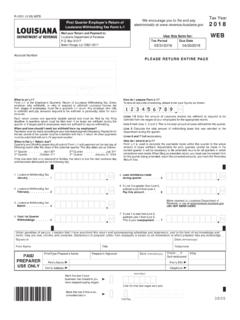

Transcription of IT-540B WEB 2021 LOUISIANA NONRESIDENT IMPORTANT! …

1 Your legal first name nameSuffixIf joint return, spouse s name nameSuffixPresent home address (number and street or rural route)Unit TypeUnit NumberCity, Town, or APOS tateZIPF oreign Nation, if not United States (do not abbreviate) IMPORTANT! Your SSNS pouse s SSNArea code and daytime telephone numberIT-540B WEB(Page 1 of 4)622652021 LOUISIANA NONRESIDENT AND PART-YEAR RESIDENTIMPORTANT!You must enter your SSN below in the same order as shown on your federal : 6 AYourself65 orolderBlind6 BSpouse65 orolderBlindX6D TOTAL EXEMPTIONS Total of 6A, 6B, and 6C 6D6C DEPENDENTS Enter dependent information below. If you have more than 6 dependents, attach a statement to your return with the required information. Enter the number of dependents claimed on Federal Form 1040 or 1040-SR in the boxes here. 6 CTotal of 6A & 6B First NameLast Name Social Security NumberRelationship to you Birth Date (mm/dd/yyyy) Your Date of BirthSpouse s Date of BirthFILING STATUS: Enter the appropriate number in the filing status box.

2 It must agree with your federal a 1 in box if a 2 in box if married filing a 3 in box if married filing a 4 in box if head of household. If the qualifying person is not your dependent, enter name here. Enter a 5 in box if qualifying widow(er). If the qualifying person is not your dependent, enter name here. IMPORTANT! All four (4) pages of this return MUST be mailed in together along with your W-2s and completed schedules. Please paperclip. Do not OFFICE USE ONLYF ieldFlagDecedent FilingName ChangeAddress ChangeAmended ReturnNOLMSRAN onresident ReturnPart-Year ReturnSpouse DecedentMark Box:WEBE nter the first 4 letters of your last name in these ADJUSTED GROSS INCOME Enter the amount of your Federal Adjusted Gross Income from the NPR worksheet, Federal column, Line ADJUSTED GROSS INCOME Enter the amount of your LOUISIANA Adjusted Gross Income from the NPR worksheet, Line OF LOUISIANA ADJUSTED GROSS INCOME TO FEDERAL ADJUSTED GROSS INCOME Divide Line 8 by Line 7.

3 Carry out to two decimal places in the percentage. DO NOT ROUND UP. The percentage cannot exceed 100%.If you did not itemize your deductions on your federal return, leave Lines 10A, 10B, and 10C blank and go to Line ITEMIZED DEDUCTIONS10 BFEDERAL STANDARD DEDUCTION10 CEXCESS FEDERAL ITEMIZED DEDUCTIONS Subtract Line 10B from Line INCOME TAX If your federal income tax has been decreased by a federal disaster credit allowed by the IRS, mark the box. See Schedule DEDUCTIONS Add Lines 10C and DEDUCTIONS Multiply Line 10E by the percentage on Line 9. Round to the nearest NET INCOME Subtract Line 10F from Line 8. If less than zero, enter zero 0. 12 YOUR LOUISIANA INCOME TAX See the Tax Computation Worksheet to calculate the amount of your LOUISIANA income PRIORITY 1 CREDITS From Schedule C-NR, Line 5 14 TAX LIABILITY AFTER NONREFUNDABLE PRIORITY 1 CREDITS Subtract Line 13 from Line 12. If the result is less than zero, or you are not required to file a federal return, enter zero 0.

