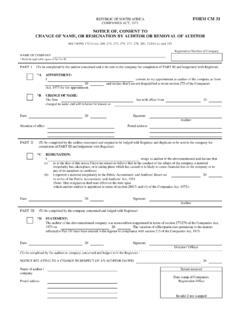

Transcription of EMPLOYEE S TAX SKILLS DEVELOPMENT LEVY UNEMPLOYMENT ...

1 EMP1e 01UL7 Magisterial districtArea codeNature of personUIF reference numberSDL reference numberPAYE reference numberEMPLOYEE S TAXSKILLS DEVELOPMENT LEVYUNEMPLOYMENT INSURANCEFUND CONTRIBUTIONS Application for registrationFOR OFFICE not for of person (indicate only 1 option with an X )Initials (Only if nature of person is individual) Name (In the case of an individual, only the surname, and in the case of a partnership, company, etc. name of partnership, company, etc.) Full namesIdentity numberIncome tax reference numberIncome tax reference numberIf not registered for Income Tax purposes state reasonFOR OFFICE USE: Reason codeVAT registration numberIf married in community of property, furnish particulars of number of Company/CC/Trust/Fund numberIdentity numberDate of birthTrading or other name4 Page of person applying for registrationResidential address if individualPhysical business addressPostal codePostal codeHome telephone number (for Individuals)

2 Business telephone numberFacsimile of businessE-mail addressWebsite addressPreferred languageAfrikaansEnglishAn employer is deemed not to have applied for registration until the application form has been completed in full and all the required information and documentation has been USE BLOCK not South African resident state country of residencePassport numberPostal address Postal codeMMDDCCYYC ellular phone numberTELFAXCODECODECODETELPage 2 Employers who fall within the categories mentioned below are not liable for the payment of the levy in terms of section 1 of the SKILLS DEVELOPMENT Levies Act, but must however still register in terms of section 5(6) of the aforementioned mark the appropriate block with an X where applicable).Any National/Provincial Public Service employerPublic Benefit OrganisationsNational/Provincial public entity, if more than 80% of your expenditure is defrayed from funds voted by ParliamentMunicipalities to whom a certificate of exemption has been grantedParticulars of ExemptionsState the number of enterprises/branches/divisions if separate enterprises/branches/divisions that also exist in the RSAS tate the number of enterprises/branches/divisions for which separate registration is the trading or other name and/or employer s reference number (PAYE number) of ALL enterprises/branches/divisions including those for which an application for separate registration will be made on EMP 102e form.

3 Format of tables requiredb) SARSTax 2000 (Employees Tax Deduction Program) on CDa) EMP10 tables (Guidelines and tables)Format in which the PAYE deduction tables are required (Mark only 1 block with an X )c) Internet access to download EMP10 tables and SARSTax 2000 updatesd) No EMP10 tables or SARSTax 2000 Indicate if a computer program, other than SARSTax 2000, is used/will be used to calculated PAYE deductibleIf YES , state the name of that programBD1 IGDate on which the business commenced/will commenceDate on which the person* became/will become liable to be registered for PAYE/UIFDate on which the person* became/will become liable to be registered for of exemptions (only for SKILLS DEVELOPMENT levy ) particulars for Employees Tax of other enterprises/branches/divisionsFOR OFFICE USE FOR OFFICE USE YESNOT rade classification codes (Refer to brochure - VAT/PAYE 403)

4 Major divisionActivity within major divisionState main activityYYCCMMDDYYCCMMDDYYCCMMDDNameName NameNameNamePAYE numberPAYE numberPAYE numberPAYE numberPAYE number77777 Surname/Company/ close corporation /Trust/Fund nameSurname/Company/ close corporation /Trust/Fund nameSurname/Company/ close corporation /Trust/Fund nameSurname/Company/ close corporation /Trust/Fund nameInitialsInitialsInitialsInitialsRegi stration number of Company/CC/Trust/Fund numberRegistration number of Company/CC/Trust/Fund numberRegistration number of Company/CC/Trust/Fund numberRegistration number of Company/CC/Trust/Fund numberIdentity numberIdentity numberIdentity numberIdentity numberIncome tax numberIncome tax numberIncome tax numberIncome tax numberPage 3 Country of residencePassport number (non-resident)Passport number (non-resident)Passport number (non-resident)Passport number (non-resident)Country of residenceCountry of residenceCountry of residenceFOR OFFICE USE: Reason codeFOR OFFICE USE: Reason codeFOR OFFICE USE: Reason codeFOR OFFICE USE.

5 Reason of 5 most senior partners/members/directors/shareholders/ trusteesPayroll informationNumber of employees on which estimated payroll is basedEstimated payroll for the following 12 month particulars for SKILLS DEVELOPMENT levy purposesSETA classification codes (Refer to guidelines - SDL 10)SETA codeChamber/SIC codeState main sector and activity,RPage 4 SurnameSurname/Company nameCapacityCapacityPartnerTreasurerPubl ic OfficerTrustee/Curator/Liquidator/ Executor/AdministratorAccounting Officer for local/public authorityPhysical address (not postal box number - must be a South African address)Postal addressCellular phone number Cellular phone number Practice numberContact telephone number Contact telephone number E-mail addressE-mail addressPostal codePostal codeName of account holderType of accountBank branch number (at least six numbers)Account of representative of external auditor/bookkeeper/accountant (where applicable)11.

6 Particulars of bank (Must be a registered bank in South Africa)54321 Surname/Company/ close corporation /Trust/Fund nameInitialsRegistration number of Company/CC/Trust/Fund numberIdentity numberIncome tax numberCountry of residencePassport number (non-resident)FOR OFFICE USE: Reason of 5 most senior partners/members/directors/shareholders/ trustees (Continue)TELI ndividualAdditional attachmentsPartnershipCompany/ close CorporationLocal Authority/Public AuthorityAssociation not for gainEstate/Liquidation/TrustClubWelfare OrganisationCertified copy of the identity document of the individualCertified copies of the identity documents of the 5 most senior partners of the partnershipPartnership agreement in writing. If verbal agreement, please complete and attach the EMP128 Certified copies of the identity documents of 5 most senior directors/members/shareholdersLetter of Authority and the Trust deedCertified copies of Certificate of Incorporation (CM1) Certified copy of the identity document of the spouse if married in community of propertyCertified copy of the Founding statement, CK1 or of register of Directors (CM29)

7 Letterhead of the Local Authority/Public AuthorityConstitution or memorandum of body applying for registrationConstitution of the of registration in terms of Non-profit Organisations Act 71 of 1997 Certified copy of exemption in terms of the Income Tax Act 58 of 1962 Certified copy of the constitution of the welfare OrganisationHave you complied with your obligations in terms of other Acts administered by SARS?Declaration by the employer/representative employer completing this form I declare that I am the employer/representative employer and that the information furnished herein is true and correct and that all required documents are by the person assisting the employer/representative employer with the completion of this form I declare that I assisted the employer/representative employer with the completion of this form and that the information furnished herein is true and correct as provided to me by the Employer.

8 Name Signature Capacity Date Initials and Surname Signature DateEdited by:Page 5 YESNO13. Declaration by employerFor office required of person applying for registrationFor office useDocuments to be submitted with all applicationsLatest bank statement or original cancelled cheque or letter from your bankerLetter of appointment as external auditor/bookkeeper/accountant or CM31 if Is completedPart 7 Certified copy of the identity document of the representative employer or work permit if non-residentRecent copy of the business municipal account or copy of lease agreement to confirm the physical business address or confirmation of physical business address by representative employerPlease tick blocks for the documents Name Signature Capacity

9 Dat