Transcription of Financial Institutions - Reserve Bank of India

1 Financial InstitutionsChapter role of Financial Institutions has beenunder discussion in recent years. Althoughsetting up of the development financeinstitutions (DFIs) was an important feature inthe overall development of the Financial system;with the emergence of the capital market as animportant source of finance in the late 1980sand early 1990s, and the renewed role of banksin term-financing, DFIs have been increasinglyexposed to greater competition. Liberalisation ofthe Financial sector, with its associated processesof decontrol, deregulation and globalisation, hasled to increased competition for financialintermediaries across different segments. Thecompetitive pressures have come into thebusiness domain of FIs on account of the entryof new players. Moreover, with the initiation offinancial sector reforms in the early 1990s,access of FIs to assured sources of long-duration/concessional funds from theGovernment, particularly SLR bonds that weresubscribed to by banks and insurancecompanies, has been gradually phased out.

2 FIsat present are overwhelmingly dependent onmarket borrowings - wholesale and retail,domestic and foreign - for their resourcemobilisation. As a consequence, DFIs arerequired to raise funds from the capital the removal of administrative controls onthe interest rate structure, it has becomeincreasingly difficult for DFIs to raise long-termfunds. This in turn has affected their ability tooffer competitive rates to their from the competitive pressure forraising resources, the role of DFIs as an exclusivesource of development finance has diminished asother intermediaries especially banks have alsoentered into long-term and high risk projectfinancing. Therefore, FIs are increasingly facingcompetition not only in terms of raising resourcesbut also in the deployment of funds.

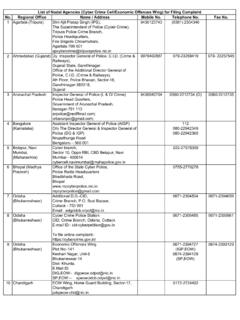

3 In short,the change in the operating environment coupledwith the legacy of high non-performing assets hasled to serious Financial stress on the term lendingfinancial Financial Institutions in India canbe broadly classified into three categories, viz.,All- India Financial Institutions (AIFIs), State levelinstitutions and other Institutions (Chart ).On the basis of functions and activities, the AIFI shave four segments; (i)all- India developmentbanks, (ii) specialised Financial Institutions ,(iii) investment Institutions and (iv) refinanceinstitutions. The State level Institutions compriseState Financial Corporations (SFCs) and StateIndustrial Development Corporations (SIDCs).Other Financial Institutions include ExportCredit Guarantee Corporation of India (ECGC)Ltd.

4 And Deposit Insurance and CreditGuarantee Corporation (DICGC). Out of 17 AIFIs,the Reserve Bank regulates and supervises onlynine. Out of these nine, six FIs, viz., IndustrialDevelopment Bank of India (IDBI), IndustrialFinance Corporation of India (IFCI) Ltd.,Industrial Investment Bank of India (IIBI) Ltd.,Tourism Finance Corporation of India (TFCI)Ltd., Infrastructure Development FinanceCompany (IDFC) Ltd. and EXIM Bank are TermLending Institutions , while the remaining threeFIs, viz., National Bank for Agriculture and RuralDevelopment (NABARD), National Housing Bank(NHB) and Small Industries Development Bankof India (SIDBI) are termed as RefinanceInstitutions for regulatory and Initiatives for Reserve Bank regulates andsupervises nine AIFIs1 under Section 5 of theReserve Bank of India Act, 1934.

5 The FIs arecurrently on the transition path as recommendedby the Narasimham Committee II, by makingendeavours, to convert themselves either into abank or NBFC. The focus of the policy initiativesby the Reserve Bank and the Government hasbeen on Financial as well as organisationalrestructuring to facilitate their transition intouniversal banks. As a corollary, the Reserve1 IFCI Limited, IDBI, EXIM Bank, IIBI Limited, TFCI Limited, IDFC Limited, NABARD, NHB and : Organisational Structure of Financial Institutions *The erstwhile Industrial Reconstruction Bank of India (IRBI), established in 1985 under the IRBI Act, 1984, wasrenamed as Industrial Investment Bank of India Ltd. (IIBI) with effect from March 27, 1997. ** IVCF-IFCI Venture Capital Funds Ltd. # SIDBI is termed as the Refinancing institution , for regulatory and supervisory purpose.

