wk 17 wk 18 wk 19 wk 20 wk 21 wk 22 wk 23 wk 24 CORN PLANTING PROGRESSPERCENT PLANTED, 18 STATES. Souce: USDA/NASS2010201320142010-14 planted2015 WASDEA verage ofWASDEMay-15analystsApr-152014 - - - - - - of Analysts Estimates ---- billions of bushels ---- Analyst Estimates ahead of USDA WASDE Report Survey of Analysts Conducted and Reported by Reuters