Transcription of BPI INVEST US EQUITY INDEX FEEDER FUND

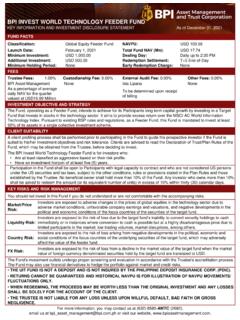

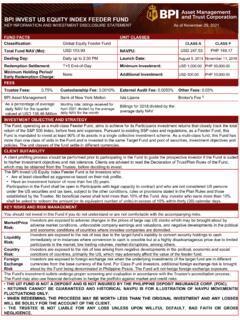

1 fund FACTSUNIT CLASSESC lassification:Global EQUITY FEEDER fund CLASS ACLASS PTotal fund NAV (Mn):USD : USD Day:Daily up to 2:30 PM Launch Date:August 5, 2014 November 11, 2019 Redemption Settlement:T+5 End-of-DayMinimum Investment:USD 1, 50, Holding Period/Early Redemption Charge:None Additional Investment:USD 10, External Audit Fee: Asset ManagementBank of New York Mellon Isla Lipana Broker's Fee 5As a percentage of average daily NAV for the quarter valued at USD MillionMonthly rate: billings received for April 2021 divided by the average daily NAV for the monthBillings for 2018 divided by the average daily NAV INVESTMENT OBJECTIVE AND STRATEGYThe fund , operating as a multi-class FEEDER fund , aims to achieve for its Participants investment returns that closely track thetotal return of the S&P 500 INDEX , before fees and expenses.

2 Pursuant to existing BSP rules and regulations, as a FEEDER fund , thisFund is mandated to INVEST at least 90% of its assets in a single collective investment scheme. As a multi-class fund , this Fundhas more than one class of units in the fund and is invested in the same Target fund and pool of securities, investment objectives and policies. The unit classes of the fund settle in different currencies. CLIENT SUITABILITYA client profiling process should be performed prior to participating in the fund to guide the prospective investor if the fund is suited to his/her investment objectives and risk tolerance. Clients are advised to read the Declaration of Trust/Plan Rules of the fund , which may be obtained from the Trustee, before deciding to INVEST .

3 The BPI INVEST US EQUITY INDEX FEEDER fund is for investors who: Are at least classified as aggressive based on their risk profile. Have an investment horizon of more than five (5) in the fund shall be open to Participants with legal capacity to contract and who are not considered US personsunder the US securities and tax laws, subject to the other conditions, rules or provisions stated in the Plan Rules and thoseestablished by the Trustee. No beneficial owner shall hold more than 10% of the fund . Any investor who owns more than 10% shall be asked to redeem the amount (or its equivalent number of units) in excess of 10% within thirty (30) calendar days. KEY RISKS AND RISK MANAGEMENT You should not INVEST in this fund if you do not understand or are not comfortable with the accompanying Risk:Investors are exposed to adverse changes in the prices of large cap US stocks which may be brought about by adverse market conditions, unfavorable company earnings and valuations, and negative developments in the political and economic conditions of countries where investee companies are Risk.

4 Investors are exposed to the risk of loss due to the target fund s inability to convert security holdings to cash immediately or in instances where conversion to cash is possible but at a highly disadvantageous price due to limited participants in the market, low trading volumes, market disruptions, among Risk:Investors are exposed to the risk of loss arising from negative developments in the political, economic and social conditions of countries, primarily the US, which may adversely affect the value of the FEEDER Exchange RiskInvestors are exposed to foreign exchange risk when the underlying investments of the target fund are in different currencies from the base currency of the fund . For Class P unit investors, additional foreign exchange risk is brought about by the fund being denominated in Philippine Pesos.

