Transcription of Carbon Tax Rates by Fuel Type from July 1, 2012

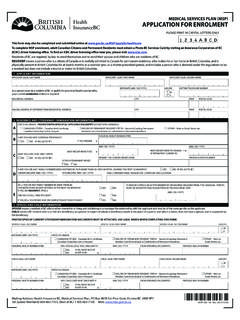

1 Ministry of Finance Tax Schedule ISSUED: September 2009 REVISED: February 2023 The Carbon tax rate changes announced in Budget 2020, which were deferred to provide relief to people and businesses as part of our COVID-19 support measures, will take effect on April 1, 2021. The Carbon tax Rates effective April 1, 2021 and April 1, 2022 are aligned with the federal Carbon pricing backstop methodology, where applicable. This means these Carbon tax Rates are revised from the Rates that were previously set in 2017. Also, effective April 1, 2021, the Rates for shredded and whole tires are replaced with a new category for combustible waste. Combustible waste includes tires in any form and asphalt shingles as a new taxable combustible. Carbon Tax Rates by Fuel Type From July 1, 2012 to March 31, 2023. April 1, 2022 - Units for July 1, April 1, April 1, April 1, March 31, Tax Rates 2012 2018 2019 2021 2023.

2 Liquid Fuels Gasoline /litre Light Fuel Oil * /litre Heavy Fuel Oil /litre Aviation Fuel /litre Jet Fuel /litre Kerosene /litre Naphtha /litre Methanol /litre Gaseous Fuels Natural Gas /gigajoule or /cubic metre Propane /litre Butane /litre Ethane /litre Gas Liquids /litre Pentanes Plus /litre Refinery Gas /cubic metre Coke Oven Gas /cubic metre Solid Fuels Low Heat Value Coal $/tonne High Heat Value Coal $/tonne Coke $/tonne Petroleum Coke /litre PO Box 9442 Stn Prov Govt Victoria BC V8W 9V4. Carbon Tax Rates by Fuel Type From July 1, 2012 to March 31, 2023. April 1, 2022 - Units for July 1, April 1, April 1, April 1, March 31, Tax Rates 2012 2018 2019 2021 2023. Combustibles Peat $/tonne Tires shredded $/tonne Tires combined under Tires whole $/tonne Combustible Waste Combustible Waste (includes whole and shredded tires and asphalt New category beginning shingles) $/tonne April 1, 2021 * Light fuel oil subcategories of light fuel oil include: Diesel Locomotive fuel Heating oil Industrial oil Further Information Online: Toll free: 1-877-388-4440.

3 Email: Subscribe to our What's New page to receive email updates when information changes. Carbon Tax Rates by Fuel Type From July 1, 2012 to March 31, 2023 Page 2 of 2.

![[Anjarwalla & Khanna] is a top choice for complex ...](/cache/preview/9/c/f/9/2/3/3/f/thumb-9cf9233f25ddb0d44887569614760df2.jpg)