Transcription of Applying for Immediate Retirement Under the …

1 FERSA pplying forImmediateRetirementUnder theFederalEmployeesRetirementSystemFeder al EmployeesRetirement SystemThis pamphlet is for you if youare currently a federal employeecovered by the federal EmployeesRetirement system (FERS) and youwant to apply for Retirement whichbegins within 30 days after thedate of your final separation fromFederal StatesOffice ofPersonnelManagementRetirementandinsura nceServiceSF 3113 Revised May 2001 Previous edition is not provide Retirement information on theInternet. You will find Retirement brochures,forms, and other information at: may also communicate with us usingemail of ..2 Continuing Health Benefits andLife Insurance Coverageinto for Benefits ..7 Payments ..9 Survivor Benefits ..11 NSN 7540-01-385-74403113-103iPage IntroductionThis pamphlet, along with form SF 3107,FERSA pplication for Immediate Retirement ,is for youif you are currently a federal employee coveredby the federal Employees Retirement system (FERS), and you want to apply for retirementwith an Immediate annuity (annuity beginningwithin 30 days after the date of final separationfrom federal service).

2 This includes individualswho transferred to FERS from the Civil ServiceRetirement system (CSRS) and who are eligibleto have part of their annuity computed underCSRS not use this pamphlet, or form SF 3107,FERSA pplication for Immediate Retirement ,if you areapplying for a deferred annuity. A deferred annu-ity begins more than 30 days after the date offinal separation. If you want to apply for adeferred annuity, you should request an RI92-19,FERS Application for Deferred orPostponed Retirement ,from Office of Personnel ManagementFederal Employees Retirement Box 200 Boyers, PA EligibilityAge and Service RequirementsThe following chart outlines the requirements foran Immediate annuity Under the federal Employ-ees Retirement system (FERS).Type ofRetirementMinimumAgeMinimumServiceSpec ialRequirementsOptional625 None6020 NoneMRA*30 NoneMRA*10 None (Note: Annuity isreduced by 5% for eachyear the employee isunder age 62.)

3 Anyage502520 You must retire underspecial provisions for airtraffic controllers, lawenforcement or Office of PersonnelManagement must havedetermined that youragency is undergoing amajor reorganization,reduction-in-force, ortransfer of separation must beinvoluntary and not formisconduct or must be disabled foruseful and efficient ser-vice in both your currentposition and any othervacant position at thesame grade or pay levelfor which you are quali-fied. Other requirementsmust also be met.*Minimum Retirement Retirement Age (MRA)The Minimum Retirement Age depends on youryear of birth. To determine your MRA, refer tothe following you were born inYour MRA isBefore 194855 years194855 years, 2 months194955 years, 4 months195055 years, 6 months195155 years, 8 months195255 years, 10 months1953 to 196456 years196556 years, 2 months196656 years, 4 months196756 years, 6 months196856 years, 8 months196956 years, 10 monthsAfter 196957 years3 Age ReductionIf you have 10 or more years of service and areretiring at the Minimum Retirement Age, yourannuity will be reduced for each month that youare Under age 62.

4 The reduction is 5 percent peryear (5/12 of a percent per month). However,your annuity will not be reduced if you com-pleted at least 30 years of service, or if you com-pleted at least 20 years of service and yourannuity begins when you reach age can reduce or eliminate this age reduction,by postponing the beginning date of your the Beginning Date ofAnnuity to Reduce or Avoid the AgeReductionYou can reduce or eliminate the age reduction ifyou choose to have your annuity begin at a datelater than your MRA. You can choose any begin-ning date between your MRA and 2 days beforeyour 62nd birthday. However, you cannot beginyour annuity while you are reemployed. Youragency Retirement counselor can provide youwith the annuity rates with and without the agereduction. If you decide to postpone the begin-ning date of your annuity, do not complete formSF 3107,FERS Application for Immediate to the Office of Personnel Manage-ment 60 days before the date you want yourannuity to begin and request an RI 92-19,FERSA pplication for Deferred or Postponed address Office of Personnel ManagementFederal Employees Retirement Box 200 Boyers, PA you choose to postpone thebeginning date of your annuity, youshould be aware of the followingLife InsuranceYou cannot continue your life insurancecoverage unless you are receiving an annu-ity.

5 Therefore, if you postpone the beginningdate of your annuity, your life insuranceenrollment will terminate. When your annu-ity begins, the life insurance coverage youhad when you separated from your employ-ment will InsuranceIf you postpone the beginning date of yourannuity, you will be eligible to temporarilycontinue your health benefits coverage for 18months from the date of separation fromyour employing agency; however, you mustcontact your agency within 60 days and paythe total premium, plus a 2% administrativecharge. When your annuity payments begin,you will again have the opportunity to enrollin a health benefits plan Under the regularFederal Employees Health Benefits Program,and the Office of Personnel Management(OPM) will pay the government share of sIf you delay your annuity beginning date,your annuity rate will not include anycost-of-living adjustments (COLA s) that occurbefore you begin to receive the annuity.