5 The fund will not hedge foreign exchange fund 's investment outlets undergo proper screening and evaluation in accordance with the Trustee's accreditation fund may also use financial derivatives to hedge the portfolio against market and credit risks. THEUITFUNDISNOTADEPOSITANDISNOTINSUREDBY THEPHILIPPINEDEPOSITINSURANCECORP.(PDIC) . RETURNSCANNOTBEGUARANTEEDANDHISTORICALNA VPUISFORILLUSTRATIONOFNAVPUMOVEMENTS/FLU CTUATIONSONLY. WHENREDEEMING,THEPROCEEDSMAYBEWORTHLESST HANTHEORIGINALINVESTMENTANDANYLOSSESWILL BESOLELYFORTHEACCOUNTOFTHECLIENT. THETRUSTEEISNOTLIABLEFORANYLOSSUNLESSUPO NWILLFULDEFAULT, INVEST US EQUITY INDEX FEEDER FUNDKEY INFORMATION AND INVESTMENT DISCLOSURE STATEMENT As of October29, 2021 fund PERFORMANCE AND STATISTICS AS OF OCTOBER 29, 2021(Purely for reference purposes and is not a guarantee of future results)NAVPU GRAPHNAVP uover the past 12 monthsClass AClass Lowest STATISTICSC lass AClass PVolatility, Past 1 Year(%) Error, Since Inception(%) PERFORMANCE (%) 71 mo 3 mos 6 mos 1YR 3 YRS Class PERFORMANCE (%) 1YR 2 YRS 3 YRS 4 YRS 5 YRS Class YEAR PERFORMANCE (%)

6 7 RELATED PARTY TRANSACTIONS*YTD 2020 2019 2018 2017 2016 The fund has no transactions and outstanding investments with entities related to BPI Asset Management and Trust Corporation (BPI AMTC).Class * Related party in accordance with BPI AMTC s internal COMPOSITIONTOP TEN HOLDINGSA llocation % of fund Name % of Target fund Target Microsoft Apple Time deposits and money Other receivables -net of liabilities Tesla Portfolio Allocation% of Target fund Alphabet Inc. Information Alphabet Inc. Health Meta Platforms Consumer NVIDIA Berkshire Hathaway Inc. Other JPMorgan Chase & OTHER fund FACTSFund Currency:US DollarTrustee and Custodian:State Street Bank & Trust *:S&P 500 IndexFund structure:ETF (NYSE)Name of Target fund :SPDR S&P 500 ETF TrustInception Date:January 22, 1993 Regulator:SEC (US)Total Expense Manager:State Street Global AdvisorsThe fund Performance Report and relevant information about the SPDR S&P500 ETF Trust can be viewed and downloaded through For more information, you may contact us at 8580-AMTC (2682),email us at or visit our website, are net of fees.

7 2 Since the degree to which the fund fluctuates vis- -vis its average return over a period of of deviation between the fund s return and benchmark returns. A lower number means the fund s return is closely aligned with the of buying/selling of shares/units of the Target fund through accrued income, investment securities purchased, accrued expenses, of Class P since inception, November 11, 2019.*Declaration of Trust is available upon request through branch of account.*S&P 500 Index75100125150175200225250275 Oct-16 Oct-17 Oct-18 Oct-19 Oct-20 Oct-21 Class AClass PBenchmark*OUTLOOK AND , , ,theUSHouseofRepresentativesapprovedasho rt-termincreaseinthedebtceilingby$480bil lion, , , , ,coal,crude, , OF PROSPECTIVE INVESTMENTSINVESTMENT OBJECTIVE OF TARGET FUNDT rack the performance of the S&P 500 INDEX composed of 500 predominantly large-capitalization US sapprovedinvestmentoutlets,whereintheTru steeintendstoinvestdependingonstrategy,a vailability,orothermarket-drivencircumst ances:a)Primarilyinasinglecollectiveinve stmentschemewhoseinvestmentobjectiveisto provideinvestmentresultsthatmaximizeinco me.

8 ProvidedfurtherthatsuchCISisapprovedorre gisteredandsupervisedbyaregulatoryauthor itythatisamemberoftheInternationalOrgani zationofSecuritiesCommissions(IOSCO)andm anagedbyreputablefundmanager/s;providedf urtherthattheinvestmentinthesaidcollecti veinvestmentschemeshouldatleastbeninetyp ercent(90%) )Short-termtradablefixed-incomeinstrumen tsissuedorguaranteedbythePhilippinegover nmentortheBSP;tradablesecuritiesissuedby thegovernmentofaforeigncountry,anypoliti calsubdivision/agencyofaforeigncountryor anysupranationalentity;tradablefixed-inc omeinstrumentsissuedbyforeignorlocalfina ncialinstitutionsorprivatecorporations;e xchange-listedsecurities;marketableinstr umentsthataretradedinanorganizedexchange ;loanstradedinanorganizedmarket;and, ,that,afinancialinstrumentisregardedastr adableiftwo-waypricesarequoted,readilyav ailableorregularlyavailablefromanexchang e,dealer,broker,industrygroup,pricingser viceorregulatoryagency,andthosepricesrep resentactualandregularlyoccurringmarkett ransactionsonanarm