Transcription of CHINA - OECD.org

1 3. DEVELOPMENTS IN INDIVIDUAL OECD AND SELECTED NON-MEMBER ECONOMIESOECD ECONOMIC OUTLOOK, VOLUME 2018 ISSUE 2 PRELIMINARY VERSION OECD 201889 CHINAA fter having held up well into 2018, growth has recently weakened and is projectedto decline in 2019-20. Signs of slowdown include the weakening of industrialproduction, profits and revenues. Foreign trade flows will lose some momentumfollowing the escalation of trade tensions. The slowdown of activity also reflects thecutback of infrastructure investment, as local government debt has been subject togreater scrutiny, though it could rebound following the recent acceleration of debtissuance and announcement of new conditions are now being eased to support economic escalation of trade tensions resulted in a fall of the exchange rate, which was haltedby government interventions, and a decline in stock prices.

2 Fiscal policy will remainsupportive to counteract the weakening of growth. Government spending efficiency willbenefit from newly introduced comprehensive performance budgeting, but capitalallocation efficiency needs to be improved by gradually removing implicit guarantees tostate-owned enterprises and other government entities. Measures introduced recently tolower average tariffs are welcome and should continue alongside further easing of theoperation of foreign economy has remained relatively unscathed by rising global uncertaintiesGrowth has been holding up well, notwithstanding the escalation of trade tensionsand heightening global uncertainties.

3 The frontloading of exports and the depreciation ofthe renminbi have mitigated the impact of tariff hikes so far. Imports have also held upwell on the back of tariff cuts coming into effect earlier this year and subsequent targetedretaliatory tariff increases and as outbound tourism remained robust. As a result, thecurrent account registered its first deficit in two decades in the first half of the demand, in particular consumption, has remained robust and will continue to bea stable driver of growth thanks to rising disposable incomes.

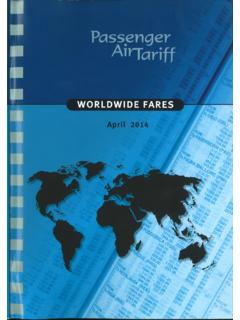

4 Infrastructure investmenthas slowed following restrictions imposed on shadow banking, a major source ofChina1. Monthly industrial value added data for January and February are not published separately, but for the two months combined. Themissing data are computed by linear 2 o y % changes Industrial value added Real GDPI ndustrial production growth has moderated 2502550 30 20 1001020304050201620172018 Y o y % changesExportsImportsMerchandise trade growth has remained relatively strong3.

5 DEVELOPMENTS IN INDIVIDUAL OECD AND SELECTED NON-MEMBER ECONOMIESOECD ECONOMIC OUTLOOK, VOLUME 2018 ISSUE 2 PRELIMINARY VERSION OECD 201890infrastructure financing. Excess capacity still plagues a number of industrial sectors,weighing on business investment. Services, in contrast, are expanding steadily, especiallyin the digital and sharing and fiscal policy may ease, but structural reforms should accelerateMonetary policy was tightened somewhat by the restrictions put on shadow banking,which were necessary to maintain financial stability.

6 This affected disproportionatelyChina:Demand, output and prices1 2 &XUUHQW SULFHV &1< WULOOLRQ*'3 DW PDUNHW SULFHV 7 RWDO GRPHVWLF GHPDQG ([SRUWV RI JRRGV DQG VHUYLFHV ,PSRUWV RI JRRGV DQG VHUYLFHV 1HW H[SRUWV Memorandum items*'3 GHIODWRU B &RQVXPHU SULFH LQGH[ B *HQHUDO JRYHUQPHQW ILQDQFLDO EDODQFH RI *'3 B +HDGOLQH JRYHUQPHQW ILQDQFLDO EDODQFH RI *'3 B &XUUHQW DFFRXQW EDODQFH RI *'3 B &RQWULEXWLRQV WR FKDQJHV LQ UHDO *'3 DFWXDO DPRXQW LQ WKH ILUVW FROXPQ Source.)]]]

7 2(&' (FRQRPLF 2 XWORRN GDWDEDVH 3 HUFHQWDJH FKDQJHV YROXPH SULFHV (QFRPSDVVHV WKH EDODQFHV RI DOO IRXU EXGJHW DFFRXQWV JHQHUDO DFFRXQW JRYHUQPHQW PDQDJHG IXQGV VRFLDO VHFXULW\ IXQGV DQG WKH VWDWH RZQHG FDSLWDO PDQDJHPHQW DFFRXQW 7KH KHDGOLQH ILVFDO EDODQFH LV WKH RIILFLDO EDODQFH GHILQHG DV WKH GLIIHUHQFH EHWZHHQ UHYHQXHV DQG RXWOD\V 5 HYHQXHV LQFOXGH JHQHUDO EXGJHW UHYHQXH UHYHQXH IURP WKH FHQWUDO VWDELOLVDWLRQ IXQG DQG VXE QDWLRQDO EXGJHW DGMXVWPHQW 2 XWOD\V LQFOXGH JHQHUDO EXGJHW VSHQGLQJ UHSOHQLVKPHQW RI WKH FHQWUDO VWDELOLVDWLRQ IXQG DQG UHSD\PHQW RI SULQFLSDO RQ VXE QDWLRQDO GHEW China1.)))

8 Core shadow banking items include entrusted loans, trusted loans and undiscounted bankers' :CEIC; and 2 10 505101520 1001020201620172018Y o y % changes Total creditCore shadow banking items Shadow banking has been reined in05010015003060901201501802007200920112 01320152017 % of GDPG eneral governmentHouseholdsNon financial enterprisesCorporate debt has stabilised, but at a high level3.

9 DEVELOPMENTS IN INDIVIDUAL OECD AND SELECTED NON-MEMBER ECONOMIESOECD ECONOMIC OUTLOOK, VOLUME 2018 ISSUE 2 PRELIMINARY VERSION OECD 201891private and smaller firms, which have less access to commercial bank loans, and promptedthe authorities to incentivise lending to smaller firms by exempting banks from taxliabilities related to their lending to such firms. Rising bond defaults resulted in a highercredit risk premium. Going forward, moderate easing of monetary policy is envisaged toreduce the debt burden. Corporate debt has levelled off relative to GDP, but deleveragingremains slow.

10 Sliding stock prices will damp stimulus will hold growth up but better pricing of risk is needed to reducemisallocation of capital. Removal of implicit guarantees to state-owned enterprises andother public entities would help, and the recent announcement to let ailing localgovernment investment vehicles exit the market is pointing in that direction. The impactof tax cuts aimed at boosting consumption may be mitigated by adverse confidence effectsand slow progress in structural reforms. A minimum level of public services should beensured through better allocation of resources to provide more equal opportunities toindividuals regardless of their place of birth.