6 Onceyour annuity begins, you will be entitled toCOLA s on any portion of your annuity whichwas computed Under Civil Service RetirementSystem (CSRS) rules. However, you will notreceive COLA s on the federal EmployeesRetirement system (FERS) part of your bene-fit until you are BenefitsIf you defer receipt of your annuity and diebefore you begin to receive it, your spousecan still receive FERS survivor benefits. Continuing Health Benefits andLife Insurance Coverage intoRetirementIf you wish to continue your federal EmployeesHealth Benefits (FEHB) and/or federal Employ-ees Group Life Insurance (FEGLI) coverage as aretiree, you must meet the following basicrequirements. You must be retiring on an imme-diate annuity and you must have been enrolledin the program for the five years of federal serv-ice immediately preceding your Retirement , or ifless than five years, since your earliest opportu-nity to enroll.

7 FEHB coverage as a family mem-ber counts toward the five-year Services Health Benefits Programcoverage also counts provided you are anFEHB enrollee when you you are eligible to continue your FEHB cover-age, your agency will automatically transferyour enrollment to the Office of Personnel Man-agement (OPM). You do not need to do anythingunless you want to make some change in pamphlet, RI 76-21,FEGLI federal Employ-ees Group Life Insurance Program,has moreinformation about eligibility to continue yourFEGLI coverage as a retiree and the cost of cover-age. If you are eligible to continue your FEGLI basic coverage, you must complete an SF 2818,Election of Post- Retirement Basic Life optional FEGLI coverage you haveand are eligible to retain as a retiree will auto-matically be continued unless you make somechange.

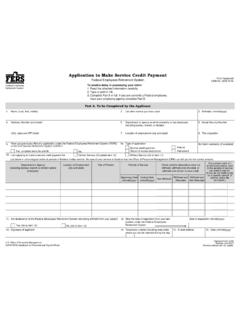

8 Our experience has been that many peo-ple cancel all or a portion of their life insurancecoverage at Retirement due to its cost. Therefore,you should let OPM know at Retirement , if you donot want to continue a portion of your life insur-ance coverage. You may also want to file an6SF 2823,FEGLI Designation of Beneficiaryform.(The designation of beneficiary form for yourFERS Retirement contributions and any lumpsum of accrued annuity is SF 3102.)Based on the documentation your employingagency is required to submit with your retire-ment application, OPM will determine whetheryou are eligible to continue your health and lifeinsurance coverage as a retiree. However, if youhave any questions about your eligibility, askyour employing office for assistance before youretire. Applying for BenefitsForm to UseUse form SF 3107,FERS Application for Imme-diate Retirement ,to apply for Immediate retire-ment.

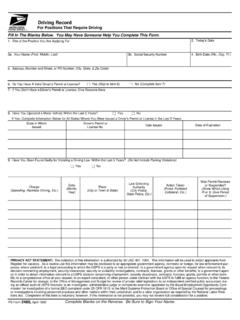

9 You can obtain the form from youremploying the ApplicationSubmit the completed application to youremploying agency. Give your agency at least 60days notice before the date you intend to agency will then complete the Schedule D,Agency Checklist of Immediate Retirement Proce-dures and the SF 3107-1,Certified Summary ofFederal Service,which are included in theSF 3107,FERS Application for agency will complete the SF 3107-1,Certi-fied Summary of federal Service,and forward itto you for your review and signature. You shouldreview it carefully before signing it. Any errors,omissions, or discrepancies will delay the proc-essing of your application, and may result inincomplete credit for service in the initial com-putation of your you are Applying for disability Retirement , askyour employing agency for a copy of the formspackage SF 3112,Documentation in Support ofDisability Retirement agency will forward the application to to do if your Address Changes BeforeProcessing is CompleteIf your address changes before you receive yourclaim number, write to us, giving your name,date of birth, and your social security number.

10 Ifyou have received your claim number you caneither telephone us or write to us to report yournew address. Please refer to your claim numberin any correspondence. You can phone us at1-888-767-6738. Customers within local callingdistance to Washington, DC must contact us on202-606-0500. If you prefer to write to us, youshould report your new address Office of Personnel ManagementATTN: Change of Box 440 Boyers, PA 16017-0440In addition, notify your old post office of yourforwarding Happens After You File Your RetirementApplicationYour employing office will close out your rec-ords, using the Agency Checklist to assure thatall necessary steps are taken. When this process(which includes paying you any unpaid com-pensation, such as for unpaid annual leave) hasbeen completed, the agency will forward yourapplication and records to the Office of PersonnelManagement (OPM).