Transcription of Enrollment guide Your 401(k) plan - Bank of America

1 1 bank of America believes that the 401(k) plan is one of the best ways for you to save for retirement. That s why, to make it as easy as possible for you to start saving, you ll be automatically enrolled in the plan at 3% of your eligible pay about 45 days after your start date. The contributions will be taken from your pay before taxes. To help you gradually save more over time and maximize the company s matching contributions, we ll automatically increase your pre-tax contributions after a year of service with the company by 1% each year until you reach 5% of eligible don t stop there you can enroll even sooner, or contribute even more at any time. This guide outlines your contribution options and ways to invest under the plan. Things to consider: You can opt out of automatic Enrollment (which includes automatic increase) during the 45-day waiting period through Benefits OnLine ( ).

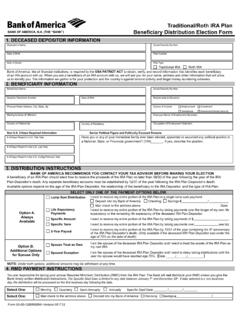

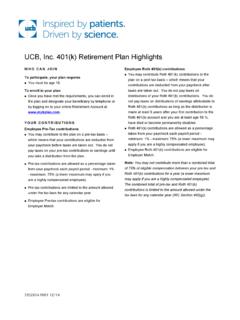

2 Unless you elect otherwise, your account will be invested in the LifePath Index Fund with the year closest to your assumed retirement (age 65). You can change your contributions and investment elections at any time. This guide provides an educational summary of your 401(k) plan. It is not meant to provide full details of the plan provisions. For more details about the plan, see the enclosed Investment guide and Summary Plan information in this guide applies to both the bank of America 401(k) Plan and the Merrill Lynch & Co., Inc. 401(k) Savings & Investment 401(k) planEnrollment guide 2 Tax advantagesYou can choose pre-tax contributions, Roth (after-tax) contributions or both. Each type of contribution has certain tax advantages:**The 401(k) plan offers you a convenient way to prepare for retirement, and provides great benefits that help you boost your savings, including: Company matching contribution of up to 5% of eligible pay Annual company contribution of 2% of eligible pay (3% after 10 or more years of service) Convenient payroll deductions A broad range of investment options Tax-advantaged savings Take a few minutes to learn how the plan works to be sure you re taking full advantage of all the benefits available to you.

3 Flexible savingsYou decide how much to contribute to the plan each pay period. You can contribute up to the following amounts:Plan limitUp to 75% of your eligible pay*2018 IRS limit$18,500 for pre-tax and/or Roth contributionsIf you re age 50 or overYou can contribute a higher amount (currently up to $24,500 in 2018) to help make up for years that you might not have saved as much. * Eligible pay includes base, overtime, shift, differential, vacation and holiday pay, short-term disability benefits and certain bonuses, commissions and incentives that are designated as plan-eligible compensation. (It does not include any stock-based compensation or deferrals to the nonqualified deferred compensation plan.)**For additional information, see the Disclosures section of this contributionsYour 401(k) savings are deducted from your pay before federal and, in most cases, state taxes are applied, reducing your tax bill for the current contributionsBecause these are after-tax contributions, you don t save on taxes in the year you make contributions.

4 But your contributions and investment earnings could be tax-free when you withdraw money from your account in retirement, if you meet certain criteria. Have you made contributions to a previous employer s plan?If you contributed to a 401(k) plan at a previous employer this year, you will need to monitor your total contributions to avoid exceeding the annual IRS contribution limits. Excess contributions may be subject to taxes, fees and penalties. (Contributions in excess of the IRS limit must be refunded by the tax-filing deadline next year, generally April 15. If your request is not processed by the deadline, taxes, fees and penalties may apply.)3 The convenience of automatic Enrollment You don t have to take any action with the plan s automatic Enrollment and automatic increase features. It s a convenient way to start contributing to the your own strategy You can participate in the plan sooner and/or make your own contribution and investment decisions.