4 62266 Enter your Social Security Number. If you are not required to file a federal return, indicate wages this box and enter zero 0 on Line Form IT-540B WEB (Page 2 of 4)REFUNDABLE TAX CREDITS152021 LOUISIANA REFUNDABLE CHILD CARE CREDIT Your Federal Adjusted Gross Income must be EQUAL TO OR LESS THAN $25,000 to claim the credit on this line. See the instructions and the Refundable Care Credit Worksheet. 15 AEnter the qualified expense amount from the Refundable Child Care Credit Worksheet, Line the amount from the Refundable Child Care Credit Worksheet, Line LOUISIANA REFUNDABLE SCHOOL READINESS CREDIT - Your Federal Adjusted Gross Income must be EQUAL TO OR LESS THAN $25,000 to claim the credit on this line. See the Refundable School Readiness Credit REFUNDABLE PRIORITY 2 CREDITS From Schedule F-NR, Line 918 TOTAL REFUNDABLE PRIORITY 2 CREDITS Add Lines 15, 16, and 17. Do not include amounts on Lines 15A, and LIABILITY AFTER REFUNDABLE PRIORITY 2 CREDITS 20 OVERPAYMENT AFTER REFUNDABLE PRIORITY 2 CREDITS 5 4 3 2 WEBCONTINUE ON NEXT PAGEE nter the first 4 letters of your last name in these AND SIGN RETURN ON NEXT PAGEE nter your Social Security Number.

5 6226721222324252627282930313233343536373 83921 NONREFUNDABLE PRIORITY 3 CREDITS From Schedule J-NR, Line 16 22 ADJUSTED LOUISIANA INCOME TAX Subtract Line 21 from Line 19. 23 CONSUMER USE TAX 24 TOTAL INCOME TAX AND CONSUMER USE TAX Add Lines 22 and OF REFUNDABLE PRIORITY 2 CREDITS Enter the amount from Line PRIORITY 4 CREDITS From Schedule I-NR, Line 6 PAYMENTS27 AMOUNT OF LOUISIANA TAX WITHHELD FOR 2021 Attach Forms W-2 and OF CREDIT CARRIED FORWARD FROM 202029 AMOUNT PAID ON YOUR BEHALF BY A COMPOSITE PARTNERSHIP FILING Enter name of partnership. 30 AMOUNT OF ESTIMATED PAYMENTS MADE FOR 202131 AMOUNT PAID WITH EXTENSION REQUEST32 TOTAL REFUNDABLE TAX CREDITS AND PAYMENTS Add Lines 25 through 31. 33 OVERPAYMENT If Line 32 is greater than Line 24, subtract Line 24 from Line 32. Your overpayment may be reduced by Underpayment of Estimated Tax Penalty. Otherwise, go to Line PENALTY See the instructions for Underpayment Penalty and Form R-210NR.

6 If you are a farmer, check the OVERPAYMENT If Line 33 is greater than Line 34, subtract Line 34 from Line 33, and enter on Line 35. If Line 34 is greater than Line 33, subtract Line 33 from Line 34, and enter the balance on Line DONATIONS From Schedule D-NR, Line 20 REFUND DUE37 SUBTOTAL Subtract Line 36 from Line 35. This amount of overpayment is available for credit or OF LINE 37 TO BE CREDITED TO 2022 INCOME TAX CREDIT39 AMOUNT TO BE REFUNDED Subtract Line 38 from Line 37. If mailing to LDR, use Address 2 on the next page. Enter a 2 in box if you want to receive your refund by paper a 3 in box if you want to receive your refund by direct deposit. Complete information below. If information is unreadable, you are filing for the first time, or if you do not make a refund selection, you will receive your refund by paper check. REFUND DIRECT DEPOSIT INFORMATIONR outing NumberType: Checking SavingsAccount NumberYes NoWill this refund be forwarded to a financial institution located outside the United States?

