Transcription of Global Equity Model (GEM) Handbook - Alacra

1 Global Equity RISK Model Handbook . BARRA makes no warranty, express or implied, regarding the Global Equity Risk Model or any results to be obtained from the use of the Global Equity Risk Model . BARRA EXPRESSLY DISCLAIMS ALL WARRANTIES, EXPRESS OR IMPLIED, REGARDING. THE Global Equity RISK Model , INCLUDING BUT NOT LIMITED TO ALL IMPLIED WARRANTIES OF. MERCHANTABILITY AND FITNESS FOR A PARTICULAR PURPOSE OR USE OR THEIR EQUIVALENTS UNDER THE LAWS. OF ANY JURISDICTION. Although BARRA intends to obtain information and data from sources it considers to be reasonably reliable, the accuracy and completeness of such information and data are not guaranteed and BARRA will not be subject to liability for any errors or omissions therein.

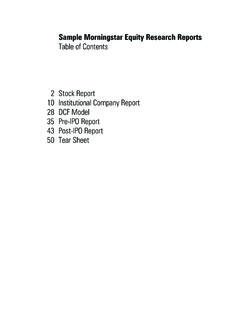

2 Accordingly, such information and data, the Global Equity Risk Model , and their output are not warranted to be free from error. BARRA does not warrant that the Global Equity Risk Model will be free from unauthorized hidden programs introduced into the Global Equity Risk Model without BARRA's knowledge. Copyright BARRA, Inc. 1998. All rights reserved. 0021 O 09/92 RV05/98. Contents About BARRA .. 1. A pioneer in risk management .. 1. The Global Equity Model .. 2. Introduction .. 3. In this Handbook .. 3. Further references .. 4. Books .. 4. Articles .. 4. 1. Risk and Return .. 5. Some definitions .. 5.

3 Risk measurement .. 6. Return decomposition .. 7. 2. The Evolution of Risk Models .. 11. Systematic return and diversification ..11. The Capital Asset Pricing Model .. 12. The Arbitrage Pricing Theory.. 13. What are multiple-factor models? .. 13. How do MFMs work? .. 14. Advantages of MFMs .. 15. Model mathematics .. 15. Risk prediction with MFMs .. 17. i 3. The Global Equity Model .. 21. Model development .. 21. Risk indices .. 22. Local markets .. 23. Industries.. 26. Currencies .. 28. 4. Model Estimation .. 31. An overview .. 31. Risk index selection and standardization .. 34. Industry definition.

4 35. Factor return estimation .. 35. Covariance matrix calculation .. 36. Exponential weighting .. 36. Computing market volatility: GARCH models .. 37. Countries in GEM .. 38. Currency risk estimation.. 39. Updating the Model .. 39. 5. Portfolio Management .. 41. Portfolio construction .. 41. Passive management .. 42. Active management .. 42. Model applications .. 44. 6. Global Equity Case Studies .. 47. Case 1: Analyzing an active portfolio .. 47. Case 2: Matching the MSEAFE .. 50. Case 3: Creating and optimizing a tilt fund .. 51. ii Global Equity Model Appendix A: Risk Index Formulas .. 53. Size.

5 53. Success .. 53. Value .. 54. Variability in Markets (VIM) .. 55. Appendix B: GEM-MSCI Risk Index Factor Returns .. 57. Appendix C: GEM-MSCI Industry Factor Returns .. 59. Appendix D: GEM-MSCI Country Factor Returns .. 73. Appendix E: GEM-MSCI Specific Risk Summary .. 91. Appendix F: GEM-FT Risk Index Factor Returns .. 93. Appendix G: GEM-FT Industry Factor Returns .. 95. Appendix H: GEM-FT Country Factor Returns .. 109. Appendix I: GEM-FT Specific Risk Summary .. 129. Glossary .. 131. Index .. 157. Contributors .. 160. Contents iii iv Global Equity Model About BARRA. In recent years, the international investment environment has expe- rienced major changes: industries are more globalized and local mar- kets are more integrated.

6 The Global marketplace includes more and more players. International portfolios offer Global investors opportu- nities for diversification and the potential for exceptional return. BARRA has responded to this increased institutional interest with the development of the Global Equity Model . A pioneer in risk management As the leading provider of Global investment decision tools, BARRA. provides quantitative products and services for Global investment managers and financial institutions. Since our founding in 1975, BARRA has been a leader in modern financial research and tech- niques. Initially, our services focused on risk analysis in Equity markets.

7 Our Equity Model set a standard of accuracy that BARRA continues to follow. BARRA uses the best risk predictors available to develop risk prediction models. In turn, these models are the basis of soft- ware products designed to enhance portfolio performance through risk analysis, portfolio optimization, returns forecasting, transaction cost analysis, and historical performance attribution. In 1979 BARRA expanded into the fixed income area with the release of our bond valuation and risk models. In the late 1980s BARRA developed the Global Equity Model (GEM), designed to analyze international portfolios of Equity and currency holdings.

8 BARRA offices are located in all major financial regions. By 1998 our clients comprised over 1200 financial institutions worldwide who rely on BARRA's investment technology and consulting services to strengthen their financial analysis and investment decision-making. 1. The Global Equity Model As BARRA has expanded internationally, we have developed Equity models for the major asset markets throughout the world. Initially released in January 1989, BARRA's Global Equity Model extends the conceptual principles of its single-country counterparts to the inter- national Equity market. A multiple-factor Model , GEM captures the effects of common fac- tors (such as local markets and industries) as well as currencies on portfolio return.

9 The Model partitions return into its various compo- nents so investors can pinpoint sources of return and adjust their portfolios accordingly. There are two versions of GEM MSCI and FT. The MSCI version uses the local markets and industry classifications of the Morgan Stanley Capital International World Index while the FT version uses local markets and industries listed in the Financial Times-Actuaries World Index. BARRA delivers the Global Equity Model via the Windows-based Aegis System . Applications within Aegis include risk analysis and portfolio optimization, to allow BARRA clients to make better investment choices.

10 2 Global Equity Model Introduction In this Handbook This Handbook first outlines the theoretical background of the Global Equity Model and then describes the Model in greater detail. It is designed to be a technical reference manual for the Model . A discussion of risk and return is the starting point for explaining the Model and its capabilities. Chapter 1. Risk and Return defines important measures of risk and outlines the decomposition of return. Multiple-factor models represent a breakthrough in financial theory and provide a framework for understanding GEM. Chapter 2. The Evolution of Risk Models catalogues the theoretical advances leading to the development of multiple-factor models and explains how these models work.