Transcription of DoD Independent Agency Session Kathy Windsor, …

1 DoD Independent Agency Session Kathy windsor , defense travel management office August 1-3, 2017 Treasury and Trade Solutions | citi Commercial Cards Agenda DTMO Role Program Benefits Proper GTCC Use Card Types Card Fees APC and Cardholder Responsibilities Scenarios Open Discussion Backup Slides / Additional Information 2 DTMO Role Serves as the DoD s travel Card Program Manager for all DoD Components Manage DoD s SmartPay 2 tailored task order Provide guidance and overall management of the program Coordinate with GSA, the Card vendor, and DoD Components/Agencies Develop DoD travel card policy and procedures Facilitate travel card training for DoD Assist with DTS Centrally Billed Account (CBA) Reconciliation Module implementation 3 Benefits of the GTCC Program Improves financial readiness/security of travelers Eliminates the need for travelers to use personal funds Reduces the need (and costs to the Department) for travel advances and related reconciliation/collection Improves audit readiness and program management Increases rebates from the travel card vendor (See GTCC Regulations Section 040306) Provides travel insurance Increases data capture, providing business intelligence to improve travel programs, reduce overall travel costs and expand strategic sourcing opportunities Allows use of GSA City Pair Program and Tax Exemption 4 Proper GTCC Usage Primary payment method for ALL official travel expenses include.

2 See the GTCC Regulations for authorized exceptions for some cash-based expenses For cardholder only Service/ Agency determines IBA usage for PCS, and whether dependents authorized expenses may be charged to the cardholders account Not for personal use 5 Card Types: Individually Billed Account 6 Card Types: Centrally Billed Account 7 Transportation Only Limited use Credit limit consistent with mission Government liability Requires management and monthly reconciliation New accounts must be approved by the CPM Unit Cards Issued to an individual or unit for group travel only when cost effective and in the best interest of the mission Appropriate for group of travelers, such as athletic teams, escort teams, bands, etc. Can be used for transportation, lodging, meals, etc., arranged using other than a contract or purchase order Credit limit consistent with mission Government liability Requires management and monthly reconciliation New accounts must be approved by the CPM Credit Limit Increase Thresholds DoD Independent Agencies 8 *Standard Account credit limit increases based on mission requirements.

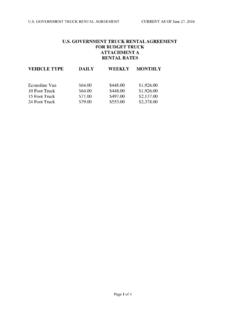

3 Limited to no more than 12 months. **Restricted Account credit limit increases based on mission requirements. Limited to no more than 6 months. **Cash and Retail limits are per monthly billing cycle. The full limit is available when the balance is paid any time during the billing cycle. * Standard **Restricted Accounts Default APC Approval Maximum HL4 Approval Maximum CPM (HL3) Approval Maximum DTMO Approval Maximum Credit *$7, 500 **$4,000 $10,000 $15,000 $50,000 No Maximum travel *$7, 500 **$4,000 $10,000 $15,000 $50,000 No Maximum Cash** *$665 **$365 $5 ,000 $10,000 $50,000 No Maximum Retail** *$250 **$100 $500 $1 ,000 $2, 000 No Maximum citi Cardholder Fees Late *Non-reimbursable in most cases Begins at 75 days $29 each 30-day cycle Non-Sufficient Funds *Non-reimbursable $29 fee for NSF check Salary Offset *Non-reimbursable $25 DFAS processing fee $55 citi Administration fee $87 (late fee $29 x 3) Re-Instatement $29 fee (if approved)

4 Expedited Card Delivery $20 fee ATM/Cash Advance *Not always reimbursable ATM service fee ATM user/terminal fee Merchant Surcharge Up to 4% United Territories Only Reduced Payment Plan (Multiple) $45 Setup $10 monthly maintenance $29 monthly late payment 9 Agency Program Coordinator APC must be the right person for the job: Independent performer/self- management Appropriate rank, grade, maturity, and skills Trained and certified with EAS access and IntelliLink Designated in writing Monitor unit s GTCC program via reporting Relay sensitive information and notify cardholders supervisor of suspected misuse and abuse Assist cardholders Conduct training as needed Increase/decrease credit limits Activate/deactivate cards Coordinate with DTS administrator to maintain cardholder profile information 10 Agency Program Coordinator (continued) Perform Program Reviews.

5 Public Law 112-194 Government Charge Card Abuse Prevention Act of 2012 Minimum requirements to ensure effective management controls Compliance checklist GTCC Regulations, Annex 9 Findings of significant weaknesses must be reported to CPM in addition to Command or Agency Head Coordinate with DTS DTA/FDTA to identify travelers not submitting a voucher within 5 days of returning from travel 11 Proprietary Information Ensure cardholders confidentiality Personally Identifiable Information (PII) Information of a sensitive nature should always be handled carefully GTCC Regulations, 041103, 0414, 041401 Keep in a secured location Use password protection Always treat information as if it were your own 12 Path of an APC Appointed in Writing Register as a non-cardholder in EAS Take mandatory APC training Determine Cycles (IBA/CBA) Policy Public Laws OMB Circular GTCC Regulations, authorized by DoDI Vol.

