Transcription of Flexible Spending Accounts (FSA) - benefits you …

1 your login provides secure access to view your HSA What happens if you die account ; request account statement reprints, additional In the event of your death, your spouse will own your checks, and debit cards; print forms; and use the ACS/ HSA and can continue to use it. If you are not married, Mellon HSA Solution SM. knowledge base. upon your death, the account can no longer function as an HSA, but the funds become a taxable part of your You will also receive monthly account statements estate. You may bequeath the funds through your will.

2 Showing your current and year-to-date withdrawals, deposits, and investment earnings. If you have no Flexible Spending balance in your account , you will receive quarterly statements. For additional support or information, Accounts (FSA). contact Mellon's HSA Solution Support Team at 1- By participating in the FSAs, you can pay for eligible 877-472-4200 or go to and healthcare and dependent care expenses on a tax-free choose the link for the HSA. basis. Investing your HSA. You may participate in one or both types of Flexible There is no minimum balance required to earn interest.

3 Spending account (FSA) plans, depending on the The interest rate is the same as for Mellon's preferred medical plan you choose: money market Accounts . Interest is applied to daily balances in the account , compounded monthly and H. ealth Care FSA There are two types of Health credited on the second banking day following the end Care FSAs. your medical plan choice determines of the month. which FSA you may choose: The standard FSA is available if you select Plan A. When your account reaches at least $2,000, you can for medical coverage.

4 You may use it to pay eligible invest it in the Dreyfus Corp. family of funds. medical, prescription drug, dental, vision, mental health, or substance abuse treatment expenses Portability of your account incurred by you and your qualified dependents An HSA is completely portable. You can take it with you The limited scope FSA is available if you select from one workplace to another and into your retirement Plan B for medical coverage. You may use it to pay years. You can choose which institution maintains your eligible dental and vision expenses, as well as HSA and how you would like the funds invested.

5 Eligible maintenance medication costs. After you satisfy your medical plan's annual deductible, you You can also transfer an HSA balance from another may also use it to pay medical expenses. administrator into your Flowserve HSA. To transfer your balance from another HSA into your Flowserve HSA, call D. ependent Care FSA Regardless of which medical Mellon HSA Solutions at 1-877-472-4200. plan you choose, or if you waive medical coverage, you may participate in this FSA. It covers expenses you incur to provide day care for a qualified dependent.

6 (Qualified dependents are described on page 24.). How FSAs and HSAs Affect Social Security benefits Because FSA and HSA contributions reduce your taxable pay, you save money in FICA taxes, as well as federal (and, in some cases, state) income taxes. However, FSA and HSA contributions also lower the earnings that are reported to the Social Security Administration for 20 purposes of calculating your Social Security benefit. Therefore, your future Social Security benefits may be slightly reduced if you participate in an FSA or HSA.

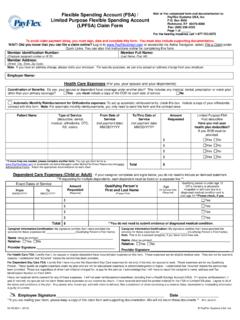

7 How the FSAs work You may not transfer money between the Health Care 1. You decide how much money you want to contribute to and Dependent Care FSAs. The Health Care FSA may a Health Care or Dependent Care Flexible Spending not be used to reimburse dependent care expenses, and account for the plan year up to $5,000 for each. the Dependent Care FSA may not be used to reimburse 2. your contributions are deducted from your paycheck healthcare expenses. each pay period, before any federal or FICA taxes are If you have any money remaining in either FSA at the end withheld.

8 Of the year, you forfeit it. You have until March 31, 2009, to 3. When you incur an eligible expense, you typically pay submit claims for eligible expenses you incur during 2008. the healthcare or dependent care provider and then file You cannot begin, stop, or change the amount of your a claim for reimbursement from your may be FSA contributions during the calendar year unless reimbursed for some healthcare expenses automatically, you experience a qualified change in status, such as explained on page 22. as marriage, divorce, or birth/adoption of a child (as 4.)

9 Money from your FSA is paid back to you tax-free to explained on page 9). reimburse your expenses. your potential savings with a Health Care FSA. Restrictions on FSAs The amount of money you save in taxes by using an FSA. In exchange for the tax advantages FSAs offer, the IRS will depend on your individual tax circumstances. The table places certain restrictions for both the Health Care and below shows the tax savings for a hypothetical couple. Dependent Care FSAs: You may only use the money in your FSAs to reimburse Matt earns $35,000 a year.

10 He is married with two children. expenses that you have incurred during the plan year. His wife, Jill, also earns $35,000 a year. Matt deposits $1,500 in the Health Care FSA to help cover his family's healthcare costs. Here's how Matt saves using the FSA. Without FSAs With FSAs Annual household earnings $70,000 $70,000. Health Care FSA deposits $0 ($1,500). 2008 adjusted gross income $70,000 $68,500. 2008 estimated federal income tax1 ($6,072) ($5,848). Estimated FICA tax 2 ($5,355) ($5,240). Healthcare expenses ($1,500) ($1,500).