5 To do so, visit Benefits OnLine to: ( ) Choose how much to contribute (up to plan or IRS limits; see previous page). Determine how to invest your contributions. The plan offers a variety of investment choices to choose from. Set your own schedule for automatic contribution increases. You can increase your contribution rate by 1%, 2% or 3% of your eligible pay every 1, 2 or 3 years (up to legal limits).*Approximately one calendar year from your 401(k) automatic Enrollment date.**Approximately 45 days after your service anniversary date.** You are eligible to receive company matching contributions and the annual company contribution beginning the first of the month after one year of service. You are immediately vested in company matching contributions, and your annual company contribution account is vested after you have completed 36 months of is for illustrative purposes only and assumes automatic Enrollment at a rate of 3% and that the participant makes no other changes to their contribution EnrollmentAutomatic IncreaseWhen you re hiredAfter one year of service*After two years of service You ll be enrolled approximately 45 days after your start date.

6 your contribution rate will be 3% of your eligible pay on a pre-tax basis. your contributions will automatically be directed into the LifePath Index Fund with the year closest to your assumed retirement (age 65). your contributions will be increased automatically by 1% to a new contribution rate of 4% of your eligible pay on a pre-tax basis.** You receive company matching contributions on 4% of your eligible pay that you contribute each pay period and are also eligible to receive an annual company contribution of 2% of pay.** your contributions will be increased automatically by 1%, so you will now be contributing 5% of your eligible pay on a pre-tax basis and will be maximizing the company match.** You receive the maximum company matching contribution of 5% of eligible pay that you contribute each pay period and are still eligible to receive an annual company contribution of 2% of pay.

7 ** Getting started in the plan The 401(k) plan offers a variety of approaches to help you start and continue contributing for retirement. Important reminder: You can stop or change your contributions and investment direction in the plan at any more details about the plan, see the enclosed Investment guide and Summary Plan Description.*Please call the Employee Retirement Savings Center at if you worked for a company that merged with or was acquired by bank of America . You may be eligible to receive service credit for the time you worked with the merged or acquired company.** The maximum eligible pay to determine your matching contributions and annual company contributions is $150,000. Employer contributionsAfter you complete a full year of service, we boost your retirement savings with company matching contributions and the annual company contribution.

8 *Company matching contributionsThese are dollar-for-dollar matching contributions of up to 5% of your eligible pay.** Matching contributions are credited to your account each pay period that you company contributionsAt the beginning of each year, you also get a contribution of 2% of your eligible pay** (3% if you have at least 10 or more years of service). It can really add up These employer contributions could really make a big difference over time. Janice contributes 5%, or about $100, every two weeks. When you factor in employer contributions, it starts to add up. After 10 years, her total contribution of $25,000 could become as much as $79,000 with earnings. The story could get even better after 20 and 30 hypothetical illustration assumes a salary of $50,000, a 5% pre-tax contribution rate (a $ contribution at the end of every two weeks) and a 6% rate of return compounded annually.

9 It also assumes a company match of 100% for every dollar contributed up to 5% of eligible pay, and an annual contribution of 2% of eligible pay. Hypothetical results are for illustrative purposes only and are not meant to represent the past or future performance of any specific investment vehicle. Investment return and principal value will fluctuate and when redeemed, the investments may be worth more or less than their original cost. Taxes are due upon withdrawal. If you take a withdrawal prior to age 59 , you may also be subject to a 10% additional federal s eligible pay: $50,000401(k) contribution: 5% each pay periodCompany match: 5% each pay periodCompany contribution: 2% or more annually, 3% after 10 or more years of service$100,000$200,000$300,000$400,000$ 500,00010 Years: 20 30 5 LifePath Index FundUse a professionally managed, diversified LifePath Index Fund that automatically adjusts to a more conservative mix of investments over time.

10 Simply choose the fund that corresponds to the year you plan to Access Get personalized recommendations to guide your investments with these three options. PersonalManager monitors and adjusts your account regularly. Portfolio Rebalancing maintains your investment mix until you make a change. One-Time Implementation puts the recommendations to work for you. Build your portfolioSelect from among the available investment choices, including fixed income, equity and specialty investments. You will need to monitor your investments over time and make any necessary adjustments. Three ways to investThe 401(k) plan offers three investment approaches and a variety of investment choices. Make sure to review your options to determine the best fit for you. For additional information on LifePath Index Funds and Advice Access, see the Disclosures section of this for meDo it yourselfGive me helpGet helpful adviceAs an employee, you have access to the Benefits Education & Planning Center, a confidential and free resource where licensed EY (formerly Ernst & Young) financial counselors can provide you with personal advice to help you achieve your financial goals and get the most out of your bank of America employee benefits.