6 4 Reporting Schedule & Pull Reports Analyze Reports Advise cardholders & management Maintenance Hierarchies Cardholder Profiles Training/SOU Applications Correspondence 13 Cardholder Responsibilities Be familiar with GTCC Regulations Verify receipt card with GTCC vendor Update contact/card information in DTS and GTCC vendor Ensure the account is active, available for use prior to travel Use card for all expenses related to official travel unless otherwise exempted Submit travel vouchers within 5 business days Use split disbursement during travel settlement process Ensure charges are accurate; dispute inaccuracies within 60 days 14 Scenario #1: Your supervisor advised you will be a GTCC APC for your organization You will be designated in writing by a commander or director as responsible for the management of the travel card program You will be assigned GTCC hierarchies to manage You will complete initial APC travel Card Program management (APC Course) (Mandatory) found on the TraX website: You will obtain Electronic Access System (EAS) training (GSA SmartPay Forums, citi CLASS (computer based trainings (CBTs), guides, or on-site training) You will register for EAS non-cardholder access 15 Scenario #2.)

7 A new traveler in-processes into your organization Determine if the traveler travels frequently, infrequently, and when the next trip is scheduled Determine if the traveler had a DoD GTCC at their prior organization If yes, have cardholder provide their certificate of Cardholder 101 Training to you; have them complete a new Statement of Understanding (SOU); transfer GTCC into your hierarchy via EAS If not, have applicant complete Cardholder 101 Training and provide the certificate to you; have them complete a SOU; work with applicant to complete either an on-line or paper IBA application 16 Scenario #3: A GTCC cardholder is retiring and out-processing from your organization Log into the EAS and determine if there is a balance (credit or debit) on the GTCC Advise balances must be cleared Search CCMS for the cardholder: Select CCMS>Card management >Account management >Modify>Account>Search Click on Account Status Drop Down and select either T-1 (terminated) or V-9 (Closed by Agency ) Select submit 17 Scenario #4: Scheduling CCRS Reports Log into citi : Under Web tools select CCRS Select the hierarchy (CBA or IBA) Select Organizational Shared Folders Select DoD travel Shared Folders Mouse over the report you want to subscribe to Select subscriptions underneath the title and add the subscription 18 Scenario #4.

8 Scheduling CCRS Reports (continued) Select Daily Load Complete from the schedule prompt Type your full email address and select okay You will receive an email when the reports are ready in the CCRS history list 19 Scenario #5: You pulled the monthly IBA Aging Analysis and Delinquency HL Reports and have delinquent cardholders Review the Delinquency Report for accounts in the 61+ delinquency buckets Notify cardholders and supervisors using sample 61+; 91+ and 121+ delinquency letters (GTCC Regulations Annexes 5-7) Maintain a file of delinquency correspondence (GTCC Regulations Section 041103) Educate the cardholder on submitting vouchers within 5 days of returning from travel , Scheduled Partial Payments (SPPs) for long term TDY, Mission Critical for PCS (where authorized), and proper split-disbursement 20 Scenario #6: A restricted cardholder s supervisor notifies you to activate and increase the GTCC credit limits for TDY Log into the EAS and search CCMS for the cardholder: Select CCMS>Card management >Account management >Modify>Account>Search Make sure the Account Status is Open, Active, & Receipt Verified Type in the Active Start Date & Active End Date Mouse over the credit limit field; type in the temporary limit.

9 Click set temporary credit limit (limited to 6 months) Select submit at the bottom of the page 21 Open Discussion 22 Backup Slides (for reference only) 23 Metric Reporting (Green) (Yellow) > (Red) IBA-Delinquent Accounts (Green) (Yellow) > (Red) CBA-Delinquent Dollars 80% 100% (Green) (Yellow) 60% and Under (Red) Split Disbursement 24 Delinquency Timeline for IBA 25 Delinquency Timeline for CBA Current Receive statement Day 1 = The day after charges post to the cardholder s statement Past Due status at day 31 Prompt Pay Act (PPA) Interest is incurred at day 31 Disputed/Fraudulent transactions must be reported within 60 days of when the charge first appears on a statement Suspended No new charges without CBA exception granted by travel card vendor PPA interest is being accrued until payment receipt Affects Command s delinquency rate Accounts past billing 61+ days require DoDIA CPM/HL 3 authorization Cancelled/Closed PPA interest is being accrued until payment receipt At 126 days and beyond no further exceptions can/will be approved Reinstatement of account upon payment in full and CPM approval Cannot transfer to another HL Charge Off May charge off Could affect the organization s ability to open new CBA accounts Delinquency removed from HL 26 0 - 60 Days* 126 - 210 Days* 61 - 125 Days* 211 Days* *Days = days past billing

10 Statement date Causes of Delinquency Unauthorized charges that are not reimbursable Not properly utilizing Split Disbursement for GTCC expenses Need to adjust Split Disbursement amounts on DTS Payment Totals page Not signed up for Scheduled Partial Payments (SPP) when on long term travel Not paying undisputed charges in full on the monthly statement by due date Not disputing unrecognized charges 27 Causes of Delinquency (continued) Misuse/Abuse Utilizing card for personal use Using ATM to withdraw credit balance refund Late submission of travel claim travel claims should be submitted within 5 working days of completion of official travel Coordinate with your LDTA if you do not have access to obtain the Unsubmitted Voucher report in DTS Report Scheduler 28 Account Closure and Cancellation An account may be cancelled for the following reasons.