Transcription of Filing Instructions for Sales and Use Tax Accounts …

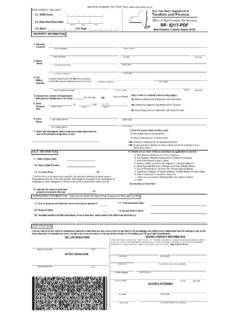

1 BOE-367-SUT (FRONT) REV. 4 (4-15) STATE OF CALIFORNIABOARD OF EQUALIZATIONFILING Instructions FOR Sales AND USE TAX Accounts ON A QUARTERLY AND PREPAYMENT Filing BASIS(The following due dates do not apply to taxpayers Filing on a special reporting basis.)Prepayments of tax are due as follows:FIRST, THIRD AND FOURTH CALENDAR QUARTERSThe first prepayment is due on or before the 24th day of the month following the first month of the second prepayment is due on or before the 24th day of the month following the second month of the prepayments in the first, third and fourth quarters must be an amount:1.

2 Not less than 90% of the tax liability for the month, or2. equal to one third (1/3) of the measure of tax liability reported for the corresponding quarterly period of the preceding year mul tiplied by the tax rate in effect when prepayment is made, provided you or your predecessor were in business during all of the CALENDAR QUARTERThe first prepayment is due on or before May 24th. This prepayment is for the month of April and must be an amount:1. not less than 90% of the tax liability for the month of April, or2.

3 Equal to one third (1/3) of the measure of tax liability reported for the corresponding quarterly period of the preceding year mul tiplied by the tax rate in effect when prepayment is made, provided you or your predecessor were in business during all of the second prepayment is due on or before JUNE 24th. This prepayment is for the period of May 1 through June 15 and must be an amount:1. equal to 135% of the tax liability for May, or2. equal to 90% of the tax liability for May plus 90% of the tax liability for the first 15 days of June, or3.

4 Not less than one half (1/2) of the measure of tax liability reported for the corresponding quarterly period of the preceding year multiplied by the tax rate in effect when prepayment is made, provided you or your predecessor were in business during all of the Due Date for Sales and Use Tax Prepayments and ReturnsQUARTERLY OR QUARTERLY PREPAYMENT REPORTING BASISREPORTING PERIODPERIOD ENDING DATEDUE DATE1ST QUARTER (JANUARY MARCH)FIRST PREPAYMENT1/31/YY2/24/YYSECOND PREPAYMENTLast day of February3/24/YYQUARTERLY RETURN3/31/YY4/30/YY2ND QUARTER (APRIL JUNE)FIRST PREPAYMENT4/30/YY5/24/YYSECOND PREPAYMENT6/15/YY6/24/YYQUARTERLY RETURN6/30/YY7/31/YY3RD QUARTER (JULY SEPTEMBER)FIRST PREPAYMENT7/31/YY8/24/YYSECOND PREPAYMENT8/31/YY9/24/YYQUARTERLY RETURN9/30/YY10/31/YY4TH QUARTER (OCTOBER DECEMBER)FIRST PREPAYMENT10/31/YY11/24/YYSECOND PREPAYMENT11/30/YY12/24/YYQUARTERLY RETURN12/31/YY1/31/YY(over)BOE-367-SUT (BACK) REV.

5 4 (4-15) Filing Due Date for Sales and Use Tax Accountson a Monthly, Regular Quarterly, Yearly*, and Fiscal Yearly BasisMONTHLY OR REGULAR QUARTERLY REPORTING BASISREPORTING PERIODPERIOD ENDING DATEDUE DATEJANUARY1/31/YYLast day of FebruaryFEBRUARYLast day of February3/31/YYMARCH3/31/YY4/30/YYFIRST QUARTER RETURN3/31/YY4/30/YYAPRIL4/30/YY5/31/YYM AY5/31/YY6/30/YYJUNE6/30/YY7/31/YYSECOND QUARTER RETURN6/30/YY7/31/YYJULY7/31/YY8/31/YYAU GUST8/31/YY9/30/YYSEPTEMBER9/30/YY10/31/ YYTHIRD QUARTER RETURN9/30/YY10/31/YYOCTOBER10/31/YY11/3 0/YYNOVEMBER11/30/YY12/31/YYDECEMBER12/3 1/YY1/31/YYFOURTH QUARTER

6 RETURN12/31/YY1/31/YYYEARLY REPORTING BASIS*REPORTING PERIODJANUARY DECEMBERPERIOD ENDING DATE12/31/YYDUE DATE1/31/YY* Includes individuals or unregistered service business who file BOE 401 DS, Use Tax ReturnFISCAL YEARLY REPORTING BASISREPORTING PERIODJULY JUNEPERIOD ENDING DATE6/30/YYDUE DATE7/31/YYFiling Due Date for Qualified Purchasers and Consumer Use Tax Accounts on a Yearly BasisYEARLY REPORTING BASISREPORTING PERIODJANUARY DECEMBERPERIOD ENDING DATE12/31/YYDUE DATE4/15/YYRemember, you must file a tax return even if you did not make any Sales or purchases subject to use tax during the period.