District of Columbia - tax.thomsonreuters.com

District of Columbia “529” college savings plan. A subtraction up to $4,000 ($8,000 MFJ) is allowed for an amount contributed to a qualified taxpayer-owned District of Columbia “529” col-lege savings plan. If married individuals file a joint or combined

Tags:

District, Columbia, District of columbia

Information

Domain:

Source:

Link to this page:

Please notify us if you found a problem with this document:

Documents from same domain

2017 Tax Year – Individual Income Tax

tax.thomsonreuters.com2017 Tax Year – Individual Income Tax . State Conformity to the provisions in the 2017 Disaster Relief Act, 2017 Tax Cuts and Jobs Act and 2018 Budget Act. Most states conform to the provisions of the Internal Revenue Code (IRC). States achieve this either by automatically

Automatic Exchange of Information (AEOI)

tax.thomsonreuters.comAutomatic Exchange of Information (AEOI) CRS and FATCA Regulatory Compliance Your Foundation in a Changing World. Evolving international tax regulations are challenging organizations around the world to implement new procedures to maintain compliance. Furthermore, financial institutions are investing significant resources in finding ways to ...

Information, Automatic, Exchange, Automatic exchange of information

Practice Management for Your Entire Team

tax.thomsonreuters.comFact Sheet Project Manager Practice Management for Your Entire Team With the cloud-based Thomson Reuters Onvio Project Manager, practice management is a team endeavor. All the tools and resources you need are combined into one place, where centralized data and real-time

STATE AND LOCAL TAX TOOLS YOU CAN USE

tax.thomsonreuters.comresults, organized uniformly and clearly for easy review ... our chart finder option ... Easily find available federal and state tax credits and incentives for a specific address, as well as by jurisdiction, credit type, or industry type with this unique and innovative new tool.

PPC Library Template Report - tax.thomsonreuters.com

tax.thomsonreuters.comLetter for engagements to perform bookkeeping services, prepare financial statements, compile those financial statements, and perform corporate tax return services. ... APPENDIX 6E: Sample Receipt and Release Word No Audits of Financial Institutions (5/16) (20160501) (top)

Accounting and Reporting for Business Combinations

tax.thomsonreuters.comdifferences exist between the accounting for business combinations and asset acquisitions. For instance, in a business combination, an entity recognizes goodwill; no goodwill is recognized for an asset acquisition. As another example, in a business combination, transaction costs are expensed as incurred. Transaction costs are

Business, Cost, Transactions, Accounting, Combination, Incurred, Business combinations, Transaction costs

Social Security Benefits Worksheet (2019)

tax.thomsonreuters.comSocial Security Benefits Worksheet (2019) Caution: Do not use this worksheet if any of the following apply. 1) If the taxpayer made a 2019 traditional IRA contribution and was covered (or spouse was covered) by a qualified retirement plan, see IRA Deduction and Taxable Social Security on Page 14-6.

CS Professional Suite 2021 Price List

tax.thomsonreuters.comTax Products UltraTax CS Federal, State, and Local Products UltraTax CS Federal Products UltraTax/1040 (Includes Organizer) $3,760 Electronic UltraTax/1120 (Includes S&C) $2,695 UltraTax/1120 Consolidated $1,635 UltraTax/1065 $2,085 UltraTax/1041 $1,980 UltraTax/5500 $1,795 UltraTax/990 $1,795 document UltraTax/706 $1,215 UltraTax/709 $1,215 …

Checkpoint Tools - Thomson Reuters

tax.thomsonreuters.comBusiness Valuations Cash, Tax and Other Bases of Accounting Compilation and Review Engagements Compilation and Review Reports Construction Contractors Dealerships Forecasts and Projections Government Financial Statements Homeowners’ Associations HUD Audits Internal Control and Fraud Prevention Limited Scope Audits of Standard 401k Plans

Business, Construction, Valuation, Contractor, Construction contractors, Business valuations, Checkpoint

Depreciation (2020 Tax Year)

tax.thomsonreuters.com• Qualified smart electric meters and qualified smart electric grid systems placed in service after October 3, 2008.6 200% Declining balance 10 years Half-year or mid-quarter 15-year property • Certain improvements made directly to land or added to it (such as fences, roads, and bridges). • Retail motor fuels outlet (see Tab 7).

