Transcription of CITIGROUP GLOBAL MARKETS INC. AND …

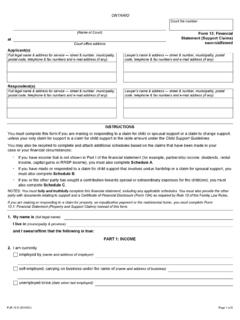

1 CITIGROUP GLOBAL MARKETS INC. AND SUBSIDIARIES. (An indirect wholly owned subsidiary of CITIGROUP GLOBAL MARKETS Holdings Inc.). Consolidated Statement of financial Condition December 31, 2017. (With Report of Independent Registered Public Accounting Firm Thereon). UNITED STATES OMB APPROVAL. SECURITIES AND EXCHANGE COMMISSION OMB Number: 3235-0123. WASHINGTON, 20549 Expires: August 31, 2020. Estimated average burden hours per response .. ANNUAL AUDITED REPORT. FORM X-17A-5. PART III SEC FILE NUMBER. 8-08177. FACING PAGE. Information Required of Brokers and Dealers Pursuant to Section 17 of the Securities Exchange Act of 1934 and Rule 17a-5 Thereunder REPORT FOR THE PERIOD BEGINNING 01/1/17 AND ENDING 12/31/17. MM/DD/YY MM/DD/YY. A. REGISTRANT IDENTIFICATION. NAME OF BROKER-DEALER: CITIGROUP GLOBAL MARKETS Inc. (Filed as Public Information) OFFICIAL USE ONLY. ADDRESS OF PRINCIPAL PLACE OF BUSINESS: (Do not use Box No.)

2 FIRM NO. 388 Greenwich Street (NO. AND STREET). New York NY 10013. (City) (State) (Zip Code). NAME AND TELEPHONE NUMBER OF PERSON TO CONTACT IN REGARD TO THIS REPORT. John McCoy 212-816-4460. (Area Code - Telephone Number). B. ACCOUNTANT IDENTIFICATION. INDEPENDENT PUBLIC ACCOUNTANT whose opinion is contained in this Report*. KPMG, LLP. (Name If individual, state last, first. middle name). 345 Park Avenue New York NY 10154. (Address) (City) (State) (Zip Code). CHECK ONE: X Certified Public Accountant Public Accountant Accountant not resident in United States or any of its possessions. FOR OFFICIAL USE ONLY. *Claims for exemption from the requirement that the annual report be covered by the opinion of an independent public accountant must be supported by a statement of facts and circumstances relied on as the basis for the exemption. See Section 240. 17a-5(e)(2).

3 Potential persons who are to respond to the collection of SEC 1410 (06-02). information contained in this form are not required to respond unless the form displays a currently valid OMB control number. KPMG LLP. 345 Park Avenue New York, NY 10154-0102. Report of Independent Registered Public Accounting Firm To the Board of Directors CITIGROUP GLOBAL MARKETS Inc.: Opinion on the Consolidated financial Statement We have audited the accompanying consolidated statement of financial condition of CITIGROUP GLOBAL MARKETS Inc. and subsidiaries (the Company) as of December 31, 2017, and the related notes (collectively, the consolidated financial statement). In our opinion, the consolidated financial statement presents fairly, in all material respects, the financial position of the Company as of December 31, 2017, in conformity with generally accepted accounting principles.

4 Basis for Opinion This consolidated financial statement is the responsibility of the Company's management. Our responsibility is to express an opinion on this consolidated financial statement based on our audit. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Company in accordance with the federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB. We conducted our audit in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the consolidated financial statement is free of material misstatement, whether due to error or fraud. Our audit included performing procedures to assess the risks of material misstatement of the consolidated financial statement, whether due to error or fraud, and performing procedures that respond to those risks.

5 Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the consolidated financial statement. Our audit also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the consolidated financial statement. We believe that our audit provides a reasonable basis for our opinion. We have served as the Company's auditor since 2001. March 1, 2018. KPMG LLP is a Delaware limited liability partnership and the member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative ( KPMG International ), a Swiss entity. CITIGROUP GLOBAL MARKETS INC. AND SUBSIDIARIES. (An indirect wholly owned subsidiary of CITIGROUP GLOBAL MARKETS Holdings Inc.). Consolidated Statement of financial Condition December 31, 2017.