7 2021 Form IT-540B WEB (Page 3 of 4)No use tax from the Consumer Use Tax , FEIN, or LDR Account Number of Paid PreparerIndividual Income Tax ReturnCalendar year return due 5/15/20221 Mail Balance Due Return with Payment TO: Department of Revenue P. O. Box 3550 Baton Rouge, LA 70821-35502 Mail All Other Individual Income Tax ReturnsTO: Department of Revenue P. O. Box 3440 Baton Rouge, LA 70821-3440{Address}AMOUNTS DUE LOUISIANA40 AMOUNT YOU OWE If Line 24 is greater than Line 32, subtract Line 32 from Line DONATION TO THE MILITARY FAMILY ASSISTANCE FUND 42 ADDITIONAL DONATION TO THE COASTAL PROTECTION AND RESTORATION FUND43 ADDITIONAL DONATION TO LOUISIANA FOOD BANK ASSOCIATION44 INTEREST From the Interest Calculation Worksheet, Line FILING PENALTY From the Delinquent Filing Penalty Calculation Worksheet Line PAYMENT PENALTY From Delinquent Payment Penalty Calculation Worksheet Line PENALTY See the instructions for Underpayment Penalty and Form R-210NR.

8 If you are a farmer, check the DUE LOUISIANA Add Lines 40 through 47. If mailing to LDR, use address 1 below. For electronic payment options, see page 3 of the instructions. PAY THIS the first 4 letters of your last name in these your Social Security Number. 404142434445464748 IMPORTANT! All four (4) pages of this return MUST be mailed in together along with your W-2s and completed schedules. Please paperclip. Do not penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and belief, they are true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge. If I made a contribution to the START Savings Program, I consent that my Social Security Number may be given to the LOUISIANA Office of Student Financial Assistance to properly identify the START Savings Program account holder.

9 If married filing jointly, both Social Security Numbers may be submitted. I under-stand that by submitting this form I authorize the disbursement of individual income tax refunds through the method as described on Line SignatureDate (mm/dd/yyyy)Spouse s Signature (If filing jointly, both must sign.)Date (mm/dd/yyyy)PAIDPREPARERUSE ONLYP rint/Type Preparer s Name Preparer s SignatureDate (mm/dd/yyyy)Check if Self-employedFirm s Name Firm s FEIN Firm s Address Telephone 2021 Form IT-540B WEB (Page 4 of 4)For Office Use DO NOT SEND NONRESIDENT and Part-Year Resident (NPR) Worksheet See instructions for completing the NPR , salaries, tips, interest3 Dividends4 Business income (or loss) and farm income (or loss)5 Gains (or losses)6 IRA distributions, pensions and annuities7 Rental real estate, royalties, partnerships, S corporations, trusts, Security benefits9 Other income - Enter the amount of LOUISIANA NOL utilized_____ 10 Total Income Add the income amounts on Lines 1 9 for each Adjustments to Income12 Adjusted Gross Income Subtract Line 11 from Line 10 for each column.

10 Enter the amount in the Federal column on Form IT-540B , Line 7. The amount shown in the Federal column should agree with Federal Form 1040 or 1040-SR, Line and dividend income from other states and their political subdivisions14 Recapture of START contributions15 Add back of donation to school tuition organization credit16 Add back of pass-through entity loss17 Total - Add Lines 12 through INCOME - Enter on Lines 18A through 18F the amount of any exempt income included in Line 12 in the LOUISIANA column. Enter the description and associated code, along with the dollar amount. See the Income DescriptionCodeAmount18AE18BE18CE18DE18E E18FE19 Total Exempt Income Add Lines 18A through ADJUSTED GROSS INCOME. Subtract Line 19 from Line 17. Also, enter this amount on Form IT-540B , Line your Social Security Number. 62269 ATTACH TO RETURN IF - See the instructions. CodeNative American Income08 ESTART Savings Program Contribution09 EMilitary Pay Exclusion10 ERoad Home11 ERecreation Volunteer13 EVolunteer Firefighter14 EVoluntary Retrofit Residential Structure16 EElementary and Secondary School Tuition17 EEducational Expenses for Home-Schooled Children18 EEducational Expenses for Quality Public Education19 ECapital Gain from Sale of LOUISIANA Business20 EEmployment of Certain Qualified Disabled Individuals21ES Bank Shareholder Income Exclusion22 EEntity Level Taxes Paid to Other States23 EPass - Through Entity Exclusion24 EIRC Code 280C Expense25 ECOVID-19 Relief Benefits27 EOther, see : _____49 EDescription - See instructions.