Related documents

UNITED STATES DISTRICT COURT FOR THE DISTRICT OF …

www.dcd.uscourts.gov1 UNITED STATES DISTRICT COURT FOR THE DISTRICT OF COLUMBIA In re GRAND JURY INVESTIGATION Grand Jury Action No. 18-34 (BAH) Chief Judge …

District, Columbia, The district of columbia, The district of

UNITED STATES DISTRICT COURT FOR THE DISTRICT OF …

ag.ny.gov1 UNITED STATES DISTRICT COURT FOR THE DISTRICT OF COLUMBIA . STATE OF NEW YORK 28 Liberty Street, 19th Floor . New York, NY 10005 . Civ. Action No. 18-1747

District, Columbia, The district of columbia, The district of

District Of Columbia - dchealth.dc.gov

dchealth.dc.govIN THE DISTRICT OF COLUMBIA . Your interest in becoming certified, as an advanced practice registered nurse in the District of Columbia, is welcomed. We look forward to providing expedient and professional service. However, the quality of our service is dependent on the completeness of your application. Please read the instructions carefully.

District, Columbia, District of columbia, The district of columbia

District of Columbia; General Obligation - cfo.dc.gov

cfo.dc.govThe District of Columbia, the capital of the U.S., is a unique governmental entity in that it combines state, county, and municipal characteristics. Its employment mix reflects the District's unique nature, consisting of government, military

District, Columbia, District of columbia, The district, The district of columbia

District of Columbia Workforce Investment Council POLICY ...

dcworks.dc.govThe State Workforce Development Board, referred to in the District of Columbia as the Workforce Investment Council (WIC), has been designated, to act on behalf of the Mayor, as the oversight entity of the Workforce Innovation and Opportunity Act (WIOA) of 2014, Title I adult, youth and

District, Workforce, Columbia, The district of columbia, District of columbia workforce

District of Columbia - Clinician Consultation Center

nccc.ucsf.eduDistrict of Columbia A Quick Reference Guide for Clinicians to District of Columbia HIV Testing Laws April 8, 2011 This document is a product of the National HIV/AIDS Clinicians’ Consultation Center at San Francisco General Hospital, UCSF.

DISTRICT OF COLUMBIA COMMUNITY HEALTH NEEDS …

dchealth.dc.govThe District of olumbia Department of Health is pleased to present the first edition of the District of olumbia ommunity Health Needs Assessment , a comprehensive analysis of a series of indicators and outcomes that describe the overall health status of District residents.

District of Columbia (Washington, D.C.)

cfo.dc.govDistrict of Columbia. Tax Changes Under the TCJA. 2 The Tax Cuts and Jobs Act (TCJA) is the most significant revision to the federal tax system since 1986

DISTRICT OF COLUMBIA - Compendium

comp.ddot.dc.govDistrict of Columbia is divided into eight (8) geographic Wards, with a Team Leader assigned to manage the construction projects within each Ward. The Construction Manager will receive direction and oversight from the Team Leader within the specific Ward in which that project

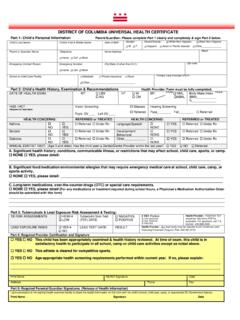

DISTRICT OF COLUMBIA UNIVERSAL HEALTH CERTIFICATE - …

dcps.dc.govDISTRICT OF COLUMBIA UNIVERSAL HEALTH CERTIFICATE Part 1: Child’s Personal Information Parent/Guardian: Please complete Part 1 clearly and completely & sign Part 5 below. Child’s Last Name: Child’s First & Middle Name: Date of Birth: Gender:

Health, Certificate, District, Universal, Columbia, District of columbia universal health certificate