Transcription of How to complete Form W-8BEN - Alliance Trust

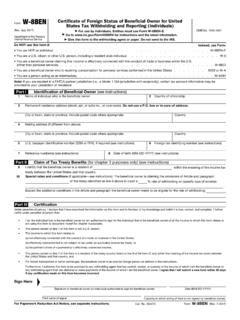

1 About form W-8 BENForm W-8 BEN is a form that you must complete if you want to invest in US (United States) stocks and shares through any Account with Alliance Trust Savings. It captures information that we have to record for the US Internal Revenue Service (IRS). Completing the W-8 BEN also means you can benefit from treaty relief on dividend and interest payments if you live in a country that has a relevant treaty with the take care when you are completing the form because we are unable to accept W-8 BEN forms that have had amendments made to them. If you do make a mistake please start again with another to complete form W-8 BENFull name of beneficial owner of permanentresidential address in the country where you claim to be your ATS Client Reference Number your country of residence for tax purposes of England,Scotland, Wales or Northern Ireland, should enter your currentcitizenship is inEngland, Scotland,Wales or Northern Ireland, you should enterUnited James ExampleUnited KingdomUnited Kingdom123 Example StreetCity Example, D21 32B1234567801/31/1979 United KingdomResidents of England, Scotland, Wales or Northern Ireland, should enter only enter a different mailing address that has already been agreed with of England, Scotland, Wales or Northern Ireland.

2 Should enter United make sure you enter the date in the American format shown month first, then day of the month, then and date the form . Along with full printed name and the capacity in which you are ExampleMr James ExampleSelfContinued overleaf >>Joint Accounts and Accounts held in the name of a corporate or other entityIf your Account is a joint Account, each individual Account holder must complete the your Account is held in the name of a corporate or other entity rather than in the name of an individual(s) you will need to complete the W-8 BENE form instead. You can download a copy of this direct from the IRS website at won t be able to trade in US stocks and shares until you have completed the form W-8 BEN in full and returned it to us at Client Services team, Alliance Trust Savings, PO Box 164, 8 West Marketgait, Dundee, DD1 9YP.

3 If you need more help to complete the formThe guidance notes in this document are designed to give you pointers about how to fill out form W-8 BEN but they are not exhaustive and we can t give you tax advice. So if you are in any doubt at all about how best to fill out the form we recommend you also read the full, official IRS guidance notes at If your circumstances changeIf your circumstances change after completing your form W-8 BEN we may withdraw your ability to invest in US stocks and shares until you send us an updated Trust SavingsPO Box 164, 8 West Marketgait, Dundee DD1 9YP T +44 (0)1382 573737 F +44 (0)1382 321183E Trust Savings Limited is a subsidiary of Alliance Trust PLC and is registered in Scotland No. SC 98767, registered office, PO Box 164, 8 West Marketgait, Dundee DD1 9YP; is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority, firm reference number 116115.

4 Alliance Trust Savings gives no financial or investment advice. Calls may be recorded for training and security GNR MIS 0001 Any questions? : 01382 573737PO Box 164,8 West MarketgaitDundeeDD1 9 YPe.