Transcription of Guide to Completing 2018 Pay and File Tax Returns

1 Guide to Completing 2018 Tax ReturnsPage 1 Guide to Completing2018 Pay & File Self-Assessment Returns RPC011007_EN_WB_L_1 Guide to Completing 2018 Tax ReturnsPage 2 The information in this document is provided as a Guide only and is not professional advice, including legal advice. It should not be assumed that the guidance is comprehensive or that it provides a definitive answer in every to Completing 2018 Tax ReturnsPage 3 ContentsPage PART ONEWho is this Guide for? 4 About this Guide 4 Expression of Doubt 5 Accessibility 6 Revenue contact details 6 Revenue Online Services (ROS) 6 Mandatory e-filing 7 General guidance on Completing a tax return 8 Introduction to self-assessment 8 Panel PART TWO A Personal Details 11 B Income from Trades, Professions or Vocations 14 C Irish Rental Income 23 D Income from Irish Employments, Offices (Including Directorships), Pensions, etc.

2 Income from Foreign Offices or Employments attributable to the Duties of those Offices and Employments Exercised in the State 25 E Foreign Income 30 F Income from Fees, Covenants, Distributions, etc. 34 G Exempt Income 36 H Annual Payments, Charges and Interest Paid 38 I Claim for Tax Credits, Allowances, Reliefs and Health Expenses 44 J High-Income Individuals: Limitation on Use of Reliefs 53 K Capital Acquisitions in 2018 53 L Capital Gains in 2018 54 M Chargeable Assets Acquired in 2018 55 N Property Based Incentives on which Relief is claimed in 2018 56 O Self Assessment made under Chapter 4 of Part 41A 58 PART THREE Income Tax Calculation Guide 2018 59 Index 65 Guide to Completing 2018 Tax ReturnsPage 4 Who is this Guide for?

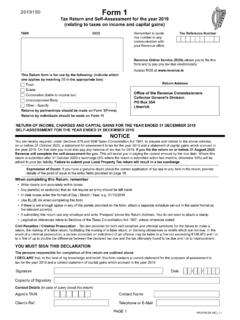

3 The main purpose of this Guide is to assist individuals who are taxed under the self-assessment system to complete their 2018 Tax Return the Form 11. For 2018, self-assessment taxpayers are required to complete the full Form 11 (either in paper format or via ROS (see page 6 of this Guide ), unless all of the information relevant to them is contained in the shorter version Form you are not obliged to file your return of income (Form 11) electronically you will have received a paper Form 11S is the shorter version of the Form 11 Income Tax Return for self-assessed individuals. It is an extract of the main personal Tax Return form (Form 11). If however after reading the helpsheet that accompanied your Form 11S you find you are obliged to complete a Form 11, you can download it from customers Completing Form 12 or Form 12S will find information in this Guide useful and should consult the Index to locate relevant this Guide This Guide is intended to deal with the Pay and File obligations of self-assessed individuals in general terms.)

4 As such, it does not attempt to cover every issue which may arise on the subject. It does not purport to be a legal interpretation of the statutory provisions and consequently, responsibility cannot be accepted for any liability incurred or loss suffered as a result of relying on any matter published in this Guide does not answer your questions you may contact your local Revenue office or consider seeking independent professional advice from a tax layout of this Guide follows the layout of the Form 11. For data capture purposes each entry in the Form 11 and Form 11S is allocated its own Line number. For convenience this Guide uses these Line numbers for cross-reference between the Return Forms and the Guide . The Line numbers appear in bold print at the various headings throughout this Guide , [1-2] for lines 1 and 2.

5 Part 2 is a panel-by-panel commentary on the completion of the 2018 Form 11 Tax Returns , Part 3 incorporates information charts and examples to assist self-assessment taxpayers in the calculation of their income tax liability for Pay and File ONEG uide to Completing 2018 Tax ReturnsPage 5 Expression of DoubtThe 2018 return provides a facility for a taxpayer to include an expression of doubt under Section 959P TCA is to indicate to Revenue a genuine doubt about the application of law or the treatment for tax purposes, of any matter contained in the return. You must have consulted all relevant Revenue leaflets and guidelines published on our website with a view to establishing the correct treatment of the point at issue. The expression of doubt box is not for general comments and should be used only for the intended following information will be required to enable your expression of doubt to be examined.

