Transcription of CORP ORATE CREDIT - Janney Montgomery Scott

1 Pr i m e r: Ag e n c y Bo n d sj A n n e y c o rP o rAt e c r e d i tFe B r uA r y 5 , 2 0 1 4 Janney Montgomery Scott 2014 Janney Montgomery Scott LLCM ember: NYSE, FINRA, SIPCA gency bonds PAge 1 ContentsOverview Of typesfeatures & structurefrequent issuers HOusingfrequent issuers Bankingfrequent issuers utilitiesOtHer issuerscOnclusiOninfOrmatiOn & DisclaimersJody Lurie corporate CREDIT analyst 215 665 6191 page 6 for important information regarding certifications, our ratings system as well as other disclaimers. Agencies provide extra yield vs. Treasuries, offer predictable and relatively safe income , and can be a part of a diversified fixed income portfolio. The agency market is one of the most liquid markets globally. While issuance has declined in recent years, secondary trading of these securities continues to be active, attracting investors of all kinds who incorporate the securities into their investment strategies and income needs.

2 While each issuer s relationship to the US government is unique, most agencies operate with high quality CREDIT ratings and many depend on their high ratings to issue debt at lower costs than potential S Agency securities, long considered to be among the highest quality fixed income investments, have been a mainstay of institutional and individual fixed income portfolios for many years. While most agency debt is not backed by the US government, agencies have an implied support of the government, given that most entities were put in place by Congress to support some portion of the market: housing, agriculture, and regional lending. As a consequence of challenges in the 2008-2009 period, the agency market has changed somewhat, with new regulatory measures in place and new methods for governmental oversight of housing US agency market remains one of the most liquid fixed income markets globally. Primary issu-ance has declined in recent years, partly a consequence of the winding down of Fannie and Freddie s balance sheets.

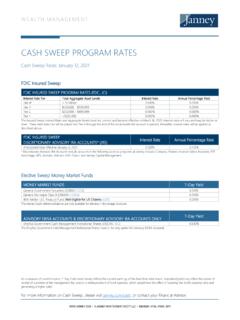

3 In 2013, over $440B in new US agency debt priced from more than 5,000 issues compared to in 2010, when $ trillion in new debt priced among over 9,000 issues. In the last twelve months, about $700B in par value agency bonds traded, per FINRA s TRACE, with an average daily trading volume of $2B in par value most recently. Given issuers higher ratings and the sizable amount of debt outstanding, the agency market is liquid. New issues are sold in a variety of ways. Shorter maturities are generally sold through competitive auction, while longer maturities are typically marketed using underwriting groups. Large bench-mark issues, structured as bullets, come to market in single maturity pieces as large as $5B or even more. Callable issues, step ups, and other structures are marketed in smaller lots, usually through negotiation with the funding desks of the agency Of TypesThere are two types of agency bonds: those issued by government-sponsored entities ( GSEs ) and those issued by US government agencies.

4 GSEs are for the most part federally-chartered, pri-vately-owned corporations, which focus on financing loans to targeted borrowers ( homeowners or farmers). Debt issued by GSEs has an implied guarantee, meaning that the debt is not specifi-cally backed by the full faith and CREDIT of the US government, but US government has a theoretical moral obligation. US government agencies are organizations established by either legislation or executive orders which serve specific functions. While some debt issued by government agencies is backed by the full faith and CREDIT of the US government ( Ginnie Mae debt), other debt is just backed by the issuer s revenues ( Tennessee Valley Authority) or some other source. feaTures & sTrucTure Of agency BOnds CREDIT Risk: Because debt issued by GSEs is not backed by the full faith and CREDIT of the US government, but rather only have an implied guarantee, it trades at a slightly higher yield than similarly maturity Treasuries.

5 These yield premiums are a result of CREDIT risk. j a n n e y f i x e d i n c o m e s t r at e g yf eB r U a ry 5 , 2 0 1 4 Janney Montgomery 2014 Janney Montgomery Scott LLCM ember: NYSE, FINRA, SIPCA gency bonds PAge 2 Contentsoverview of typesfeatures & struCturefrequent issuers Housingfrequent issuers Bankingfrequent issuers utilitiesotHer issuersConClusioninformation & DisClaimersPrimary issuance has de-clined in recent years, partly a consequence of the wind-ing down of Fannie and Freddie s balance sheets. Bullets and Callable Bonds: Agencies issue both bullets ( fixed maturity and no call provi-sion) and callable bonds (callable as early as 3 months after issue, depending on the bond). Investors will require more yield to compensate for possibility calls, so all else being equal, a callable bond should offer a higher yield over a bullet of the same maturity. Step-ups: Step-up bonds are fairly common among agency issuance, particularly in low-rate environments.

