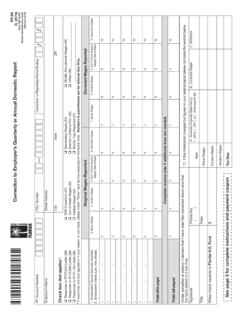

Transcription of Form W-2c (Rev. February 2009) - IRS tax forms

1 Attention: This form is provided for informational purposes only. Copy A appears in red, similar to the official IRS form . Do not file copy A downloaded from this website with the SSA. The official printed version of this IRS form is scannable, but the online version of it, printed from this website, is not. A penalty may be imposed for filing forms that can t be scanned. See the penalties section in the current General Instructions for forms W-2 and W-3 for more information. To order official IRS forms , call 1-800-TAX- form (1-800-829-3676) or Order Information Returns and Employer Returns Online, and we ll mail you the scannable forms and other products. You may file forms W-2 and W-3 electronically on the SSA s website at Employer Reporting Instructions & Information. You can create fill-in versions of forms W-2 and W-3 for filing with SSA. You may also print out copies for filing with state or local governments, distribution to your employees, and for your records. See IRS Publications 1141, 1167, 1179 and other IRS resources for information about printing these tax forms .

2 RetirementplanThird-partysick payStatutoryemployeeEmployee s first name and initial13 Copy A For Social Security AdministrationDepartment of the TreasuryInternal Revenue ServiceFormCat. No. 61437DW-2cCorrected Wage and Tax Statement44444 OMB No. 1545-0008 For Official Use Only 162 Allocated tips78 Wages, tips, other compensationFederal income tax withheldSocial security tax withheldSocial security wages43 Medicare wages and tipsSocial security tips5 Medicare tax withheldEmployer s name, address, and ZIP codeaTax year/ form correctedcEmployee s previously reported namegRetirementplanThird-partysick payStatutoryemployeePreviously reportedCorrect informationPreviously reportedCorrect informationFor Privacy Act and Paperwork Reduction Act Notice, see separate instructions.(Rev. 2- 2009) Complete boxes f and/or g only if incorrect on form previously filed17 Wages, tips, other compensationSocial security wages3 Medicare wages and tipsSocial security tips562 Allocated tips8 Federal income tax withheldSocial security tax withheld4 Medicare tax withheld13 Note: Only complete money fields that are being corrected(exception: for corrections involving MQGE, see the Instructionsfor forms W-2c and W-3c, boxes 5 and 6).

3 Employee s previously reported SSNfDependent care benefits910 Advance EIC payment9 Advance EIC paymentDependent care benefits10 See instructions for box 121112aNonqualified plans11 Nonqualified plansSee instructions for box 1212aCodeCode12c12cCodeCode12b12bCodeCod e12d12dCodeCode15 State wages, tips, wages, tips, wages, tips, wages, tips, income tax1717 State income tax17 State income taxState income tax17 Local wages, tips, wages, tips, wages, tips, wages, tips, income tax1919 Local income tax19 Local income taxLocal income tax19 Locality name2020 Locality name20 Locality nameLocality name20 State15 State15 State15 StateState Correction InformationLocality Correction Information14 Other (see instructions)14 Other (see instructions) Employer s state ID numberEmployer s state ID numberEmployer s state ID numberEmployer s state ID numberhLast nameEmployee s address and ZIP codeiDO NOT CUT, FOLD, OR STAPLE THIS FORMP reviously reportedCorrect informationPreviously reportedCorrect reportedCorrect informationPreviously reportedCorrect informationEmployer s Federal EINbeCorrected SSN and/or name (Check this box and complete boxes f and/org if incorrect on form previously filed.)

