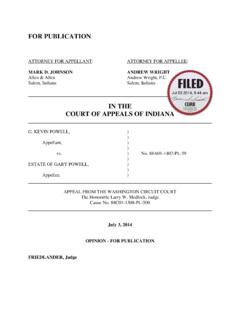

Transcription of CHANGE OF OWNERSHIP STATEMENT REAL PROPERTY OR ...

1 H. This is a transfer of PROPERTY :1. to a revocable trust that may be revoked by the transferor and is for the benefit of the transferor, and or the transferor's to a trust that may be revoked by the creator/grantor who is also a joint tenant, and which names the other joint tenant(s) as beneficiaries when the creator/grantor dies. 3. to a irrevocable trust for the benefit of the creator/grantor and/or grantor's spouse. 4. to an irrevocable trust from which the PROPERTY reverts to the creator/grantor within 12 OF OWNERSHIP STATEMENT REAL PROPERTY OR MANUFACTURED HOMES SUBJECT TO LOCAL PROPERTY TAXESThis STATEMENT represents a written request from the Assessor.

2 Failure to file will result in the assessment of a DOCUMENT IS NOT SUBJECT TO PUBLIC INSPECTIONBOE-502-AH (P1) REV. 12 (08-09)NAME AND MAILING ADDRESS OF BUYER/TRANSFEREE(Make necessary corrections to the printed name and mailing address)RFILE THIS STATEMENT BY:PART 1. TRANSFER INFORMATION Please complete all This transfer is solely between husband and wife (addition of a spouse, death of a spouse, divorce settlement, etc.).C. This document is recorded to create, terminate, or reconvey a lender's interest in the This document is recorded to substitute a trustee of a trust, mortgage, or other similar This transfer resulted in the creation of a joint tenancy in which the seller (transferor) remains as one of the joint This transfer returns PROPERTY to the person who created the joint tenancy (original transferor).

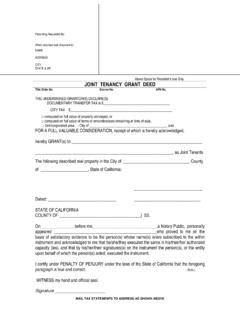

3 I. This PROPERTY is subject to a lease, and has the remaining lease term 35 years or more including written This transaction is to replace a principal residence by a person 55 years of age or This transfer is solely between domestic partners currently registered with the California Secretary of This is a transfer between parties in which proportional interests of the transferor(s) and transferee(s) remain the same after the This is a transfer subject to subsidized low-income housing requirements with governmentally imposed This transfer is to the first purchaser of a new building containing an active solar energy system. L. This transaction is to replace a principal residence by a person who is severely disabled as defined by Revenue and Taxation Code section This transaction is only a correction of the name(s) of the person(s) holding title to the PROPERTY ( , a name CHANGE upon marriage).

4 If YES, please explain:D. This transaction is recorded only as a requirement for financing purposes or to create, terminate, or reconvey a security interest ( , cosigner). If YES, please explain:J. This is a transfer between:parent(s) and child(ren)grandparent(s) and grandchild(ren).If you checked YES to statements J, K, L, or P, you may qualify for a PROPERTY tax reassessment exclusion, which may result in lower taxes on your PROPERTY . If you do not file a claim, it will result in the reassessment of your PROPERTY . Contact the Assessor for claim provide any other information that will help the Assessor understand the nature of the OF SELLER/TRANSFEROR (LAST, FIRST, MIDDLE INITIAL)STREET ADDRESS OF REAL PROPERTYCITYZIP CODEASSESSOR'S PARCEL NUMBERBOE-502-AH (P2) REV.

5 12 (08-09)STREET ADDRESS OF REAL PROPERTYASSESSOR'S PARCEL NUMBERRRPART 2. OTHER TRANSFER INFORMATION PART 3. PURCHASE PRICE AND TERMS OF SALEC heck and complete as and complete as Date of transfer, if other than recording date: A. Cash down payment, or value of trade or exchange. Do not include closing First deed of interest for% interest foryears; monthly payment (principal and interest) $ years; monthly payment (principal and interest) $ C. Second deed of Value of any improvement bond assumed by the Value of real estate commission. Enter an amount only if the PROPERTY was traded or Total purchase or acquisition price. Add items A through The PROPERTY was purchased:I.

