Transcription of City of St. Gabriel - Louisiana

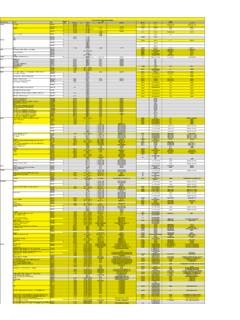

1 1*01 city of St. Gabriel , LouisianaSt. Gabriel , LouisianaFinancial StatementsJune 30,2007 Under provisions of state law, this report is adocument A copy of the report has been submitted tothe entity and other appropriate public officials. Thereport is available for public inspection at the BatonRouge office of the Legislative Auditor and, whereappropriate, at the office of the parish clerk of courtRelease Date(o I Op^ city oi'St. Gabriel , LouisianaTable of ContentsJune 30, 2007 Exhibit PageFHNANCIAI,SECTIONI ndependent Auditor's ReportManagement's Discussion and AnalysisBasic Financial StatementsGovernment-wide Financial StatementsStatement of Net Assets A 16 Statement of Activities A-l 17 FuiKl Financial StatementsGovernmental FundsBalance Sheet A-2 18 Reconciliation of the Governmental Funds Balance.)

2 Sheetlo the Statement of Net Assets A-3 19 Statement of Revenues, Expenditures, and Changes in Fund Balance A-4 20 Reconciliation of (he Statement of Revenues, Expenditures, and Changes inFund Balances of the Governmental Funds to (he Statement of Activities A-5 2 JProprietary FundsStatement of Net Assets A-6 22 Statement of Revenues. Expenses and Changes in Fund Net Assets A-7 23 Statement of Cash Flows A-8 24 Notes to Financial Statements A-9 25 Required Supplementary InformationGeneral FundStatement of Revenues.))

3 Expenditures and Changes in Fund Balance -Budget (GAAP Basis) and Actual B 46Ad Valorem Tax Fund H2 Statement of Revenues, Expenditures and Changes in Fund Balance -Budget (GAAP Basis) and Actual B-l 47 Civic Center Operating FundStatement of Revenues, Expenditures and Changes in Fund Balance -Budget (GAAP Basis) and Actual B-2 48 Parish-Wide Sales and Use Tax FundStatement of Revenues. Expenditures, and Changes in Fund Balance-Budget (GAAP Basis) and Actual B-3 49 Code Enforcement Grant FundStatement of Revenues, Expenditures, and Changes in Fund Balance-Budget (GAAP Basis) and Actual B-4 50 Notes to Required Supplementary Information B-5 51 Supplementary InformationCombining and Individual Fund StatementsMajor Governmental FundsGeneral FundStatement of Revenues - Budget (GAAP Basis) and Actual C 52 Statement of Departmental Expenditures - Budget (GAAP Basis)

4 And Actual CM 53(Continued) city of St. Gabriel , LouisianaTable of ContentsJune 30,2007 Exhibit PaceSupplementary InformationCombining and Individual Fund StatementsNon-Major Governmental FundsGeneral FundCombining Balance SheetCombining Statement of Revenues, Expenditures and Changes in Fund BalanceSales and Use Tax FundStatement of Revenues, Expenditures and Changes in Fund Balance -Budgel (GAAP Basis) and ActualAd Valorem Tax FundStatement of Revenues, Expenditures and Changes in Fund Balance -Budget (GAAP Basis) and ActualCivic Center Capital Project FundStatement of Revenues, Expenditures and Changes in Fund Balance -Budget (GAAP Basis) and ActualRecreational Parks Capital Projects FundStatement of Revenues, Expenditures and Changes in Fund Balance -Budgel (GAAP Basis) and ActualSidewalks Improvement Capital Projects FundStatement of Revenues. Expenditures and Changes in Fund Balance -Budget (GAAP Basis) and ActualRoad Improvement Capita!

5 Project FundStatement of Revenues, Expenditures and Changes in Fund Balance -Budget (GAAP Basis) and ActualDebt Service FundStatement of Expenditures, Other Financing Sources and Changes in FundBalance - Budget (GAAP Basis) and Actual -SPECIAL AUDITORS REPORTSR eport on Internal Control over Financial Reporting and on Compliancefind Other Matters Based on an Audit of Financial Statements Performedin Accordance with Government Auditing StandardsSchedule of Findings and Questioned CostsSummary of Prior Year FindingsSTATISTICAL IN FORMATIONT otal Assets - Government-wideLiabilities and Net Assets - Government-wideGeneral Fund Revenues/ExpendituresSpecial Revenue Fund Revenues/TransfersCapital Projects Revenues and Expenditures/Transfers InSewer Fund Rcvcnues/Expenditurcs/Transfers InDD-lD-2D-4D-5D-6D-7D-8 SchedulevS-1S-2S-3S-4S-5S-65657585960636 4656773 HAV/THORN, WAYMOUTH 6 CARROLL, PARKER. C.

