Transcription of CI Open and Registered Plan

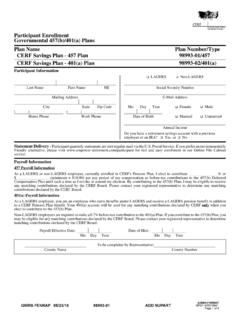

1 CI open and Registered plan Mutual Fund Application Form NON- Registered plan ( open ) CI CORPORATE CLASS. RETIREMENT SAVINGS plan (RSP) PORTFOLIO SERIES . SPOUSAL RSP PORTFOLIO SELECT SERIES . LOCKED-IN RETIREMENT ACCOUNT (LIRA) SIGNATURE FUNDS . GROUP RSP CAMBRIDGE FUNDS. RETIREMENT INCOME FUND (RIF) BLACK CREEK FUNDS. SPOUSAL RIF HARBOUR FUNDS . LIFE INCOME FUND (LIF) SYNERGY FUNDS. LOCKED-IN RETIREMENT INCOME FUND (LRIF) MARRET FUNDS. RESTRICTED LIFE INCOME FUND (RLIF) CI FUNDS . RESTRICTED LOCKED-IN RSP (RLSP) G5|20 SERIES . PRESCRIBED RIF (PRIF) T-CLASS. CI open and Registered plan Mutual Fund Application Form 1 plan Information plan OPTIONS. q Transfer existing open Account to an RSP. CI Account Number q Transfer existing RSP/LIRA to an RIF/LIF/LRIF/RLSP/RLIF. ACCOUNT TYPES. q Non- Registered plan ( open ) q Retirement Savings plan (RSP) q Spousal RSP q Group RSP . q Locked-In Retirement Account (LIRA)* q Restricted Life Income Fund (RLIF)* q Prescribed RIF (PRIF).

2 Q Retirement Income Fund (RIF) q Spousal RIF q Life Income Fund (LIF)* . q Restricted Locked-In RSP (RLSP)* q Locked-In Retirement Income Fund (LRIF)* . *Attach the applicable Provincial/Federal addendum . Applicable under approved provincial jurisdiction only . G5|20 Series Funds are not eligible for these plan types 2 Unitholder Information Primary Unitholder/Annuitant Information Language Preference: q English q French Gender: q Male q Female q Mr. q Mrs. q Miss q Ms. q Dr. Surname First Name Middle Initial(s). E-mail Address Street Address Apt. City Province Postal Code Y M D. M A N D A T O R Y M A N D A T O R Y. Telephone (Home) Telephone (Business) Social Insurance Number Birth Date q Joint Tenants with Right of Survivorship* q Tenants in Common* q In Trust For*. q Joint Tenants In Trust For* q Corporation* (Articles of Incorporation) *Note: Not applicable for Registered Products q Mr. q Mrs. q Miss q Ms. q Dr. q Contributing Spouse's Information (For Spousal RSP Accounts only) OR q Joint Unitholder* OR q In Trust For Information*.

3 Q And* q And/or*. Y M D. M A N D A T O R Y M A N D A T O R Y. Surname First Name Middle Initial(s) Social Insurance Number Birth Date MANDATORY FOR ALL NON- Registered ACCOUNTS To be completed by the primary unitholder and joint unitholder (if applicable). The following question should be answered only by individual applicants. Are you a resident for tax purposes (which includes a citizen)? Primary Unitholder q Yes q No Joint Unitholder (if applicable) q Yes q No If YES, provide a Taxpayer Identification Number (TIN). Primary Unitholder's TIN_____ Joint Unitholder's TIN (if applicable)_____. If NO, and you are a temporary visitor, such as retirees or snowbirds and students, who spend considerable time vacationing in the , you can make the following optional Visitor Declaration: Optional Temporary Visitor Declaration check box if making this declaration: Primary Unitholder q Joint Unitholder (if applicable) q I certify that I am a resident of Canada.

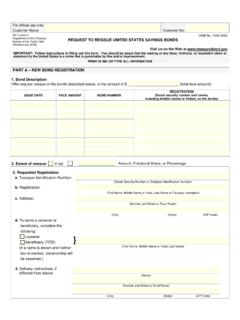

4 I further certify that any address, telephone number or standing instructions to transfer funds to an account maintained in the associated with this account only exists or will arise only in the context of temporary visits that I make to the while I remain a resident of Canada and not, at any time, a resident of the for tax purposes or a citizen. I agree to notify CI Investments if events cause this certification to become false or misleading. THREE COPIES OF THIS APPLICATION ARE REQUIRED TO BE PRINTED AND SIGNED BY THE CLIENT. Part 1 - CI Copy PART 2 - CLIENT COPY PART 3 - REPRESENTATIVE COPY. 3 Beneficiary Information (Applicable for Registered Products only). I designate the person(s) named below, if then living, as beneficiary(ies) to receive the proceeds of the account upon my death. I hereby revoke any previous designation of beneficiary made by me for this account. Unless otherwise indicated, at the time of my death the proceeds of my account shall be divided equally between the surviving beneficiaries.

