Transcription of HOP HING GROUP HOLDINGS LIMITED

1 1 Hong Kong Exchanges and Clearing LIMITED and The Stock Exchange of Hong Kong LIMITED take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this HING GROUP HOLDINGS LIMITED (Incorporated in the Cayman Islands with LIMITED liability)(Stock Code: 47)ANNOUNCEMENT OF INTERIM RESULTS FOR THE SIX MONTHS ENDED 30 JUNE 2017 RESULTSThe Board of Directors (the Board ) of Hop Hing GROUP HOLDINGS LIMITED (the Company ) herein present their unaudited condensed consolidated results of the Company and its subsidiaries (the GROUP )

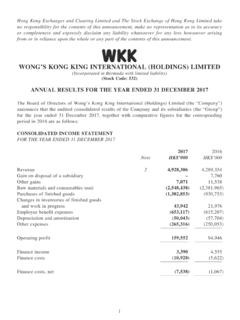

2 For the six months ended 30 June 2017, together with the comparative interim financial results have not been audited, but have been reviewed by the Company s audit committee and the Company s CONSOLIDATED INCOME STATEMENTU nauditedFor the six monthsended 30 June20172016 NotesHK$ 000HK$ 000 TURNOVER51,048,0391,017,372 Cost of sales(374,735)(376,079)Other income and gains, net510,4142,140 Selling and distribution expenses(469,035)(492,142)General and administrative expenses(91,981)(95,996)PROFIT FROM OPERATING ACTIVITIES6122,70255,295 Finance costs7(524)(500)PROFIT BEFORE TAX122,17854,795 Income tax expense8(35,887)(15,170)PROFIT FOR THE PERIOD86,29139,625 PROFIT ATTRIBUTABLE TO EQUITY HOLDERS OF THE COMPANY86,29139,625 EARNINGS PER SHARE ATTRIBUTABLE TO EQUITY HOLDERS OF THE cent3 CONDENSED CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOMEU nauditedFor the six monthsended 30 June20172016HK$ 000HK$ 000 PROFIT FOR THE PERIOD86,29139,625 OTHER COMPREHENSIVE INCOME/(EXPENSE)Other comprehensive income/(expense) to be reclassified to income statement in subsequent periods.

3 Exchange differences on translation of foreign operations12,507(8,344)OTHER COMPREHENSIVE INCOME/ (EXPENSE) FOR THE PERIOD12,507(8,344)TOTAL COMPREHENSIVE INCOME FOR THE PERIOD98,79831,281 TOTAL COMPREHENSIVE INCOME ATTRIBUTABLE TO EQUITY HOLDERS OF THE COMPANY98,79831,2814 CONDENSED CONSOLIDATED STATEMENT OF FINANCIAL POSITIONU nauditedAudited30 June31 December20172016 NotesHK$ 000HK$ 000 NON-CURRENT ASSETSP roperty, plant and equipment199,223188,907 Deferred tax assets39,53234,524 Prepayment and rental deposits48,74447,016 Total non-current assets287,499270,447 CURRENT ASSETSS tocks108,71694,758 Accounts receivable117,8858,142 Prepayments, deposits and other receivables80,87068,990 Tax recoverable1,6311.

4 787 Cash and cash equivalents573,343537,086 Total current assets772,445710,763 CURRENT LIABILITIESA ccounts payable12147,220118,422 Other payables and accrued charges323,911313,884 Interest-bearing bank loan10,00010,000 Tax payable12,39811,939 Total current liabilities493,529454,245 NET CURRENT ASSETS278,916256,518 TOTAL ASSETS LESS CURRENT LIABILITIES566,415526,965 NON-CURRENT LIABILITIESD eferred tax liabilities21,03223,168 NET ASSETS545,383503,797 EQUITYE quity attributable to equity holders of the CompanyIssued share capital1,007,0431,007,043 Reserves(461,660)(503,246)Total equity545,383503,7975 Notes:1.