4 Employee s correct SSNd/ W-2 Comp Specialist: This form needs to have a 2/3" head margin when the PDF is 1 State, City, or Local Tax DepartmentDepartment of the TreasuryInternal Revenue ServiceFormW-2cCorrected Wage and Tax Statement(Rev. 2- 2009) RetirementplanThird-partysick payStatutoryemployeeEmployee s first name and initial1344444 OMB No. 1545-0008 For Official Use Only 162 Allocated tips78 Wages, tips, other compensationFederal income tax withheldSocial security tax withheldSocial security wages43 Medicare wages and tipsSocial security tips5 Medicare tax withheldEmployer s name, address, and ZIP codeaTax year/ form correctedcEmployee s previously reported namegRetirementplanThird-partysick payStatutoryemployeePreviously reportedCorrect informationPreviously reportedCorrect informationComplete boxes f and/or g only if incorrect on form previously filed17 Wages, tips, other compensationSocial security wages3 Medicare wages and tipsSocial security tips562 Allocated tips8 Federal income tax withheldSocial security tax withheld4 Medicare tax withheld13 Note: Only complete money fields that are being corrected(exception: for corrections involving MQGE, see the Instructionsfor forms W-2c and W-3c, boxes 5 and 6).

5 Employee s previously reported SSNfDependent care benefits910 Advance EIC payment9 Advance EIC paymentDependent care benefits10 See instructions for box 121112aNonqualified plans11 Nonqualified plansSee instructions for box 1212aCodeCode12c12cCodeCode12b12bCodeCod e12d12dCodeCode15 State wages, tips, wages, tips, wages, tips, wages, tips, income tax1717 State income tax17 State income taxState income tax17 Local wages, tips, wages, tips, wages, tips, wages, tips, income tax1919 Local income tax19 Local income taxLocal income tax19 Locality name2020 Locality name20 Locality nameLocality name20 State15 State15 State15 StateState Correction InformationLocality Correction Information14 Other (see instructions)14 Other (see instructions) Employer s state ID numberEmployer s state ID numberEmployer s state ID numberEmployer s state ID numberhLast nameEmployee s address and ZIP codeiPreviously reportedCorrect informationPreviously reportedCorrect reportedCorrect informationPreviously reportedCorrect informationEmployer s Federal EINbeCorrected SSN and/or name (Check this box and complete boxes f and/org if incorrect on form previously filed.)

6 Employee s correct SSNd/ W-2 Safe, accurate,FAST! UseVisit the IRS websiteat B To Be Filed with Employee s FEDERAL Tax ReturnDepartment of the TreasuryInternal Revenue ServiceFormW-2cCorrected Wage and Tax Statement(Rev. 2- 2009) RetirementplanThird-partysick payStatutoryemployeeEmployee s first name and initial1344444 OMB No. 1545-0008 For Official Use Only 162 Allocated tips78 Wages, tips, other compensationFederal income tax withheldSocial security tax withheldSocial security wages43 Medicare wages and tipsSocial security tips5 Medicare tax withheldEmployer s name, address, and ZIP codeaTax year/ form correctedcEmployee s previously reported namegRetirementplanThird-partysick payStatutoryemployeePreviously reportedCorrect informationPreviously reportedCorrect informationComplete boxes f and/or g only if incorrect on form previously filed17 Wages, tips, other compensationSocial security wages3 Medicare wages and tipsSocial security tips562 Allocated tips8 Federal income tax withheldSocial security tax withheld4 Medicare tax withheld13 Note: Only complete money fields that are being corrected(exception: for corrections involving MQGE, see the Instructionsfor forms W-2c and W-3c, boxes 5 and 6).

7 Employee s previously reported SSNfDependent care benefits910 Advance EIC payment9 Advance EIC paymentDependent care benefits10 See instructions for box 121112aNonqualified plans11 Nonqualified plansSee instructions for box 1212aCodeCode12c12cCodeCode12b12bCodeCod e12d12dCodeCode15 State wages, tips, wages, tips, wages, tips, wages, tips, income tax1717 State income tax17 State income taxState income tax17 Local wages, tips, wages, tips, wages, tips, wages, tips, income tax1919 Local income tax19 Local income taxLocal income tax19 Locality name2020 Locality name20 Locality nameLocality name20 State15 State15 State15 StateState Correction InformationLocality Correction Information14 Other (see instructions)14 Other (see instructions) Employer s state ID numberEmployer s state ID numberEmployer s state ID numberEmployer s state ID numberhLast nameEmployee s address and ZIP codeiPreviously reportedCorrect informationPreviously reportedCorrect reportedCorrect informationPreviously reportedCorrect informationEmployer s Federal EINbeCorrected SSN and/or name (Check this box and complete boxes f and/org if incorrect on form previously filed.)