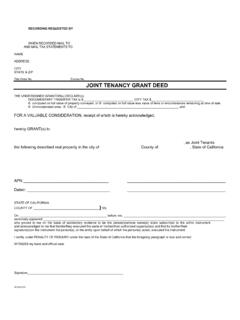

6 Please explain any special terms, seller concessions, financing not shown above, and any other information that would assist the Assessor in the valuation of your Only a partial interest in the PROPERTY was YES, indicate the percentage transferred:B. Type of transfer:PurchaseContract of sale. Date of contract:Sale/leasebackCreation of a leaseOther. Please explain:Other. Please explain:Original term in years (including written options):Remaining term in years (including written options):Assignment of a leaseInheritance. Date of death:Termination of a lease. Date lease began:ForeclosureGiftTrade or exchangeMerger, stock, or partnership acquisitionYESNO%$$$$$$$$$Through broker.

7 Provide broker name and telephone:Direct from sellerFrom a family memberFHA ( ____ ) discount pointsFixed rateNew loanConventionalVariable rateAssumed existing loanVA ( ____ ) discount pointsBank or savings & loanLoan carried by sellerFixed rateBank or savings & loanNew loanCal-VetLoan carried by sellerBalloon payment due:Balloon payment due:AmountAmountVariable rateFinance companyAssumed existing loan% interest foryears; monthly payment (principal and interest) $ D. Other financing. Type of financing:$$Bank or savings & loanFixed rateNew loanLoan carried by sellerBalloon payment due:Outstanding balance:AmountVariable rateAssumed existing loanBOE-502-AH (P3) REV. 12 (08-09)STREET ADDRESS OF REAL PROPERTYASSESSOR'S PARCEL NUMBER$$RPART 4.

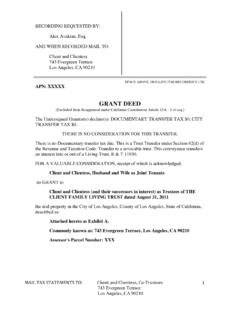

8 PROPERTY INFORMATIONC heck and complete as Type of PROPERTY transferredSingle-family residenceAgriculturalLease/rentTimeshare Multiple-family residence. Number of units:Co-opContractManufactured homeCommercial/industrialCondominiumMine ral rightsOther:Unimproved lotOther. Description: ( , timber, mineral, water rights, etc.) YES, indicate the date of occupancy:If YES, attach an itemized list and enter the value:If YES, enter the allocated value attributed to the manufactured home:If YES, the income is from:Or the date of intended occupancy:MM/DD/YYYYMM/DD/YYYYThis PROPERTY is intended as my personal PROPERTY (other than a manufactured home subject to local PROPERTY tax), or incentives, are included in the purchase price.

9 Examples are furniture, farm equipment, machinery, club memberships manufactured home is included in the purchase manufactured home is subject to local PROPERTY tax. If NO, enter decal number:The PROPERTY produces condition of the PROPERTY at the time of sale was: Please explain the physical condition of the PROPERTY , and provide any other information that would assist the Assessor in determining the value of the PROPERTY . The Assessor's office may contact you for additional information regarding this NOTICEI certify (or declare) under penalty of perjury under the laws of the State of California that the foregoing and all information hereon, including any accompanying statements or documents, is true and correct to the best of my knowledge and belief.

10 This declaration is binding on each and every co-owner and/or OF OWNER OR CORPORATE OFFICERTITLEDATEDAYTIME TELEPHONENAME OF NEW OWNER/LEGAL REPRESENTATIVE/CORPORATE OFFICERE-MAIL ADDRESSThe law requires any transferee acquiring an interest in real PROPERTY or manufactured home subject to local PROPERTY taxation, and that is assessed by the county assessor, to file a CHANGE of OWNERSHIP STATEMENT with the County Recorder or Assessor. The CHANGE of OWNERSHIP STATEMENT must be filed at the time of recording or, if the transfer is not recorded, within 45 days of the date of the CHANGE in OWNERSHIP , except that where the CHANGE in OWNERSHIP has occurred by reason of death the STATEMENT shall be filed within 150 days after the date of death or, if the estate is probated, shall be filed at the time the inventory and appraisal is filed.