6 (In millions of dollars). Assets Cash and cash equivalents $ 471. Cash segregated under federal and other regulations 4,675. Securities borrowed or purchased under agreements to resell (including $93,975 at fair value) 162,683. Trading account assets ($23,829 pledged as collateral). Mortgage-backed securities 24,642. Treasury and federal agency securities 14,351. Equity securities 7,522. Corporate debt securities 6,470. State and municipal securities 3,520. Asset-backed securities 2,455. Derivatives 1,626. Foreign government securities 927. Other debt securities 1. 61,514. Securities received as collateral, at fair value (all pledged to counterparties) 15,443. Receivables: Customers 13,244. Brokers, dealers and clearing organizations 9,051. Other 686. 22,981. Goodwill 145. Other assets 4,632. Total assets $ 272,544. See accompanying notes to consolidated financial statements.

7 1. CITIGROUP GLOBAL MARKETS INC. AND SUBSIDIARIES. (An indirect wholly owned subsidiary of CITIGROUP GLOBAL MARKETS Holdings Inc.). Consolidated Statement of financial Condition December 31, 2017. (In millions of dollars, except shares and per share amounts). Liabilities and Stockholder's Equity Short-term borrowings $ 1,251. Securities loaned or sold under agreements to repurchase (including $8,810 at fair value) 146,794. Trading account liabilities: Treasury and federal agency securities 15,832. Corporate debt securities 3,609. Equity securities 2,447. Derivatives 900. Foreign government securities 382. Other debt securities 119. 23,289. Payables and accrued liabilities: Customers 38,660. Obligations to return securities received as collateral, at fair value 15,443. Brokers, dealers and clearing organizations 2,368. Other 3,754. 60,225. Long-term debt 22,025. Subordinated indebtedness 9,945.

8 Total liabilities 263,529. Stockholder's equity: Common stock ($10,000 par value, 1,000 shares authorized, issued and outstanding) 10. Additional paid-in capital 8,937. Retained earnings 68. Total stockholder's equity 9,015. Total liabilities and stockholder's equity $ 272,544. See accompanying notes to consolidated financial statements. 2. CITIGROUP GLOBAL MARKETS INC. (An indirect wholly owned subsidiary of CITIGROUP GLOBAL MARKETS Holdings Inc.). Notes to Consolidated Statement of financial Condition December 31, 2017. (1) Summary of Significant Accounting Policies (a) Principles of Consolidation The Consolidated Statement of financial Condition includes the accounts of CITIGROUP GLOBAL MARKETS Inc. (CGMI) and its subsidiaries (the Company) prepared in accordance with generally accepted accounting principles (GAAP). CGMI is a direct wholly owned subsidiary of CITIGROUP financial Products Inc.

9 (CFPI, or Parent), and is an indirect wholly owned subsidiary of CITIGROUP GLOBAL MARKETS Holdings Inc. (CGMHI), which is a wholly owned subsidiary of CITIGROUP Inc. ( CITIGROUP or Citi). CGMI is registered as a securities broker dealer and investment advisor with the Securities and Exchange Commission (SEC), a municipal securities dealer and advisor with the Municipal Securities Rulemaking Board (MSRB), and registered swap dealer and futures commission merchant (FCM) with the Commodities Future Trading Commission (CFTC). The Company is a member of the financial Industry Regulatory Authority (FINRA), the Securities Investor Protection Corporation (SIPC), the National Futures Association (NFA) and other self- regulatory organizations. The Company provides corporate, institutional, public sector and high-net-worth clients with a full range of brokerage products and services, including fixed income and equity sales and trading, foreign exchange, prime brokerage, derivative services, equity and fixed income research, investment banking and advisory services, cash management, trade finance and securities services.

10 CGMI transacts with clients in both cash instruments and derivatives, including fixed income, foreign currency, equity and commodity products. The Company consolidates subsidiaries in which it holds, directly or indirectly, more than 50% of the voting rights or where it exercises control. Entities where the Company holds 20% to 50% of the voting rights and/or has the ability to exercise significant influence are accounted for under the equity method. (b) Use of Estimates Management must make estimates and assumptions that affect the Consolidated Statement of financial Condition and the related Notes to the Consolidated Statement of financial Condition. Such estimates are used in connection with certain fair value measurements. See Note 10 to the Consolidated Statement of financial Condition for further discussions on estimates used in the determination of fair value.