6 A full explanation of all facts and circumstances concerning the matter. Include appropriate background details and the supporting documents that are being submitted in relation to the matter. Highlight which aspect(s) of tax legislation is / are a matter of doubt and why doubt exists. Detail the tax legislation, case law and / or statements of practice being relied upon. State the full value of the income / profits / gains / reliefs / deductions or losses at issue. State the tax impact arising from the tax treatment return of income and documentation in support of the expression of doubt must be received on or before the return filing date. Revenue will examine your expression of doubt and will reply to you as to whether it is accepted as genuine or not.

7 Where your expression of doubt is not accepted as genuine, you have a right of appeal to the Tax Appeal Commissioners within 30 days of notice of the decision in accordance with Section 959P(8) TCA 1997. A "notice of appeal" form and guidance notes are available on the Tax Appeal Commissioners websiteAdditional informationPart of the Income Tax, Capital Gains Tax and Corporation Tax to Completing 2018 Tax ReturnsPage 6 AccessibilityIf you are a person with a disability and require this leaflet in an alternative format the Revenue Access Officer can be contacted at: contact detailsRevenue s Website address is: Visit our website for more information on anything contained in this HelpdeskInformation on ROS is available on our website. The ROS Helpdesk can be contacted at: or +353 1 738 & LeafletsForms & Leaflets are available on Revenue's website or from Revenue's Forms & Leaflets Service by telephoning +353 1 738 Online Service (ROS)ROS, which is available 24/7, 365 days a year, is a quick and easy way to: file your tax return / accounts information, pay your tax liability, securely access your Revenue account, receive immediate acknowledgement of transactions, instantly and accurately calculate your income tax liability, and, aids the making of a self assessment.

8 Using ROS you can select three payment methods - ROS Debit Instruction, Online Banking or debit / credit card. You can e-file your Return early and select a payment date of your choosing up to the filing date. Revenue guarantees that only amounts specified by you or your agent will be taken from your : If you wish to view your own personal tax details or if you wish to file your tax Returns online you must first register for ROS. Agents: If you are a tax agent and require access to view the records or file Returns on behalf of your clients via ROS you must also apply to become a customer. To ensure that your client list is up to date please contact the relevant Revenue office. Guide to Completing 2018 Tax ReturnsPage 7In order to become a ROS customer you must visit our website and complete the following three steps: Step 1: Apply for your ROS Access Number (RAN).

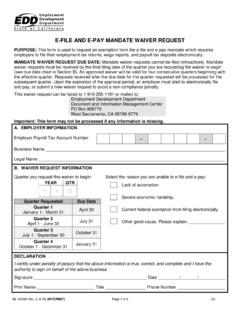

9 When you successfully apply to become a ROS customer, a letter will be issued to you with your personal ROS access number. This number will enable you to 2: Apply for your Digital CertificateStep 3: Retrieve your Digital CertificateFor more information, including how to register for ROS, visit our website or contact the ROS Helpdesk. Mandatory electronic filing and payment of Income TaxIMPORTANT NOTICEM andatory electronic payments and filing, using ROS, is part of Revenue's strategy to establish the use of electronic channels as the normal way of conducting tax details of categories of taxpayers who are mandatory e-filers, in addition to the full list of relevant exemptions and reliefs, are available on our website. If you are planning on filing a paper Return of Income you should review the website to ensure you are not within one of the categories of mandatory you are an individual who falls into any of the above categories, you must file electronically, even if you have received a paper Return of Income from , even if you are not a mandatory e-filer, ROS is a fast, efficient and secure way to file your return and pay your tax.

10 Guide to Completing 2018 Tax ReturnsPage 8 General guidance on Completing a tax return You should be careful and accurate when Completing the form. What is written in the form will appear in the assessment. What is omitted from the form will not appear in the assessment. Include all your income on the form (this includes PAYE income and tax deducted). Enter the annual amount of the income, not weekly or fortnightly amounts. Enter euro amounts only - no foreign currency amounts. Any panel(s) or section(s) that do not require an entry should be left blank. Do not enter terms such as per attached , as before , etc. You must instead enter the requested information. Incomplete Returns will be sent back to you for proper completion and you may incur a surcharge (see page 9 / 10) if the corrected Return is submitted late.