5 BASIS OF PREPARATIONThe condensed consolidated interim financial statements are prepared in accordance with Hong Kong Accounting Standard ( HKAS ) 34 Interim Financial Reporting and other relevant HKASs and Interpretations, Hong Kong Financial Reporting standards (collectively, the HKFRSs ) issued by the Hong Kong Institute of Certified Public Accountants (the HKICPA ) and the disclosure requirements of Appendix 16 of the Rules Governing the Listing of Securities ( Listing Rules ) on The Stock Exchange of Hong Kong LIMITED ( Stock Exchange ). Save for the adoption of revised HKFRSs during the period as set out in note 2 below.

6 The accounting policies and basis of preparation adopted in the preparation of the condensed consolidated interim financial statements are the same as those used in the preparation of the annual financial statements for the year ended 31 December IMPACT OF REVISED HONG KONG FINANCIAL REPORTING STANDARDSThe GROUP has adopted the following revised HKFRSs for the first time for the current period s condensed consolidated interim financial to HKAS 7 Disclosure InitiativeAmendments to HKAS 12 Recognition of Deferred Tax Assets for Unrealised LossesAmendments to HKFRS 12 included in Annual Improvements 2012-2014 CycleDisclosure of Interests in Other EntitiesThe adoption of the revised HKFRSs has had no significant financial effect on these interim financial issued BUT NOT YET effective HONG KONG FINANCIAL REPORTING STANDARDSThe GROUP has not applied the following new and revised HKFRSs, that have been issued but are not yet effective .

7 In these interim financial to HKFRS 2 Classification and Measurement of Share-based Payment Transactions1 Amendments to HKFRS 4 Applying HKFRS 9 Financial Instruments with HKFRS 4 Insurance Contracts1 HKFRS 9 Financial Instruments1 Amendments to HKFRS 10 and HKAS 28 (2011)Sale or Contribution of Assets between an Investor and its Associate or Joint Venture3 HKFRS 15 Revenue from Contracts with Customers1 Amendments to HKFRS 15 Clarifications to HKFRS 15 Revenue from Contracts with Customers1 HKFRS 16 Leases2 Amendments to HKAS 40 Transfer of Investment Property1HK(IFRIC)-INT 22 Foreign Currency Transactions and Advance Consideration issued1HK(IFRIC)

8 -INT 23 Uncertainty over income tax treatments21 effective for annual periods beginning on or after 1 January 20182 effective for annual periods beginning on or after 1 January 20193 No mandatory effective date yet determined but is available for adoptionThe GROUP is in the process of making an assessment of the impact of these new and revised HKFRSs upon initial application but is not yet in a position to state whether these new and revised HKFRSs would have any significant impact on its results of operations and financial OPERATING SEGMENT INFORMATIONThe GROUP s primary operating segment is quick service restaurants ( QSR ) business.

9 Since the QSR business is the only operating segment of the GROUP , no further analysis thereof is addition, the QSR business revenue and non-current assets, other than deferred tax assets, are predominantly attributable to a single geographical region, which is the PRC. Therefore, no analysis by geographical regions is TURNOVER AND OTHER INCOME AND GAINS, NETT urnover represents the invoiced value of goods sold, net of sales related taxes, during the analysis of turnover and other income and gains, net is as follows:UnauditedFor the six monthsended 30 June20172016HK$ 000HK$ 000 Turnover Sales1,048,0391,017,372 Other income and gains, net Bank interest income3,2112,310 Foreign exchange differences, net3,716(2,155) Government grants*2,3001,095 Others1,18789010,4142,140* Government grants represent the subsidies received from the local government for the GROUP s business activities carried out locally.

10 There were no unfulfilled conditions during the period in which they were PROFIT FROM OPERATING ACTIVITIESThe GROUP s profit from operating activities is arrived at after charging:UnauditedFor the six monthsended 30 June20172016HK$ 000HK$ 000 Direct cost of stocks sold*343,958351,735 Depreciation51,99351,028 Lease payments under operating leases in respect of lands and buildings minimum lease payments127,698133,911 contingent rents17,06317,612 Loss on write-off of items of property, plant and equipment, net3,1761,079* Direct cost of stocks sold is included in Cost of sales in the condensed consolidated income FINANCE COSTSAn analysis of finance costs is as follows.