Transcription of CHAPTER 41:01 TAXATION ARRANGEMENT OF SECTIONS …

1 TAXATION Cap. 41:01 1 CHAPTER 41:01 TAXATION ARRANGEMENT OF SECTIONS PART I preliminary section 1. Short title 2. Interpretation of certain general terms 3. Commissioner of Taxes PART II ADMINISTRATION 4. Delegation of functions by Commissioner 5. Report by Commissioner 6. Officers to observe secrecy 7. Forms 8. Service of documents 9. Service of oral notices 10. Validity of documents PART III INCOME Division 1 Determination of Assessable Income 11. Income and assessable income 12. Special circumstances in which income deemed to have accrued 13. Exemption 14. Income-annuities 15. Non-recognition of capital gain or capital loss in certain cases 15A. Involuntary conversion of assets 15B. Capital gains on disposal of business assets 16.

2 Income-payments for services 17. Income-sums received on cessation of employment 18. Income-expenses and benefits 19. Expenses and benefits. Asset belonging to employer 20. Expenses and benefits. Employer may furnish statement 21. section 18, 19 and 20 not to apply in certain cases 22. Income-passages 23. Premiums 24. Timber sales 25. General 26. Foreign exchange gain and foreign exchange loss 27. Income deemed to have accrued in Malawi Division 2-Deductions, Determination of Taxable Income 28. Allowable deductions in determining taxable income 29. Allowable deductions-educational passages 30. Personal allowances 31. Alimony 2 Cap. 41:01 TAXATION section 32. Allowable deductions-repairs 33. Allowable deductions-capital allowances 34.

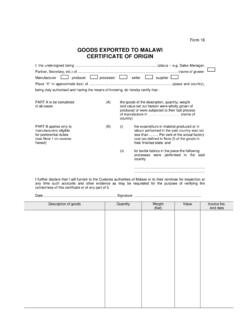

3 Allowable deductions-premiums paid 35. Allowable deductions-bad debts 36. Allowable deductions-doubtful debts 36A. Allowable deductions-export allowance 37. Allowable deductions-pension funds and provident funds 38. Allowable deductions-sale of timber 39. Allowable deductions-research, etc. 40. Allowable deductions-annuity payment 41. Allowable deductions-new business initial expenditure 41A. Allowable deductions-training allowance 41B. Allowable deductions-transport allowance 42. Allowance of losses-General 43. Allowance of losses-change in shareholding in company 44. Allowance of losses-formation of new company 45. Deductions not to be made 46. Deductions not admissible as regards income derived from trade Division 3-Stock and Work in Progress 47. Trading stock and work in progress to be taken into account 48.

4 Valuation of stock and work in progress at end of year 49. Valuation of stock and work in progress at beginning of year 50. Definition of cost and market selling value 51. Domestic consumption 52. Gifts and sales 53. Valuation of livestock Division 4-Determination of Taxable Income where Adequate Books and Records are kept 54. Books of account 55. Period of accounts Division 5-Businesses Carried on Partly in and Partly out of Malawi and Businesses controlled Abroad 56. Profits of non-resident persons from sale of exported produce 57. Persons carrying on business which extends beyond Malawi PART IV SPECIAL TRADES AND CASES 58. TAXATION of income derived from farming 59. Co-operative agricultural societies 60. Consumers co-operative societies 61. Clubs, etc.

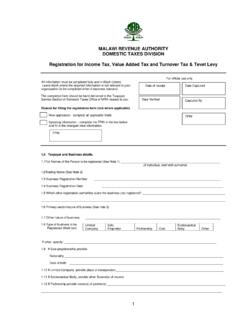

5 , formed, etc., for pleasure or recreation 62. Building society interest 63. Non-life insurance business 64. Hire purchase or other agreements providing for postponement of ownership of property 65. Approval of pension fund or provident fund TAXATION Cap. 41:01 3 PART V TAXATION OF COMPANIES Division 1-Income Tax section 66. Charge 67. Public officers of companies 68. Duty of companies to furnish returns 69. Notification of dividend declared 70. Dealings by a company in another company s shares 70A. Dividend tax account 70B. Recognition of gain or loss on distribution of property with respect to shares 70C. Effect of a distribution of shares of a company to its shareholders 70D. Distribution in complete liquidation of a company 70E.