6 Notes: 1. Figures in brackets under respective Institutions indicate the year of Figures in the brackets under SFCs/SIDCs indicate the number of Institutions in that IDBI became IDBI Ltd. on October 1, Financial InstitutionsOtherInstitutionsState LevelInstitutionsAll IndiaDevelopmentBanksIDBI (1964),SIDBI (1990)#,IIBI* (1997),IFCI (1948)IDFC (1997)SpecialisedFinancialInstitutionsEX IM Bank(1982),IVCF** (formerlyRCTC) (1988),ICICI Venture(formerly TDICI)(1988),TFCI (1989),InvestmentInstitutionsUTI (1964),LIC (1956),GIC &subsidiaries(1972)RefinanceInstitutions NABARD (1982),NHB (1980)SFCs(18)SIDCs(28)ECGC(1957)DICGC(1 962)All-IndiaFinancialInstitutionsBank has been harmonising its various policymeasures for banks and FIs in such a mannerthat FIs, on becoming banks, are in a positionto fully integrate themselves into the bankingsystem.

7 The Reserve Bank initiated variousregulatory and supervisory initiatives includingfacilitating organisational restructuring of theFIs during 2003-04. Policy initiatives for selectAIFIs laid emphasis on asset classification andprovisioning, disclosures, consolidatedaccounting and supervision, infrastructurefinancing and measures to facilitate examine the supervisory andregulatory issues relating to term lending andrefinancing Institutions and improve the flow ofresources to them, the Reserve Bank announcedthe setting up of a Working Group onDevelopment Financial Institutions whichsubmitted its Report in May 2004 (Box ).Regulatory InitiativesAsset Classification and Provisioning were advised that with effect from end-March 2006, an asset should be classified as anon-performing asset (NPA) if the interest and/or instalment of principal remain overdue formore than 90 days.

8 As regards the additionalprovision arising as on March 31, 2006 onaccount of the modification in the norms, FIswould have the option to phase out the requiredprovisioning over a period of three yearsbeginning from the year ending March 31, 2006,subject to at least one fourth of the additionalrequired provision being made in each Norms for Classification of DoubtfulAssets of a view to moving closer tointernational best practices and ensuring127 Financial Institutions128 Report on Trend and Progress of Banking in India , 2003-04In order to address the regulatory and supervisory issuesand enhance the flow of credit, the Reserve Bank of India inits mid-term Review of monetary and credit policy 2003-04announced the setting up a Working Group on DevelopmentFinancial Institutions (Chairman: N.)

9 Sadasivan)2. The broadobjectives of the Working Group were to review theexperience and prospects of DFIs for transformation intobanks and to assess the Financial position and recommenda regulatory framework for the existing Working Group observed that in the pre-reform period,DFIs faced little competition in the area of long-term financeas funds were available to them at cheaper rates frommultilateral and bilateral agencies duly guaranteed by theGovernment. The reforms in the Financial sector havechanged the operational environment for the DFIs. Alongwith the changed operating environment for banks in aglobalised scenario, the regulatory framework for FIs hasundergone a significant change. While on the supply side,the access of DFIs to low-cost funds has been withdrawn,on the demand front, they have to compete with banks forlong-term lending.

10 Out of nine select all India financialinstitutions being regulated and supervised by the ReserveBank at present, three Institutions , viz., NABARD, NHBand SIDBI extend indirect Financial assistance by way ofrefinance. The Financial health of these three institutionsis sound as their exposures are to other financialintermediaries, which in certain cases are also supportedby State Government guarantees. Of the remaining sixinstitutions, two niche players, viz., EXIM Bank and IDFCLtd. are also healthy. The remaining four Institutions thathave been operating as providers of direct assistance, areall in poor Financial health. The major recommendationsby the Group are:lThe role of DFIs as exclusive providers of developmentfinance has diminished during the 1990s with theemergence of a well-diversified banking systemoperating efficiently and acquiring skills in extendinglong-term finance.