Transcription of COMMONWEALTH OF PUERTO RICO 200 DEPARTMENT …

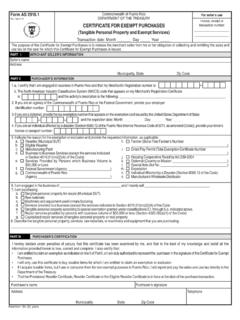

1 Form (OE) Rev. Liquidator: Reviewer: 200__ COMMONWEALTH OF PUERTO rico . DEPARTMENT OF THE TREASURY. 200__ Serial Number Field Audited By: Informative Return for Income Tax Exempt Organizations AMENDED RETURN. Date _____ /_____ /_____ UNDER SECTION 1101 OF THE PUERTO rico Receipt Stamp R M N INTERNAL REVENUE CODE OF 1994, AS AMENDED. TAXABLE YEAR BEGINNING ON. _____ 200____ AND ENDING ON _____ 200____. Employer's Identification Number Organization's Name DEPARTMENT of State Registry Number Postal Address Municipal Code Zip Code Location of Organization - Number, Street, City Merchant's Registration Number Telephone Number ( ). Type of Activities ( Educational, Charitable, etc.)

2 Date Incorporated Day_____ Month_____ Year_____. Place Incorporated Case No. _____ Type of organization: 3. Association not incorporated Date operations began Paragraph of Section 1101 under which the 1. Corporation 4. Employee's trust exemption was granted _____ 2. Trust 5. Other (Indicate)_____ Day _____ Month_____ Year_____. Part I Questionnaire Yes No Yes No 1. If you do not have a case number, did you request the exemption under 8. Indicate if, a) do you have employees in your organization?.. (8a). Section 1101 of the Code? If you checked "Yes", indicate the date requested b) If you checked "Yes", did you file the Withholding Statements?.. (8b). and paragraph of Section 1101 under which you requested: _____ (1).

3 _____ 9. Indicate if, a) have you contracted professional services?.. (9a). _____ If you checked "Yes", b) have you filed the Informative Returns If you have not requested tax exemption, do not complete this form. You (Forms , , , )?.. (9b). must file Form (Corporation Income Tax Return). c) have you made any withholding at source?.. (9c). If you checked "Yes", indicate the special tax rate that applied: _____. 2. Does the administrative opinion under which tax exemption was granted have special conditions? .. (2) 10. Indicate if, a) have you made payments to entities not engaged in industry or business in PUERTO rico ?.. (10a). 3. Indicate if the organization has exemption under the Federal Internal Revenue b) did you make the withholding at source?

4 (10b). Code. If you checked "Yes", indicate the date it was granted (3). (submit copy): _____ 11. If the organization is exempt under Section 1101(10) of the Code, indicate the name of the organization that holds the title to property: 4. Has the organization been investigated or is currently under investigation by _____. the DEPARTMENT of the Treasury? .. (4). 12. Is the organization a successor from other organization that previously existed? (12). 5. The books are in care of _____ Name _____. _____ Address _____. Address:_____ _____. _____ _____. _____. 13. If the organization is a registered investment company or a real estate 6. Accounting method used: investment trust, did you file the documents or information (6a) Cash (6b) Accrual (6c) Other(s) required?

5 (13). If you checked "Other(s)", explain: _____. _____ 14. Did you lease real estate property to (or) from other person or groups of persons related to the organization?.. (14). 7. During this year, a) did the organization derive income from non-related activities? .. (7a) 15. Indicate number of members _____. b) If you checked "Yes", did you file form this year? .. (7b) (15a) Number of stockholders _____. Indicate the non-related activities and the purposes of the organization Common _____ Preferred _____. _____. _____ 16. Are you up to date in the filing of Annual Reports (Good Standing) with the _____ DEPARTMENT of State?.. (16). Retention Period: Ten (10) years Rev.

6 Form (OE) - Page 2. Questionnaire (continued). Yes No Yes No 17. During the year, have the incorporation articles, internal regulations or 19. During the year, was the organization liquidated, dissolved or finished? If (19). similar documents been amended? If you checked "Yes", submit copy of (17) you checked "Yes", submit detail and certification of dissolution from the such changes. DEPARTMENT of State. 18. Have you had any source of income or had any activities not informed 20. Is the organization controlled or does it control other institution? (20). previously to the Secretary of the Treasury?.. (18) If you checked "Yes", indicate its name: (Submit detail of the activities).

7 _____. Part II Income, Dues, Contributions, Etc. 1. Dues, assessments, etc. from members, excluding services and other charges properly included under line 8. (See instructions Parts II and III) .. (1) 00. 2. Dues, assessments, etc. from affiliated organizations (See instructions Parts II and III) .. (2) 00. 3. Contributions, gifts, grants, etc. received (See instructions Parts II and III) .. (3) 00. 4. Patronage dividends (or patronage refund) received (See instructions Parts II and III) .. (4) 00. 5. Interest .. (5) 00. 6. Dividends .. (6) 00. 7. Rents .. (7) 00. 8. Gross income from business activities including exempt income from a registered investment company or real estate investment trust (specify which one) (See General Information, 2nd paragraph).

8 (a) _____ (8a) 00. (b) _____ (8b) 00. (c) _____ (8c) 00. (d) _____ (8d) 00. (e) _____ (8e) 00. 9. Total lines 1 through 8(e) .. (9) 00. Part III Disposition of Income, Dues, Contributions, Etc. A. Expenses attributable to declared income (Lines 7 and 8. See instructions Parts II and III): 10. Cost goods sold (in case of farming cooperatives, purchases for advances or patrons) .. (10) 00. 11. Compensation to officers, directors, fiduciaries, etc. (Include statement showing name, social security number, position, salary and time devoted to position) .. (11) 00. 12. Salaries, wages and commissions. Number of employees involved .. (12) 00. 13. Interest .. (13) 00.

9 14. Taxes (such as property, income, social security, unemployment, etc.) .. (14) 00. 15. Rents .. (15) 00. 16. Depreciation (and depletion) .. (16) 00. 17. Miscellaneous expenses (Indicate nature): (a) _____ (17a) 00. (b) _____ (17b) 00. (c) _____ (17c) 00. 18. Dues, assessments, etc. to affiliated organizations .. (18) 00. B. Contributions: 19. Contributions, gifts, grants, etc. paid (State to whom they were paid): (a) _____ (19a) 00. (b) _____ (19b) 00. (c) _____ (19c) 00. C. Other dispositions: 20. Benefit payments to or for members or their dependents: (a) Death, sickness, hospitalization, disability, life insurance or pensions (20a) 00. (b) Other benefits.

10 (20b) 00. 21. Dividends (other than patronage dividends) and other distributions to members, shareholders or depositors .. (21) 00. 22. Cash patronage dividends (or patronage refund) (for farming cooperatives only) .. (22) 00. 23. Patronage dividends (or patronage refund) in stocks, credits and other evidence of equity or indebtedness (for farming cooperatives only) .. (23) 00. 24. Additions to surplus and reserves (Include itemized schedule) .. (24) 00. 25. Total of lines 10 through 24 (See instructions Parts II and III) .. (25) 00. 26. Excess (deficit) for the year (Subtract line 25 from line 9) .. (26) 00. 27. Balance of funds at the beginning of the year.