6 MuKNIGHT. Ill, R. PEVEY, J. BROLISSABO. UNITED PLAZA BLVD., SUITE SOOBATON ROUGE, Louisiana 70809(225) 023 3000 * FAX (?25) 28, 2007 Independent Auditor's ReportThe Honorable Mayor andMembers of the city CouncilCity of St. Gabriel , Louisiana 70776We have audited the accompanying financial statements of the governmental activities, the business-typeactivities, each major fund, and the aggregate remaining fund information of theCity of St. GabrielSt. Gabriel , Louisianaas of and for the year ended June 30, 2007, which collectively comprise the city 's basic financial statementsas listed in the table of contents. These financial statements are the responsibility of the city of St. Gabriel , Louisiana 's management. Our responsibility is to express opinions on these financial statements based on conducted our audit in accordance with auditing standards generally accepted in the United States ofAmerica and the standards applicable to financial audits contained in Government Auditing Standards, issuedby the Comptroller General of the United States.

7 Those standards require that we plan and perform the auditto obtain reasonable assurance about whether the financial statements arc free of material misstatement. Anaudit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financialstatements. An audit also includes assessing the accounting principles used and significant estimates made bymanagement, as well as evaluating the overall financial statement presentation, We believe lhat our auditprovides a reasonable basis for our our opin ion, the financial statements referred to above present fairly, in all material respects, the respectivefinancial position of the governmental activities, the business-type activities, each major fund, and the aggregateremaining fund information of the city of Si. Gabriel , Louisiana , as of June 30,2007, and the respective changesin financial position and cash flows, where applicable, for the year then ended in conformity with accountingprinciples generally accepted in the United States of accordance with Government Auditing $lcimlards> we have also issued our report dated December 28,2007, on our consideration of the city of St.

8 Gabriel , Louisiana 's internal control over financial reporting andon our tests of its compliance with certain provisions of laws, regulations, contracts, and grant agreements, andother matters. The purpose of that report is to describe the scope of our testing of internal control over financialreporting and compliance and the results of that testing and not to provide an opinion on the internal control overfinancial reporting or on compliance. That report is an integral part of an audit performed in accordance withGovernment Auditing Standards and should be considered in assessing the results of our management's discussion and analysis and budgetary comparison information on pages 6 through 14and 45 through 50, are not a required part of the basic financial statements but arc supplementary informationrequired by accounting principles generally accepted in the United States of America. We have applied certainlimited procedures, which consisted principally of inquiries of management regarding the methods ofmeasurement and presentation of the required supplementary information.

9 However, we did not audit theinformation and express no opinion on it,Our and it was conducted for the purpose of form ing an opinion on the financial statements that collectivelycomprise the city of St. Gabriel , Louisiana 's, basic financial statements. The combining and individual non-major fund financial statements, and statistical tables are presented for purposes of additional analysis and arenot a required part of the basic financial statements. The combining and individual non-major fund financialstatements have been subjected to the auditing procedures applied in the audit of the basic financial statementsand , in our opinion, arc fairly stated in all material respects in relation to the basic financial statements takenas a whole. The statistical tables have not been subjected to the auditing procedures applied in the audit of thebasic financial statements and, accordingly, we express no opinion on of St.

10 Gabriel , LouisianaManagement's Discussion and AnalysisThis analysis of the city of St. Gabriel 's financial performance provides an overview of the city 's financial activitiesfor (he fiscal year ended June 30, 2007. The Management's Discussion and Analysis (MD&A) is designed to focuson the current year's activities, resulting changes, and currently known HIGHLIGHTSIn 2007, the city of St. Gabriel experienced a customary year financially as governmental revenues decreasedsignificantly relative to prior years, as did the governmental expenditures. Certain funds continued to experienceoperating deficits that are not sustainable and the priorities of operating and infrastructure needs and obligations aregreater than available resources. Accordingly, there must be a logical and thoughtful alignment of the city 's resourcesto community needs,The major financial highlights for 2007 are as follows: Assets of the city 's primary government exceeded its liabilities at the close of the year by approximately $ (net assets).)

![p I^ lU- ] 10 - Louisiana](/cache/preview/f/7/3/f/7/d/c/4/thumb-f73f7dc47bb283cf34089f83231d0637.jpg)