Transcription of Equalisation Levy - EY

1 Equalisation levy Fresh self-contained code on taxation of Digital Ecommerce transactions Background Under the BEPS Action Plan 1, the OECD had amongst the others, considered Equalisation levy as one of the modes of taxing the Digital transactions, although, report did not finally recommend such levy . India s action on BEPS agenda relating to Digital Economy was eagerly awaited as India had played a significant role in incorporating various tax options in the Action Plan. In the fiscal budget presented today, the Finance Minister has proposed to introduce Equalisation levy as a self-contained code to tax Digital Ecommerce transactions under Chapter VIII. We have summarised below the key provisions relating to this levy . Analysis Equalisation levy : Equalisation levy has been defined as Tax leviable on consideration received or receivable for any specified service under the provisions of this chapter.

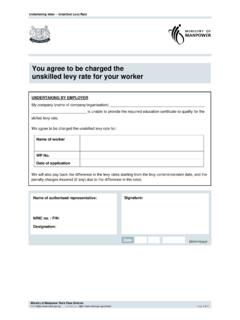

2 The levy would be under a separate self-contained code and is not part of the income-tax law. Services Covered: The Equalisation levy would be applicable at 6% on gross consideration payable for a Specified Service . Specified Service is defined as follows: (1) Online advertisement; (2) Any provision for digital advertising space or facilities/ service for the purpose of online advertisement; (3) Any other service which may be notified later. Finance Minister in his budget speech has stated that the Equalisation levy was aimed at taxing Business to Business (B2B) ecommerce transactions. Therefore, the scope of the levy may be expanded to cover a larger gamut of digital goods and services as the time progresses. Applicability: The levy will be applicable on the payments received by a non-resident service provider from an Indian resident or an Indian Permanent Establishment ( PE ) of a non-resident, in respect of the specified service.

3 The levy would not be applicable to non-resident service providers having a PE in India, as they will be subjected to a regular PE basis taxation. The levy is currently applicable only on B2B transactions, if the aggregate value of consideration in a year exceeds approx USD 1500. Date of applicability: The Government will notify the date from which this provision shall be effective. Treatment of such income under the Income-tax law: To avoid double taxation of income which has been subjected to an Equalisation levy , such income will be exempt in the hands of the non-resident under the income-tax law. However, one would need to evaluate the possibility of claiming tax credit for such levy in the home country of non-resident service provider. Who needs to comply: Every resident person and foreign company (having a PE in India) is required to withhold Equalisation levy while making payment to a non-resident service provider.

4 The compliance procedure is similar to withholding tax compliances already prevalent in India. While the compliance obligation is largely on the Indian residents, the levy would be withheld while making payment to non-resident service providers. Compliance requirements: Service recipient is required to make compliance and also file an annual statement in respect of services received. Consequences of a delayed payment: Delayed payment carries a simple interest at 1% of the outstanding levy for every month or part thereof is delayed. Consequences of non-compliance by service recipient: 1. Penalty for failure of payment: a) Equalisation levy not deducted: Penalty equal to the amount of levy failed to be deducted (along with interest and depositing of the principal levy outstanding) b) Equalisation levy deducted but not deposited: Penalty equal to INR 1,000/day subject to the maximum of the levy failed to be deducted (along with interest and depositing of the principal levy outstanding) c) Disallowance of such expenditure in the hands of the payer (unless the defect is rectified) 2.

5 Penalty for failure of filing statement of compliance: INR 100/day for each day the non-compliance continues 3. Prosecution: If a false statement has been filed then the person may be subjected to imprisonment of a term up to 3 years and a fine Other points: As it happens in case of remittances in India, it would be in the ordinary course for an Indian service recipient to ask the non-resident service provider for a No PE declaration so as to decide on the applicability of the Equalisation levy . Online advertising services are separately subject to Service tax @ (now 15%) on a reverse charge basis which is to be collected and discharged by the Indian service recipient. Comments This is the first significant step taken by India in respect of taxing Digital Economy transactions.

