Transcription of Competition in health insurance: A comprehensive study of …

1 2022 UPDATE. Competition in health insurance . A comprehensive study of markets Acknowledgments This report has been prepared by the American Medical Association Division of Economic and health Policy Research. Acknowledgment goes to the following individuals for their contributions. Jos R. Guardado, PhD. Senior economist, Division of Economic and health Policy Research Carol K. Kane, PhD. Director, Division of Economic and health Policy Research ISBN-13: 978-1-64016-283-9. 22-756038 2022 American Medical Association. All rights reserved. 2022 UPDATE 1. Table of contents I. Introduction and background .. 2. II. Data and methodology.

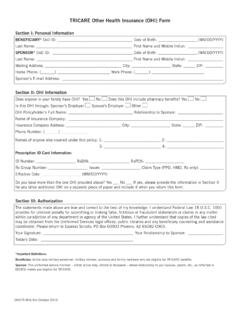

2 5. A. Product and geographic market definition .. 5. B. Data .. 5. C. Market share and HHI calculations .. 7. D. DOJ/FTC merger guidelines .. 7. III. Summary of findings and conclusion .. 8. A. MSA-level summary .. 8. B. National-level market shares .. 10. C. Conclusion .. 13. IV. Appendix: State and MSA tables .. 15. Table A-1. Market concentration (HHI) and largest insurers' market shares, as of Jan. 1, 2021. Combined PPO+HMO+POS+EXCH (Total) product markets ..15. Table A-2. Market concentration (HHI) and largest insurers' market shares, as of Jan. 1, 2021. PPO product markets .. 26. Table A-3. Market concentration (HHI) and largest insurers' market shares, as of July 1, 2021.

3 Exchanges .. 37. Table A-4. Market concentration (HHI) and largest insurers' market shares, as of Jan. 1, 2021. Medicare Advantage markets .. 48. Table A-5. State and MSA HHI by product type, as of Jan. 1, 2021 .. 59. Competition in health insurance : A comprehensive study of markets 2022 American Medical Association. All rights reserved. 2022 UPDATE 2. I. Introduction and background This is the 21st edition of the American Medical In this study , we present new information on market Association's Competition in health insurance : A concentration in the health insurance industry. Using comprehensive study of markets." This study presents 2021 data from Decision Resources Group3 the most new data on the degree of Competition in health insurance comprehensive and consistent source of data on markets across the country.

4 It is intended to help enrollment in preferred provider organization (PPO), researchers, policymakers, and federal and state regulators health maintenance organization (HMO), point-of- identify markets where consolidation involving health service (POS), public health exchange (EXCH), consumer- insurers may cause competitive harm to consumers and driven health plans (CDHP),4 and Medicare Advantage providers of care. (MA) plans we report the two largest insurers'. commercial market shares and Herfindahl-Hirschman This study addresses the following questions: Are health Indices (HHIs)for 383 metropolitan statistical areas (MSAs), insurance markets competitive or do health insurers the 50 states and the District of This is the possess market power?

5 Are proposed mergers involving first update of the study in which such information for insurers likely to maintain, enhance or create such power? MA markets is presented. These are important questions of public policy because Key findings show that, based on the DOJ/FTC Horizontal the use of market power harms society in both output and Merger Guidelines, 75% of MSA-level commercial markets input markets. When an insurer exercises market power were highly concentrated (HHI>2500). The average in its output market (the sale of insurance coverage), commercial market was also highly concentrated, with an premiums are higher and quantity of coverage is lower HHI of 3504.

6 other findings are that in 91% of MSA-level than in a competitive market. When an insurer exercises markets, at least one insurer had a commercial market market power in its input market ( , physician services), share of 30% or greater, and in 48% of markets, a single payments to providers and the quantity of health care are insurer's share was at least 50%. below competitive levels. In short, the exercise of market power adversely affects health insurance coverage and We also calculate changes in commercial market health care. concentration between 2014 and Although there were some fluctuations in either direction in the A first step in assessing the existence of or the potential intervening years, the share of commercial markets that for market power is to examine market concentration, are highly concentrated increased from 71% to 75%, and as high concentration tends to lower Competition and the average HHI rose by 181 Fifty-eight percent facilitate the exercise of market power.

7 The of markets experienced an increase in the HHI, and in Department of Justice (DOJ) and the Federal Trade 23% of markets the increase was at least 500 points. In Commission (FTC) examine market shares and market markets with a rise in the HHI, the average increase was concentration when evaluating proposed horizontal 540 points. mergers1 and may also consider them when assessing vertical Thus, it is critical to have this type of We find evidence of increases in concentration in information readily available. commercial markets that were already highly concentrated 1. Department of Justice and Federal Trade Commission, Horizontal Merger Guidelines.

8 Issued Aug. 19, 2010. 2. Department of Justice and Federal Trade Commission, Vertical Merger Guidelines. Issued June 30, 2020. 3. Decision Resources Group was formerly known as HealthLeaders-InterStudy a Decision Resources Group company. 4. We do not report CDHP enrollments as a separate plan type. CDHP lives are bolted on to the other plan types, most frequently to PPO plans. 5. For convenience, the District of Columbia is classified as a state in this study . 6. There was a change in MSA definitions between the 2016 and 2017 data. For a detailed description of this change, see footnote 5 in the AMA's 2018 Competition in health insurance study .

9 7. The change in MSA definitions noted in footnote 6 above factors into the long-term measurement of changes in HHI. However, we believe the impact to be minor. For further details, see footnote 35 below. Competition in health insurance : A comprehensive study of markets 2022 American Medical Association. All rights reserved. 2022 UPDATE 3. in 2014 as well as in those that were not. More than half Another study examined the effect of changes (56%) of the markets that were highly concentrated in in market concentration (HHI) on premiums across the 2014 became even more concentrated by 2021. Thirty United States. Using the 1999 merger between Aetna and percent of the markets that were not highly concentrated Prudential as an instrumental variable for the HHI, it found experienced an increase in the HHI large enough to place that changes in market concentration were positively them in the highly concentrated category by 2021.

10 Associated with A 2013 case study examined Another 33% also had an increase, though not large the 2008 merger between UnitedHealth and Sierra health enough to make them highly concentrated. Services, which led to a large increase in concentration in Nevada health insurance markets. The study concluded Turning to the key findings on MA, 79% of MA markets that premiums in Nevada markets increased in the wake were highly concentrated in 2021 a decrease from 87%. of the other research found evidence that of markets in 2017. On average, MA markets were also Competition in the public health exchanges in the highly concentrated with an HHI of 3331 down from form of more insurers also lowered Finally, 3932 in 2017.