Transcription of Annual Return of a Local Private Company - CR

1 Important 3. What is higher registration fee ? This pamphlet is intended to provide a general guide. It should be read in conjunction with the provisions Higher registration fees ranging from HK$870 to of the companies Ordinance (Chapter 622 of the Laws of Hong Kong) and should not be regarded as a HK$3,480 are levied in cases of late delivery of Annual returns. The fee is calculated according to an companies REGISTRY substitute for reading it. You can purchase a hard escalating fee scale based on the date of delivery of copy of the companies Ordinance from the Online the Annual Return to the companies Registry. For Government Bookstore ( ) or details, please refer to the information pamphlet call the Publications Sales Section of the Information Price Guide to Main Services.

2 Services Department at (852) 2537 1910. You can Annual Return of a also read the full text of the companies Ordinance at companies are advised to If an Annual Return is delivered by post, the Annual Return will not be regarded as having been seek independent professional advice as they see fit. Local Private Company delivered to the Registrar in satisfaction of the filing requirements if it has not been received by the Registrar. The Annual registration fee payable will be calculated according to the date of re-delivery of the Annual Return . 1. When do I need to deliver an Annual Return to the Registrar of companies (the Registrar) for The Registrar has no power to waive the higher registration ?

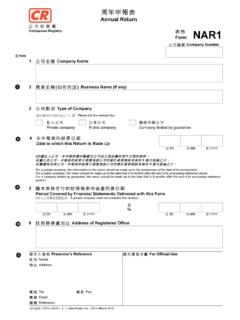

3 Registration fees prescribed in the companies (Fees) Regulation (Cap. 622K). You must in respect of every year deliver an Annual Return in the specified form (Form NAR1) to the 4. Will I receive reminder(s) for the delivery of Annual Registrar for registration within 42 days after the Return (s) to the Registrar for registration? anniversary of the date of the Company 's incorporation (prescribed time period) in that year. No. It is the obligation of a Company and its officers to comply with the requirements under the However, the requirement to deliver Annual Return companies Ordinance. You should make proper does not apply to a Company that is a dormant arrangements to deliver Annual returns for Company under section 5(1) of the companies registration within the prescribed time period.

4 Ordinance. An Annual Return e-Reminder service is available at the e-Registry ( ) for 2. What is the consequence of failing to deliver an Annual Return for registration within the prescribed registered users to receive electronic notifications for time period ? the delivery of Annual returns of Local Private companies on the most recent anniversary dates of If an Annual Return is not delivered within the incorporation of the companies . Please visit the prescribed time period for registration, a Compliance section of our website at substantially higher registration fee is payable for for details of the service. the late delivery of Annual Return .

5 Address : 14th floor, Queensway Government Offices, 66 Queensway, Hong Kong. Website : The Company and every responsible person of the 5. What form should I deliver ? e-Registry : Cyber Search Centre : Company are liable to prosecution and, if convicted, Company Search Mobile Service : default fines. The maximum penalty is HK$50,000 You should deliver an Annual Return in the specified Email : for each breach and, in the case of a continuing Form NAR1 for registration. Enquiry Hotline (IVRS) : (852) 2234 9933. offence, a daily default fine of HK$1,000. February 2017 PAM 8A_E. A Check List for Delivering an Annual Return in Hard Copy 6. Where can I obtain the specified form of Annual Form for Registration Please notify the Registrar immediately either by email Return ?

6 To or by fax to (852) 2596 0585 if Before you deliver the Annual Return for registration, you note that the particulars of your Company are please ensure that you- incorrect or have been changed as a result of mistakes You can download the specified form (Form NAR1) at or purchase a hard copy on the 14th Print the specified form in black ink and comply with in any registered documents or unauthorised filing of floor of the Queensway Government Offices. the Requirements for Documents Delivered in documents with the companies Registry. Hard Copy Form and Shareholders' Lists Delivered in the Form of CD-ROM or DVD-ROM to the Arrange for the Return to be manually signed by a 7.

7 How can I deliver my Annual Return for registration ? Registrar of companies for Registration with director or the Company secretary of the Company regard to layout, type size and colour of paper, etc. (Note 1). You can deliver a properly completed and signed Annual For further information, please refer to the Return (Form NAR1) in hard copy form together with information pamphlet Delivery of Documents in Pay correct Annual registration fee (Note 1). the correct registration fee within the prescribed time Hard Copy Form to companies Registry for period by post or in person to the companies Registry at Deliver the Annual Return within the prescribed time Registration.

8 The 14th floor of the Queensway Government Offices. period. The Registrar does not have power to extend the statutory time limit for the delivery of Use the correct bilingual specified form of Annual Annual returns. You can also deliver the Annual Return electronically Return - Form NAR1. through the e-Registry ( ). The e-Registry is a 24-hour electronic service portal If the due date for delivering the Annual Return falls Fill in all particulars and complete all items on a Saturday, the deadline for delivering the Return developed by the companies Registry to facilitate consistently in either Chinese or English with correct electronic submission of specified forms and documents.

9 Will remain unchanged. You can deposit the Annual information as at the date of the Annual Return . Use Return with a cheque in the Registry's drop-in box Key particulars of the Company registered with the traditional Chinese characters if the form is provided near the Information Counter on Deck Registry as at the Company 's Return date will be completed in Chinese. Floor, High Block, Queensway Government Offices. pre-filled in the Annual Return by the system for user's A higher Annual registration fee will be required if verification and completion of other details. Please visit State correctly the Company number, Company name the Annual Return is delivered to the Registrar beyond for details of user registration and the and particulars of the presentor.

10 A covering letter is the prescribed time period. full range of services provided at the e-Registry. not required unless you need to draw our attention to a specific issue. Notes : 8. Do I need to deliver an Annual Return for registration if Check if you have already notified the Registrar of 1. Annual returns which are not properly signed or the information contained in the last Return has not changes in the Company 's particulars since the last not accompanied by correct fees will be changed ? Annual Return by delivering the relevant documents for considered as unsatisfactory documents and will registration. For instance, the change in the address be rejected by the companies Registry.