Transcription of Charts on Q3 FY 2020/21 Facts & Figures

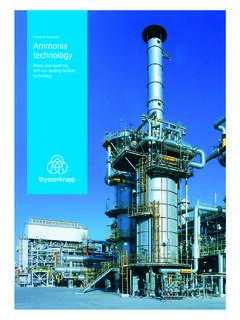

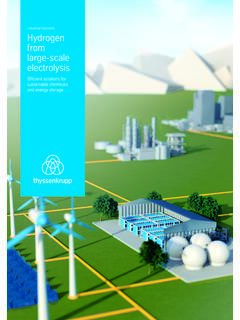

1 Charts on Q3 FY 2020/21 Facts & FiguresTicker: TKA (Share) TKAMY (ADR)September20212| thyssenkrupp AG l Investor Relations l September 2021We are committed to realize value for our shareholdersWhat we build on ..01 Leading technologies, products and services-Premium steel, diverse industrial materials, innovative supply chain services-Mission critical componentsfor advanced mobility, wind energy-H2electrolysis; efficient process technologies ( ammonia) -Our businesses mostly fill top market positionsStrong balance sheet with Net Cash position-Equity Ratio 29%, Net Cash position bn2-Financial and operational turnaround underway0302 Strong ties with long-standing customer base-Strong customer trust on the back of our more than 200 years expertise in engineering and technology -Well-known and diverse customers in NA, EU and CHN which stand for >90% of our sales104 Strategic realignment with largest restructuring ever-New Group of Companies approach with clear focus on industrial prospects, competitive profitability and cash flow-Restructuring target to reduce >12.

2 000 FTEs in executionIn-house competencies for green transformation-Clear SBTi-approved concept to reach climate neutrality by 2050-Enabling our customers decarbonisation w\ our products and technologies 051. Basedon salesFY 19/20 l 2. As | thyssenkrupp AG l Investor Relations l September 2021 Content Facts & Figures slides 37-71 Quarterly Update (August 11, 2021) Q3 FY 2020/21 slides 03-18 Group Overviewslides 19-28 ESG and Green Transformationslides 29-36 4| thyssenkrupp AG l Investor Relations l September 2021+1%+21%+2%+515 mn9M: Group performance reflects financial turnaround by advancing improvements and strong demandCost and restructuring measures clearly supporting Group performance1and will be relentlessly continuedOrder intake[ bn] +28%FCF bef.

3 M&A[ mn] +14%41(693)(279)220266(1,158)(185)78564+ bn(367)(750)(2,407)(235)32(2,988)(953)(1 ,238)Sales[ bn] EBIT adj.[ mn]Q2Q1Q2Q1FY 19/20FY 20/21Q3Q3+ bn(4,012)9M 19/209M 20/219M 18/199M 19/209M 20/219M 18/191. Continuedfigures9M 18/19 reportedin formerorganizationalstructure; asofOct01, 2019 neworganizationalstructureincl. lossofMT (236) mnytdincl. veBCF ofMT (167) mnytd5| thyssenkrupp AG l Investor Relations l September 2021Q3: continued progress in performance, restructuring and portfolioPerformanceandRestructuring EBIT adj. at 266 mnup (QoQ: + 46 mn; YoY: + 959 mn) Extraordinary strong performance of Material Services Strong demand also at AT, IC and SE; however, effects from SEMI shortage induced lower customer call-offs and higher costs for raw materials and steel components Stringent execution of planned headcount reduction: ~6,900 FTEs (>50% of reduction target of >12,000 FTEs1) FCF bef.

4 M&A at (235) mnstrongly improved (QoQ: +515 mn; YoY: + 1,003 mn) Higher earnings, mainly by price driven NWC build-up FY still with higher investments (above D/A)for performance and value upside Strong balance sheet withNet Cash of 4 bn Swift progress in portfolio streamlining at Multi Tracks Mining: signing of saleto FLSmidthon July 29, +veeffects on Net Cash, Pensions with closing Infrastructure: signing of sale on Aug 5,+veeffects on Net Cash, Pensions with closing AST: signing of sale on Sep 15,+veeffects on Net Cash, Pensions with closing Steel Europe: internal workstream initiated for stand-alone options Water electrolysis (UCE):order intake from US (CFI); frequent requests for quotations, project funnel expandingPortfolio1.

5 Target until FY 22/23 from defined programs since | thyssenkrupp AG l Investor Relations l September 2021 Strong progress on clear restructuring plan Target within defined programsof >12,000 FTEsFTEs [#]Restructuringexpenses/cash-out [ mn](Cumulative) sustainablesavings[ mn]~600way to go until 22/232~20019/ 2020/21 ERR221870919/20cum. 20/21 Ecum. until 22/232 ~2/3 of current target will already be achieved as of end FY 20/21 Total headcount reduction incl. add. initiatives: ~7,700 FTEs1 Almost all provisions made for target until 22/23 FY 20/21 cash-out of low-mid 3-digit mn Total sustainable cost benefit from restructuring in high 3-digit mnrangehigh 2-digit mnway to go until 22/232~45%>12,000 Targ et~55%Rest of worldGermany~70%~30%low-mid3-digit mnhigh3-digit mn~ 6,900 FTEsreduced1.