8 Employee s correct SSNd/ W-2 Safe, accurate,FAST! UseVisit the IRS websiteat C For EMPLOYEE s RECORDSD epartment of the TreasuryInternal Revenue ServiceFormW-2cCorrected Wage and Tax Statement(Rev. 2- 2009) RetirementplanThird-partysick payStatutoryemployeeEmployee s first name and initial1344444 OMB No. 1545-0008 For Official Use Only 162 Allocated tips78 Wages, tips, other compensationFederal income tax withheldSocial security tax withheldSocial security wages43 Medicare wages and tipsSocial security tips5 Medicare tax withheldEmployer s name, address, and ZIP codeaTax year/ form correctedcEmployee s previously reported namegRetirementplanThird-partysick payStatutoryemployeePreviously reportedCorrect informationPreviously reportedCorrect informationComplete boxes f and/or g only if incorrect on form previously filed17 Wages, tips, other compensationSocial security wages3 Medicare wages and tipsSocial security tips562 Allocated tips8 Federal income tax withheldSocial security tax withheld4 Medicare tax withheld13 Note: Only complete money fields that are being corrected(exception: for corrections involving MQGE, see the Instructionsfor forms W-2c and W-3c, boxes 5 and 6).

9 Employee s previously reported SSNfDependent care benefits910 Advance EIC payment9 Advance EIC paymentDependent care benefits10 See instructions for box 121112aNonqualified plans11 Nonqualified plansSee instructions for box 1212aCodeCode12c12cCodeCode12b12bCodeCod e12d12dCodeCode15 State wages, tips, wages, tips, wages, tips, wages, tips, income tax1717 State income tax17 State income taxState income tax17 Local wages, tips, wages, tips, wages, tips, wages, tips, income tax1919 Local income tax19 Local income taxLocal income tax19 Locality name2020 Locality name20 Locality nameLocality name20 State15 State15 State15 StateState Correction InformationLocality Correction Information14 Other (see instructions)14 Other (see instructions) Employer s state ID numberEmployer s state ID numberEmployer s state ID numberEmployer s state ID numberhLast nameEmployee s address and ZIP codeiPreviously reportedCorrect informationPreviously reportedCorrect reportedCorrect informationPreviously reportedCorrect informationEmployer s Federal EINbeCorrected SSN and/or name (Check this box and complete boxes f and/org if incorrect on form previously filed.)

10 Employee s correct SSNd/ W-2 Notice to EmployeeThis is a corrected form W-2, Wage and Tax Statement,(or form W-2AS, W-2CM, W-2GU, W-2VI or W-2c) forthe tax year shown in box c. If you have filed an incometax return for the year shown, you may have to file anamended return. Compare amounts on this form withthose reported on your income tax return. If thecorrected amounts change your income tax, fileForm 1040X, Amended Individual Income TaxReturn, with Copy B of this form W-2c to amend thereturn you already you have not filed your return for the year shown inbox c, attach Copy B of the original form W-2 youreceived from your employer and Copy B of this FormW-2c to your return when you file more information, contact your nearest InternalRevenue Service office. Employees in American Samoa,Commonwealth of the Northern Mariana Islands, Guam,or the Virgin Islands should contact their localtaxing authority for more 2 To Be Filed with Employee s State, City, or Local Income Tax ReturnDepartment of the TreasuryInternal Revenue ServiceFormW-2cCorrected Wage and Tax Statement(Rev.)