6 In such a bond structure, the coupon increases by a set amount on a set date pri-or to maturity. Typically the issuer has the option to call the bond before the coupon steps up. Zero Coupon Bonds: Fannie and Freddie offer zero coupon bonds which are issued at a dis-count to their maturity value and pay no periodic interest. These bonds may be issued directly, or can be created in the secondary markets. Taxation: Interest from U S Agency issues is subject to federal income tax, but in some cases is exempt from state and local income issuers HOusingFederal National Mortgage Assoc. (Fannie Mae; FNMA ) Aaa/AA+/AAAF annie Mae is a government-sponsored enterprise chartered by Congress in 1938 and privatized in 1968. Its public mission is to support the secondary mortgage market and increase the supply of affordable housing. FNMA securitizes mortgage loans into mortgage-backed securities that it guarantees. Fannie is the largest single issuer of mortgage-related securities, with 49% market share of new issuance in FY2012.

7 As of December 2012, Fannie owned or guaranteed 29% of the $ trillion US residential mortgage debt outstanding. Along with peer Freddie Mac, Fannie Mae entered into conservatorship in September 2008, operates under the direction of Federal Housing Finance Agency (FHFA), and continues to pay out to the Treasury its positive net worth in the form of a dividend. Fannie Mae currently funds most of its activity through the issuance of notes and bonds, with $534B in total debt outstanding. Federal Home Loan Mortgage Corp. (Freddie Mac; FMCC ) Aaa/AA+/AAAF reddie Mac is a government-sponsored enterprise chartered by Congress in 1970 as means to cre-ate a competitor for Fannie Mae. Its public mission is to provide liquidity, stability, and affordability to the US housing market. Like FNMA, FMCC securitizes mortgage loans originated by lenders into Freddie Mac mortgage-backed securities that it guarantees. Along with peer Fannie Mae, Freddie Mac entered into conservatorship in September 2008, and continues to operate under the direction of FHFA and continues to pay out to the Treasury its positive net worth in the form of a dividend.

8 Freddie Mac currently funds most of its activity through the issuance of notes and bonds, with $488B in total debt : Janney FISR; Filings; FINRA TRACET otal Agency Issuance Has Declined Since the 2010 High02,0004,0006,0008,00010,00012,00014, 000$0 bln$200 bln$400 bln$600 bln$800 bln$1,000 bln$1,200 bln$1,400 bln1999200020012002200320042005200620072 00820092010201120122013 Amount ($ bln)# Issues (R-Axis)j a n n e y f i x e d i n c o m e s t r at e g yf eB r U a ry 5 , 2 0 1 4 Janney Montgomery 2014 Janney Montgomery Scott LLCM ember: NYSE, FINRA, SIPCA gency bonds PAge 3 Contentsoverview of typesfeatures & struCturefrequent issuers Housingfrequent issuers Bankingfrequent issuers utilitiesotHer issuersConClusioninformation & DisClaimersFannie is the largest single issuer of mortgage-related securities, with 49% market share of new issuance in FY2012.**Debt issued by Fannie Mae and Freddie Mac is not guaranteed by the federal government, but is considered a moral obligation.

9 Since the 2008-2009 recession, Congress has discussed ways to unwind the two entities, most recently proposing a third entity that would assume the role that Fan-nie and Freddie originally had. Government National Mortgage Assoc. (Ginnie Mae; GNMA ) Aaa/AA+/AAAG innie Mae is a US government agency that was established in 1968 when the Fair Housing Act divided Fannie Mae into two separate entities. Unlike Fannie and Freddie, Ginnie Mae does not buy or sell loans or issue mortgage-backed securities (MBS); therefore, Ginnie Mae s balance sheet does not use derivatives to hedge or carry long term debt. Instead, it is in the mortgage guaranteeing business. These loans are insured or guaranteed by the Federal Housing Administration (FHA), HUD, Office of Public and Indian Housing (PIH), Department of Veterans Affairs (VA) Home Loan Program for Veterans, USDA s Rural Development Housing and Community Facilities Programs, and others. frequenT issuers BankingFederal Home Loan Bank ( FHLB ) System Aaa/AA+/NRChartered by Congress in 1932, the FHLB system is a group of 12 regional cooperative banks that make loans to regional and community banks to support economic development and mortgage lending.

10 For the majority of its member banks, the FHLB system is the most cost-effective way for member banks to access the CREDIT market. Each of the 12 regional FHLBs is self-capitalizing through its member banks, but all are liable for their consolidated obligations ( In the event that an individual FHLB was unable to pay a creditor, the other 11 FHLBs would be required to step in and meet debt obligations). During the 2008-2009 recession, the FHLB increased its secured loans to members outstanding to more than $1 trillion, while all other sources of funding dried up. As a result of changes since the 2008-2009 recession, the FHFA overseas the FHLB system. As of most recent filings, the FHLB system had $767B in total debt outstanding. Federal Farm CREDIT Banks ( FFCB ) Aaa/AA+/AAAThe Federal Farm CREDIT Banks was established by Congress in 1916 and is dedicated to lending in agricultural and rural communities through providing loans, leases, and services.