6 No gain or loss on certain contributions to capital 70F. Basis of assets in a qualified reorganization of a company PART VI INDIVIDUALS 71. Charge 72. Deemed taxable income 73. Income of married women and minor children 74. Partnership PART VII TRUSTEES 75. Special provisions in connexion with income derived from assets in deceased and insolvent or bankrupt estates 76. Tax payable by trust PART VIIA NON-RESIDENTS 76A. Liability for non-resident tax PART VIII REPRESENTATIVE TAXPAYERS 77. Representative taxpayers 78. Liability of representative taxpayer 78A. Protection for certain trustees 79. Right and personal liability of representative taxpayer 80. Company regarded as agent for absent shareholder 81. Power to appoint agent 82. Remedies of Commissioner against agent and trustee 83.

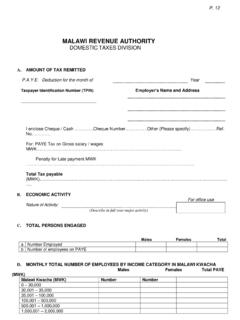

7 Power to require information PART IX RETURNS, PROVISIONAL TAX AND ASSESSMENTS 84. Return of income 84A. Payment of provisional tax 4 Cap. 41:01 TAXATION section 84B. Exemption from provisional tax 84C. Payment of balance of income tax 84D. Payment of tax 84E. Penalty for failure to pay taxes 85. Duty to furnish returns as to employees, their earnings and other matters 85A. Tax clearance certificate 86. Commissioner to have access to all public records 87. Duty of person submitting accounts in support of return or preparing account for other persons 88. Production of documents and evidence on oath 89. Estimated income 90. Assessment to tax 91. Additional Assessment 92. Assessments and notices thereof 93.

8 Register of assessments 94. Inspection of register PART IXA TAXATION OF FRINGE BENEFITS 94A. Liability of employers to pay fringe benefits tax 94B. section 94A not to apply in certain cases 94C. Employee defined 94D. Fringe benefits tax not to be imposed on employees PART X APPEALS 95. Burden of proof 96. Procedure on appeals 97. Appeal to Commissioner 98. Appeal to Special Arbitrator 99. Publication of decisions of Special Arbitrator 100. Appeals from assessments, etc., by administrative officers 101. Appeal to High Court PART XI COLLECTION AND RECOVERY OF TAX Division 1-Withholding Taxes 102. Assessment charge and collection of tax on salaries and wages 102A. Deduction of tax from certain payments 103. Priority of tax deduction at source 104. Formal assessment to be unnecessary 104A.

9 Credit of tax deducted at source Division 2-Assessments Raised by the Commissioner 105. Payment of tax on Assessment 106. Persons by whom the tax is payable 107. Recovery of tax 108. Form of proceedings TAXATION Cap. 41:01 5 section 109. Production of register of assessments 110. Payment of tax by persons leaving Malawi 111. Security of payment of tax PART XII PENALTIES 112. Liability for penalties 113. Imposition of penalty 114. Accounts deemed to have been submitted by person 115. Assisting in making incorrect returns 116. Obstruction of officers 117. Inciting a person to refuse to pay tax 118. Time limit for penalty proceedings 119. Liability of officers of company 120. Recovery of tax repaid in consequence of fraud or negligence 121.

10 Saving for criminal proceedings, etc. PART XIII GENERAL 122. Relief from double TAXATION 123. Reduction of tax payable as a result of agreements entered into in terms of section 122 124. Relief from double TAXATION in cases where no agreements have been made under section 122 125. Error or mistake 126. Repayment of tax 127. Transfers to defraud, and artificial transactions 128. Errors, etc., in assessment and notice may be rectified, and Commissioner may remit tax PART XIV MINIMUM TAX AND GRADUATED TAX 129. Application for this Part Division 1-Minimum Tax 130. Liability for minimum tax 131. Exemptions from minimum tax 132. Penalty for late payment of minimum tax 133. Production of receipt 134. Failure to produce receipts 135. Prosecution for failure to pay minimum tax 136.