5 The share belonging to the beneficiary(ies) who predeceases me shall be paid proportionally to the remaining beneficiaries. Should all named beneficiary(ies) predecease me; the proceeds of the account will be paid to my Estate. Last Name First Name & Initial(s) Relationship to Account Holder Social Insurance Number (SIN) Share%. Name of Trustee(s) appointed for minor beneficiary(ies) (except in Quebec) _____. Caution: This beneficiary and or election of Spouse as Successor Annuitant is subject at all times to the laws applicable in the province or territory in which you reside. In addition, your beneficiary designation may not automatically change as a result of any future marriage or marriage breakdown. It is your sole responsibility to ensure that the beneficiary designation or election of Spouse as Successor Annuitant is permitted, effective and changed when appropriate. I understand that if I have completed the election of Spouse as a Successor Annuitant in Section 8, the beneficiary designation above will only be effective if my spouse predeceases me or is not my spouse on the date of death.

6 Designation of beneficiary by power of attorney is not valid. In some circumstances the rights of the Annuitant's spouse may override the beneficiary designation. 4 Dealer and Representative Information M A N D A T O R Y. Dealer Number Rep Number Dealer Name Representative's Name Telephone No. E-mail Address I hereby declare that I used the original documents to verify the identity of the Owner. I have made reasonable efforts to determine if the Owner is acting on behalf of a third party. X. Representative's Signature: _____. 5 Investment Selection q T2033/T2151/TD2 transfer (attached to application) to be allocated as follows: Systematic Withdrawal Include in Fund Fund Name Purchase DSC Sales Wire Order PAC Port. Rebal. Amount* Amount/RIF/LIF/LRIF/. Number Amount 3 Charge % Number PRIF/RLIF Payment Service . $ % $ $ %. $ % $ $ %. $ % $ $ %. $ % $ $ %. $ % $ $ %. $ % $ $ %. Cash distributions q I understand payments will be Total If no sales commission method is indicated, the Total: Total: Total: Purchases deferred sales charge method will be applied to all deposited to the bank account indicated in Section 10.

7 Funds, except for Money Market Funds where the Note: Not available for Registered Products initial sales commission method will be applied. $ $ . G5|20 Series Funds are not eligible for these optional services *Minimum of $50 per fund - Please complete Sections 6 and 10. 6 Pre-Authorized Chequing plan (PAC) (Not applicable for Locked in RSPs/LIRAs/RIFs/LIFs/LRIFs/PRIFs/RLIFs/ Dollar Funds or G5|20 Series Funds). Y M D. Start Date: Frequency: M A N D A T O R Y q Monthly q Quarterly q Semi-Annually q Annually q Weekly q Bi-weekly q Bi-monthly Signature(s) required if Depositor(s) is (are) other than the Unitholder(s) indicated in Section 2. For a joint bank account, all Depositors must sign if more than one signature is required on cheques issued against the account. X. *For payments from corporate bank accounts please provide the Corporate Resolution. By signing you confirm that you have read and agree to the PAC plan Agreement outlined on the back of this application.

8 7 Non- Registered Systematic Withdrawal plan (Not applicable to G5|20 Series Funds). Start Date: Y M D Frequency: q Monthly q Quarterly q Semi-Annually q Annually Surrender sufficient securities to provide a payment of $ _____ q Gross or q Net of fees THREE COPIES OF THIS APPLICATION ARE REQUIRED TO BE PRINTED AND SIGNED BY THE CLIENT. Part 1 - CI Copy PART 2 - CLIENT COPY PART 3 - REPRESENTATIVE COPY. 8 RIF/LIF/LRIF/PRIF/RLIF plan Payment Details The payment date may be between the 1st and the 25th of any month. If the RIF plan contains G5|20 Series Funds please use the G5|20 Series RIF plan Payment Form. Start Date: Y M D Frequency: q Monthly q Quarterly q Semi-Annually q Annually If no date is specified, CI will pay out the RIF/LIF/LRIF/RLIF minimum during the month of December, and will redeem securities proportionately across all funds. q The minimum annual amount (Payments will begin in the first full calendar year following the initial investment).

9 Q The maximum annual amount (for LIF, LRIF and RLIF Plans only). q The annual amount of $ _____ q Gross or q Net of fees and withholding taxes Election of payment based on Spouse's age: (RIF accounts only) q I elect that the payment under the RIF be calculated using the age of my spouse. Y M D. M A N D A T O R Y M A N D A T O R Y. Spouse's Surname First Name Initial(s) Spouse's Birth Date Spouse's Social Insurance Number Note: For RIFs the minimum payment (based on the spouse's age) cannot exceed the maximum benefit based on the annuitant's age. I understand this election may not be changed after the end of the year in which this application is made, even in the event of my spouse's death or our separation. Election of Spouse as Successor Annuitant: (RIFs only) Where permitted by law, I hereby elect that my spouse become the annuitant under the RIF in the event of my death before the termination of the RIF, if he or she survives me.

10 I reserve the right to revoke this election as permitted by applicable law. Spouse's Surname First Name 9 Systematic Transfer plan Transfer securities from one Fund to another. (Not applicable to G5|20 Series Funds). Start Date: Y M D Frequency: q Monthly q Quarterly q Semi-Annually q Annually Amount Fund From Fund To Fund Fund Sales Charge Number Number (Maximum 2%). $ %. $ %. $ %. $ %. 10 Banking Information / plan Payment Details Please attach a VOID CHEQUE or complete financial information. q Deposit directly to bank account (You will receive your payments in a more timely manner if you choose this option). Bank Number _____ Name of Financial Institution _____. Transit Number _____ Address _____. Account Number _____ Account Name (If different from registration) _____. q Mail to Investor q Mail to alternate address: _____. 11 Group Retirement Savings plan (GRSP) (Not applicable to G5|20 Series Funds). Group Company Name _____ _____ X.