6 As the other services and the rules relating to Equalisation levy get notified, we will have better insights into the scope and intent of the levy . For further information/ clarification, kindly get in touch with Rakesh Jariwala, Partner or Nirav Shah, Director Our offices Ernst & Young LLP EY | Assurance | Tax | Transactions | Advisory About EY EY is a global leader in assurance, tax, transaction and advisory services. The insights and quality services we deliver help build trust and confidence in the capital markets and in economies the world over. We develop outstanding leaders who team to deliver on our promises to all of our stakeholders. In so doing, we play a critical role in building a better working world for our people, for our clients and for our communities.

7 EY refers to the global organization and may refer to one or more of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients. For more information about our organization, please visit Ernst & Young LLP is one of the Indian client serving member firms of EYGM Limited. For more information about our organization, please visit Ernst & Young LLP is a Limited Liability Partnership, registered under the Limited Liability Partnership Act, 2008 in India, having its registered office at 22 Camac Street, 3rd Floor, Block C, Kolkata 700016. 2016 Ernst & Young LLP. Published in India. All Rights Reserved. ED None This publication contains information in summary form and is therefore intended for general guidance only.

8 It is not intended to be a substitute for detailed research or the exercise of professional judgment. Neither Ernst & Young LLP nor any other member of the global Ernst & Young organization can accept any responsibility for loss occasioned to any person acting or refraining from action as a result of any material in this publication. On any specific matter, reference should be made to the appropriate advisor. Join India Tax Insights from EY on Follow us on India Tax Insights Blog Ahmedabad 2nd floor, Shivalik Ishaan Near. Vidhyalaya Ambawadi Ahmedabad-380015 Tel: +91 79 6608 3800 Fax: +91 79 6608 3900 Bengaluru 12th & 13th floor U B City Canberra Block , Vittal Mallya Road Bengaluru-560 001 Tel: +91 80 4027 5000 +91 80 6727 5000 Fax: +91 80 2210 6000 (12th floor) Fax: +91 80 2224 0695 (13th floor) 1st Floor, Prestige Emerald , Madras Bank Road Lavelle Road Junction Bengaluru-560 001 India Tel: +91 80 6727 5000 Fax: +91 80 2222 4112 Chandigarh 1st Floor SCO: 166-167 Sector 9-C, Madhya Marg Chandigarh-160 009 Tel: +91 172 671 7800 Fax: +91 172 671 7888 Chennai Tidel Park 6th & 7th Floor A Block (Module 601,701-702) , Rajiv Gandhi Salai Taramani Chennai-600113 Tel: +91 44 6654 8100 Fax.

9 +91 44 2254 0120 Delhi NCR Golf View Corporate Tower B Near DLF Golf Course Sector 42 Gurgaon 122 002 Tel: +91 124 464 4000 Fax: +91 124 464 4050 3rd & 6th Floor, Worldmark-1 IGI Airport Hospitality District Aerocity New Delhi-110037, India Tel: +91 11 6671 8000 Fax +91 11 6671 9999 4th & 5th Floor, Plot No 2B Tower 2, Sector 126 Noida-201 304 Gautam Budh Nagar, India Tel: +91 120 671 7000 Fax: +91 120 671 7171 Hyderabad Oval Office 18, iLabs Centre Hitech City, Madhapur Hyderabad - 500081 Tel: +91 40 6736 2000 Fax: +91 40 6736 2200 Kochi 9th Floor ABAD Nucleus NH-49, Maradu PO Kochi - 682 304 Tel: +91 484 304 4000 Fax: +91 484 270 5393 Kolkata 22, Camac Street 3rd Floor, Block C Kolkata-700 016 Tel: +91 33 6615 3400 Fax: +91 33 2281 7750 Mumbai 14th Floor, The Ruby 29 Senapati Bapat Marg Dadar (west) Mumbai-400 028, India Tel: +91 22 6192 0000 Fax: +91 22 6192 1000 5th Floor Block B-2 Nirlon Knowledge Park Off.

10 Western Express Highway Goregaon (E) Mumbai-400 063, India Tel: +91 22 6192 0000 Fax: +91 22 6192 3000 Pune C 401, 4th floor Panchshil Tech Park Yerwada (Near Don Bosco School) Pune-411 006 Tel: +91 20 6603 6000 Fax: +91 20 6601 5900

![The Handmaid's Tale[1] - Nebula](/cache/preview/b/1/f/8/5/0/0/b/thumb-b1f8500ba7b72b7af7a7b5ba2fa73a2d.jpg)