Transcription of FFIEC 019: Country Exposure Report for U.S. …

1 Country Exposure Report for Branchesand Agencies of Foreign BanksFFIEC 019 OMB No. (FRB) 7100 0213 Expires September 30, 2006 Board of Governors of the Federal Reserve SystemFederal Deposit Insurance CorporationOffice of the Comptroller of the CurrencyThis Report is required to be filed by branches and agencies of foreign banks pursuant to authoritycontained in the following statutes:Board of Governors of the Federal Reserve System Sections 7 and 13 of the International BankingAct (12 3105, 3108); Federal Deposit Insurance Corporation Section 7 of the Federal DepositInsurance Act (12 1817); and Office of the Comptroller of the Currency the National Bank Act,as amended (12 161).

2 The Federal Reserve System, the Federal Deposit Insurance Corporation, and theOffice of the Comptroller of the Currency consider individual office information reportedon this form to be exempt from public disclosure under Section (b)(8) of the Freedomof Information Act [5 552(b)(8)] and will not voluntarily disclose such informationto the of Authorized OfficerTitleas of Name, title and telephone number of person to whom inquiries regarding thisreport may be directed:NameTitleArea Code/Telephone NumberName of reporting institutionCityStateZip CodeI,an authorized officer of the branch or agency named, hereby certify ontheday of,, that this Report had beenexamined by me and is true and complete to the best of my knowledge and BURDENP ublic reporting burden for this collection of information is estimated to average 10 hours per response,including the time for reviewing instructions, searching existing data sources, gathering and main-taining the data needed, and completing and reviewing the collection of information.

3 A Federal agencymay not conduct or sponsor, and an organization (or a person) is not required to respond to a collectionof information, unless it displays a currently valid OMB control number. Send comments regarding thisburden estimate or any other aspect of the collection of information, including suggestions for reducingthis burden, to Secretary, Board of Governors of the Federal Reserve System, 20th and C Streets, ,Washington, 20551; and to the Office of Management and Budget, Paperwork Reduction Project(7100 0213), Washington, be completed for the home Country and for the five other countries to which adjusted Exposure (as calculated for Column 4) is largest, and exceeds $20 all amounts in millions United States is not to be reported as one of the five countries.

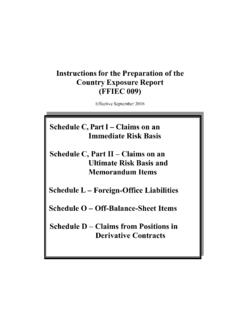

4 Do not Report any countries for which Column 4 is less than $20 incolumn (1) onborrowers witha head office orguarantor inanother Country (Column 2)Guarantees andother indirectclaims for whichcountry listed iscountry of headoffice orguarantor(Column 3)Totaladjusted claims(Column1 2 + 3)(Column 4)Claims onrelated of thereporter includedin column 4(Column 5)Total adjustedclaims onunrelatedforeign borrowerscolumns(Column 4 5)(Column 6)Commercial andstandby letters ofcredit and legallybinding loancommitments(Column 12)Total DirectClaims onForeignResidents(Column 1)Foreign public(Column 7)Unrelatedforeign banks(Column 8)Other unrelatedforeignresidents(Column 9)One year or less(Column 10)More than oneyear(Column 11)CountryNameCodeAdjustment for Guarantees andOther Indirect ClaimsAdjusted Claims on Foreign ResidentsDistribution of Claims on Unrelated Foreign ResidentsCommitmentsBy Sector of Borrower or GuarantorBy Remaining MaturityFive other CountryINSTRUCTIONS FOR THE PREPARATION OF THEC ountry Exposure Reportfor Branches and Agenciesof Foreign BanksFFIEC 019 General InstructionsScopeThis Report requires information on the distribution bycountry of claims on residents held and agencies (including their IBFs)

5 Of foreignbanks. Each reporting branch and agency must Report itsgross claims on: (1) residents of its home Country (including related offices of the reporting insti-tution) and (2) residents of the five other countries forwhich its adjusted Exposure ( , direct claims adjustedfor guarantees and other indirect claims) is largest, ifthe adjusted Exposure for the Country is also at least$20 are initially reported by the Country of directobligor and are then adjusted to reflect any guarantees ofparties in other countries. The Report covers all exten-sions of credit, as well as legally binding loan commit-ments and letters of credit.

6 The adjusted claims on unre-lated foreign residents are reported for each countryshown by type of borrower and by the Must ReportThis Report is required each quarter for each branch oragency of a foreign bank domiciled in the 50 states of theUnited States and the District of Columbia that has totaldirect claims (including those of its IBF) on foreignresidents, as defined later in these instructions, in excessof $30 million or more on the quarterly Report date. (Forpurposes of this Report , puerto Rican banks are notconsidered to be foreign banks; therefore, branchesand agencies of puerto Rican banks are not required tosubmit this Report .)

7 A separate Report is to be filed by each branch or agencythat meets the reporting criteria. However, branches andagencies of the same foreign parent bank that file theReport of Assets and Liabilities of Branches andAgencies of Foreign Banks ( FFIEC 002) on a consoli-dated basis may also file this Report on that of ReportThe Report is to be prepared quarterly, in ink or bytyping, and submitted as of the last business day of eachcalendar quarter. Computer printouts are also acceptableprovided they are identical in format to the Report of the form of submission, each copy must beindividually signed and attested.

8 Two copies of the reportshould be filed within 45 days of the as of date withthe Federal Reserve Bank in whose district the reportingbranch or agency is located. Each branch insured by theFederal Deposit Insurance Corporation should submit anadditional copy directly to the FDIC; and each Federallylicensed branch or agency should submit an additionalcopy directly to the Office of the Comptroller of amounts reported on this form should be valued dollars. Claims denominated in other currenciesshould be converted into dollars using the exchange rateprevailing on the Report reported on this form should be rounded to thenearest million Of Terms Used In The ReportUnited States ( )For purposes of the classification of the reporter s cus-tomers in this Report , the term United States covers theInstructions for Preparation of Reporting Form FFIEC 019 GEN-1 September 200050 states of the United States, the District of Columbia, puerto rico , and territories and possessions of the.

9 This is consistent with the definitions used for theFFIEC 002 Report and for the Treasury InternationalCapital (TIC) ResidentFor purposes of this Report , the terms foreign resident and resident include any individual, partner-ship, or corporation, and any government or politicalsubdivision, agency, or instrumentality thereof, locatedoutside the United States, including officesrelated to the reporting branch or agency. These termsalso include any international or regional organization(or subordinate or affiliated agency thereof) created bytreaty or convention between sovereign determining residence, reporting institutions shoulduse the customer s principal address.

10 However, claims ona representative of a foreign government that operates inan official capacity ( an embassy) should be consid-ered as direct claims on that foreign Country , regardlessof the place of residence of the representative. Claims oninternational or regional organizations should not beconsidered as claims on the Country in which such orga-nizations are located; instead, all such organizations areto be treated as a single Country (see list of countrynames and codes).Related OfficesThese include:(1) the head office of the reporting branch or agency andthe bank s branches and agencies that are locatedoutside the United States;(2) the foreign holding company of the bank;(3) other foreign banks (including their branches andagencies outside the United States) that are majority-owned by organizations described in either (i) or (ii)above, or by their majority-owned subsidiaries.