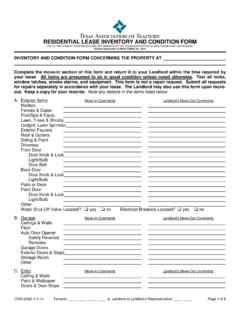

Transcription of Financial Ratio Formulas

1 Financial Ratio Formulas Prepared by Pamela Peterson Drake 1. Operating cycle InventoryInventoryNumber of days of inventory Average day's cost of goods soldCost of goods sold / 365== Accounts receivableAccounts receivableNumber of days of receivables Average day's sales on creditSales on credit / 365== Accounts payableAccounts payableNumber of days of payables Average day's purchasesPurchases / 365== Note: Cost ofEnding BeginningPurchases = goods sold inventory inventory ++ Number of days Number of daysOperating cycle of inventoryof receivables=+ purchases ofdaysofNumber sreceivable ofdaysofNumber inventory ofdays ofNumber cycle operatingNet += 2.

2 Liquidity sliabilitieCurrent assetsCurrent ratioCurrent = sliabilitieCurrent inventory - assetsCurrent Ratio Quick= SalessliabilitieCurrent - assetsCurrent Ratio sales to capital workingNet = 3. Profitability Gross incomeGross profit margin Sales= Operating incomeOperating profit margin = Sales Financial Ratio formula sheet, prepared by Pamela Peterson-Drake 1 Net incomeNet profit margin Sales= 4. Activity Inventorysold goods ofCost turnover inventory = receivable Accountscredit on Sales turnover receivable Accounts= assets TotalSales turnover asset Total= assets FixedSales turnover asset Fixed= 5.

3 Financial leverage assets Totaldebt Total Ratio assets todebt Total= assets Totaldebt term-Long Ratio assets todebt term-Long= equity rs'shareholde Totaldebt Total ratioequity todebt Total= Total assetsEquity multiplier = Shareholders' equity Interesttaxes andinterest before Earnings Ratio coverage-interest-Times= payment lease Interest payment lease taxes andinterest before Earnings Ratio coverage charge- Fixed++= Financial Ratio formula sheet, prepared by Pamela Peterson-Drake 2 6. Shareholder ratios goutstandin shares ofNumber rsshareholde to available incomeNet shareper Earnings= Dividends paid to shareholdersDividends per share Number of shares outstanding= DividendsDividend payout Ratio = Earnings Market price per sharePrice-earnings Ratio = Earnings per share 7.

4 Return ratios Operating incomeBasic earning power Ratio = Operating return on assets = Total assets Net incomeReturn on assets = Total assets Net incomeReturn on equity = Shareholders' equity Financial Ratio formula sheet, prepared by Pamela Peterson-Drake 3