6 Incl. reduction from defined programs since (~6,900 FTE) + additional FTE reduction (incl. from fluctuation); w/o reduction of external FTE l 2. Incl. way to go until FY 22/23 (FY 19/20 - FY 22/23)achieved7| thyssenkrupp AG l Investor Relations l August 2021MX: significant margin uplift due to price increases continued improvement on costs1,0251,4211,357+32%2,8881,9363,289+ 70%126-75232+307mn( )% Strong recovery from 19/20 COVID-dip, yet volumes below pre-pandemic level QoQ: Material shortage partly limiting shipments Higher materials prices especially for carbon and stainless steel and significantly higher shipments Favourable price dynamics benefitting margins Effective performance and cost management: Productivity gains of 10% ytd Sub proportional growth of costs (+14% vs.)

7 Volume >+30%) Number of FTE down by ~1,800 vs. end of FY 18/19 Economic development CY 2021 EManufacturing PMI Rising demand for carbon and stainless steel (ytd: NA +6%, EU +18%), however still below pre-pandemic level Market demand > supply from producers Seasonally lower volumes in cal. Q3 QoQEuropeNorthAmericaCarbon Steel(~45% of sales)Stainless Steel3(~15% of sales)Real steeldemandCY 2021E ( Yo Y)Trends in industrial materials supply Return to pre-pandemic level in next fiscal year Increasing demand for supply chain andprocessing services+ + + + Yo YFundamental market trends2 EBIT adj.[ mn; %]Q3 19/20Q3 20/21Q2 20/211. Materials Stockholding andProcessing (excl. direct-to-customerandAerospace business) l 2 Sources: IHS Markit(07/2021) and CRU (Q2/2021) l 3 Based on Stainless Steel FlatSales[ mn]Shipments1[kt]CY 2021E8| thyssenkrupp AG l Investor Relations l August 2021IC: market growth and stringent cost control drive profitability gains432656606+40%452626630+40%279768+ Bearings (BG) O/I: growth in industrial applications in Europe (ex Germany) and Americas Wind energy temporarily lower yoyas expected EBIT adj.

8 Yoylower due to higher steel prices and effects from product/regional mix (mainly China) YTD +veeffects from scale economies in wind energy product mix, productivity increases, restructuring Forged Technologies (FT) O/I: sig. up in all regions mainly for truck and construction machinery components; car compnt sslightly affected by SEMI shortages EBIT adj. sig. up due to cost control: reduction of FTE with improved personnel cost ratio, reduced SG&ASavings in procurement partly compensate higher cost for logistics, steel and maintenanceOrder intake[ mn]EBIT adj.[ mn; %]Comments Yo YFundamental market +22%+2%Europe and Americas93881122021E20202025E-5%+6% BG: very high demand for wind turbines in China 20 leads to temp.

9 Total decline mid-term trend up FT: demand recovery in all regions (except China)Medium & heavy vehicle production (~25% of IC sales) [mn#]:Trends and demand driversBearings (BG): green energy; capacity; size Offshore: >10 MW wind turbines Onshore: >4 MW platforms>70 m blade length (for low wind speed) Forged Technologies (FT): logistics; construction Heavy duty engines and construction machinery grow with GDPI nstallations in wind energy (~1/3 of IC sales) [GW]:GobalQ3 19/20Q3 20/21Q2 20/211. Source: Global Wind EnergyCouncil (03/2021) , IHS Markit(07/2021)AMEUS ales[ mn]CY 2021E9| thyssenkrupp AG l Investor Relations l August 2021 EBIT adj.[ mn; %]AT: strong growth in auto demand, but SEMI shortage induced lower customer call-offs QoQ7031,1581,076+53%7201,1671,077+50%(91 )7551+142mn Sig.

10 Up in all businesses with ongoing support from strong auto demand particularly in China Shortages in supply chain (SEMI products) lead to lower call-offs and production interruptions vs. Q1 and Q2, however Higher utilization at all businesses; QoQlower sales and market-related higher costs (freight, packaging, raw material, SEMI products) Higher production efficiency, favorable order structure, cost savings from restructuring6372025E22020411652021E1426 53738093+10%+4%Electric incl. Fuel CellHybridICEQ3 19/20Q3 20/21Q2 20/21 Growth in global auto production to 80 mn(+10%), however yet below pre-pandemic level SEMI shortage likely to delay production in H2 Trends for advanced components E-mobility ( rotor shafts, chassis components for new platforms) Autonomous driving (advanced chassis designs)1.