Transcription of Corporate Reports Business indiA - Ruchi Soya

1 U 60 uMAY 12-25, 2014 Business indiA u the MAgAzine of the Corporate worldCorporate ReportsRuchi soya industries ltd, the second largest f m c g (fast mov-ing consumer goods) player in indiA by consolidated turn-over, after i t c ltd, and amongst the 50 fastest growing in the world, is repositioning itself for momentous growth. clocking a standalone turnover of `26,499 crore in 2012-13, this flag-ship company of the Ruchi group of industries is also exploring new horizons beyond its traditional Business its founding in 1986 by the shahra family as a food processing unit in indore, in Madhya pradesh, Ruchi soya has evolved as an inte-grated player in the edible oil busi-ness with a presence across the entire value chain.

2 It is acknowledged as indiA s largest integrated oilseed solvent extraction (in terms of oil-seed crushing) and edible oil refin-ing company. it is also the country s foremost cooking oil and soya food maker and marketer, and the largest palm plantations company name is from the hindi word Ruchi that depicts taste or interest, especially in food. its ori-gin was in 1958 when the late family patriarch, Mahadeo shahra, and his eldest of four sons, Kailash shahra, set up their family Business in com-modities trading, farming, ginning and oil milling. dinesh shahra, the youngest son, who is managing director of Ruchi soya industries, joined the Business in the years, Ruchi group has diversified into a conglomerate of businesses promoted by the four brothers and their sons and spans edible oils, soya foods, steel, dairy, information technology and realty.

3 While Kailash chairs the group and dinesh heads Ruchi soya, suresh, the second eldest, is managing direc-tor of Anik industries ltd, and the third brother, santosh, is managing director of general food ltd and Ruchi pvt ltd. Kailash s son umesh is the manag-ing director of Ruchi strips & Alloys ltd and of indian steel corporation lt d, suresh s sons nitesh and Manish are president, refining division, and executive director, Anik industries, respectively, santosh s son Vishesh is a director in a company, and dinesh s sons sarvesh and Ankesh are Business head, f m c g & specialty ingredients, Ruchi soya, and director, Business development, Ruchi Agritrading pte ltd, singapore, soya entered the capital market with a modest i p o of `60 lakh in 1986.

4 Now listed on the Bombay and national stock exchanges, it has metamorphosed into indiA s larg-est importer and marketer of edible oils. it was the company that pio-neered soya cultivation in the coun-try, with tie-ups with indian and American agricultural universities, and the farming com mu n it company has a pan- indiA presence, with five port-based refineries, three standalone crushing plants, eight integrated crushing and refining units, one refinery, one vanaspati plant, and two palm fruit process-ing factories. its extensive distri-bution network comprises 725,000 retail stores, 106 company depots and 5,642 the years, Ruchi has trans-formed itself from being a commod-ities trader and one processing oils to a complete foods company with branding of all its products.

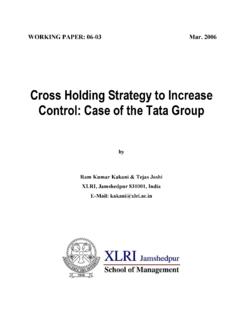

5 This has driven the company to the next level, with a strong portfolio of brands that include ready-to-eat vegetarian fare, nutrela soya foods, refined oils and table spread, sunrich sunflower Ruchi Soya is making some fast moves in the fast moving consumer goods industryThe oil baronssAnjAY BorAdeMAJOR FMCG PLAYERS IN INDIAT urnover 2012-13 (` crore)P&G IndiaColgate-PalmoliveMaricoBritannia ConsumerProductsHULR uchi SoyaIndustriesITC31,32329,80726,3176,391 6,1354,5002,8001,685 Dinesh Shahra:fmcg s paradigm shiftu 61 uMAY 12-25, 2014 Business indiA u the MAgAzine of the Corporate worldCorporate Reportsoil, mass edible oil brands Ruchi gold and Ruchi star, and Mahakosh refined soya bean oil.

6 Ruchi no. 1 is a leading edible oil and vanaspati brand, while Ruchi gold is the leader in palmolein and is indiA s single largest oil consumer a c n ielson survey of the mar-ket share of branded edible oils, or r o c p (refined oils in consumer packs), in packaging of five litres or less, ranks Adani wilmar, an equal partnership venture between the Ahmedabad-based Adani group and singapore s wilmar international ltd, in first place, with per cent. Ruchi follows closely with per cent, while chennai-based Kaleesu-wari refinery pvt ltd has a share of per cent. Ruchi , however, indi-cates that its Ruchi gold brand, with a per cent market share, contin-ues to be indiA s largest selling single oil (palm) joint ventures in the non-r o c p segment, or bulk/ institutional sales of edible oils to large consumers like hotels, restau-rants and foodstuff manufacturers, Ruchi has a strong hold and a leading position, the company maintains.

7 Nielsen doesn t provide data on this. the company besides adds that it has the highest capacity of million tonnes per annum - of oil-seed extraction, the highest capacity of million tonnes per annum - of oil refining, and the highest capacity of million tonnes per annum - of soya meal there is no ranking avail-able globally for edible oil compa-nies, the big players are American multinationals a d m (Archer daniels Midland), Bunge and cargill, and zurich-based louis dreyfus - better known as the a b c d of edible oils. indiA s f m c g sector is currently undergoing a paradigm shift, driven by a lifetime change of the custom-ers, mentions dinesh shahra.

8 This has forced major players in the sec-tor to promote products with cus-tomer preferences. observing that indiA s f m c g market is mature, com-petitive and marked by local as well as global brands, he, however, believes that the need of the hour is innovation, which sets one company apart from another. our view of innovation has been multifaceted, he says. we understand evolving customer needs and focus on provid-ing high quality products through innovation to attract increasing numbers of consumers. to give thrust to these pathways for growth, Ruchi has forged three significant joint ventures (jvs) over the past one year, the latest one, in february, having the potential to revolutionise soya bean production in indiA .

9 This jv is with d j h endrick international, inc. (djhii) of canada and k m d i international of japan for researching, producing, marketing and distributing high-yielding non-genetically modified (non-g m) soya beans in indiA . Ruchi soya will hold 55 per cent of the equity, with 35 per cent held by djhii, canada s leading centre of excellence for developing non-g m soya beans, and 10 per cent by k m d i, a japanese trader and mar-keter of high-quality food-grade soya jv combines the expertise of each partner towards enhancing the low yields in indiA . though the country is the world s fifth largest producer of soya beans, with annual yields of about 12 million tonnes and an additional million tonnes of soya bean oil, its productivity of just tonnes per hectare is less than half the global average of tonnes.

10 indiA is thus a net importer of soya bean oil, purchasing almost mil-lion tonnes yearly. indiA s soya bean oil consump-tion far outstrips domestic produc-tion, so if corrective action is not taken, the country s foreign exchange bill will continue to inflate, explains Ruchi chief operating officer (c o o) satendra Aggarwal. this jv plans on reducing import dependency through improving the oil content of domestically grown soya beans, which, in turn, will benefit public health, conserve precious foreign exchange, raise farmer incomes, and improve the rural economy. dinesh shahra stresses that Ruchi steers clear of g m seeds or crops, as research globally testifies that such tampered food can be detrimental to health.