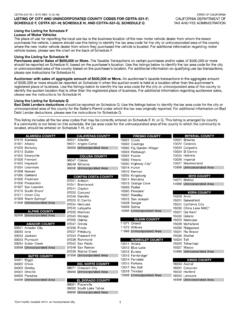

Transcription of L-595 Sales and Use Tax Rate Changes Operative April 1, 2019

1 New Sales and Use Tax Rates Operative April 1, 2019 The tax rate Changes listed below apply only within the indicated city or county limits. The new tax rates, tax codes, acronyms, and expiration dates will be available to view and download as a spreadsheet prior to April 1, 2019, on our webpage California City & County Sales & Use Tax Rates. Go to our website at and select Tax and Fee Rates, then choose Sales and Use Tax Rates (scroll down to Download for the spreadsheet).To find the specific tax rate for your area or business location, go to the California City & County Sales & Use Tax Rates webpage and select Find a Sales and Use Tax Rate by Address under the Current Tax Rates section.

2 (Please note: The new rates will not be available here until April 1, 2019.) You can also call our Customer Service Center at 1-800-400-7115 (TTY:711). Customer service representatives are available to assist you Monday through Friday from 8:00 to 5:00 (Pacific time), except state TAX RATE INCREASINGC itywideNew CodeAcronymPrior RateNew RateCity of Alameda (located in Alameda County) of Oroville (located in Butte County) of Angels Camp (located in Calaveras County) of Antioch (located in Contra Costa County) of Martinez (located in Contra Costa County) of Coalinga (located in Fresno County) of Fowler (located in Fresno County) of Kerman (located in Fresno County) of Bakersfield (located in Kern County) of Burbank (located in Los Angeles County)

3 Of Covina (located in Los Angeles County) of Culver City (located in Los Angeles County) of Pomona (located in Los Angeles County) of La Puente (located in Los Angeles County) of Santa Fe Springs (located in Los Angeles County) of Glendale (located in Los Angeles County) of Lawndale (located in Los Angeles County) of Cudahy (located in Los Angeles County) of Pasadena (located in Los Angeles County) of Chowchilla (located in Madera County) of Los Banos (located in Merced County) of King City (located in Monterey County) of Marina (located in Monterey County) of Placentia (located in Orange County) of Santa Ana (located in Orange County) of Seal Beach (located in Orange County) of Garden Grove (located in Orange County) of Roseville (located in Placer County) of Norco (located in Riverside County) of Murrieta (located in Riverside County) of Wildomar (located in Riverside County) of Sacramento (located in Sacramento County) of Barstow (located in San Bernardino County) of Oceanside (located in San Diego County)

4 Of Lodi (located in San Joaquin County) of Redwood City (located in San Mateo County) of Santa Maria (located in Santa Barbara County) of Carpinteria (located in Santa Barbara County) of Los Gatos (located in Santa Clara County) of Santa Rosa (located in Sonoma County) of Porterville (located in Tulare County) of Port Hueneme (located in Ventura County) of West Sacramento (located in Yolo County) CodeAcronymPrior RateNew RateSan Benito County(This rate applies in all unincorporated areas and in incorporated cities that do not impose a district tax.)

5 Of of San Juan County (This rate applies in all unincorporated areas and in incorporated cities that do not impose a district tax.) of of of Rohnert of of of Santa Area7 New CodeAcronymPrior RateNew RateSanta Cruz County Unincorporated County Unincorporated DISTRICT TAXES EXTENDEDC ounty/CityCodeAcronymTax RateExpiration DateHumboldt Clara of Albany (located in Alameda County) of Paradise (located in Butte County) of Rio Dell (located in Humboldt County) of San Fernando (located in Los Angeles County) of El Monte (located in Los Angeles County) of Monterey (located in Monterey County) of Sebastopol (located in Sonoma County)

6 Of Red Bluff (located in Tehama County) (2-19)1 The city increased its existing tax (ANTG) of percent to percent (ANIT) and extended the expiration date to March 31, The city increased its existing tax (KING) of percent to percent (KNGG) and extended the expiration date to March 31, The city approved a new percent tax (MRGT) to replace the existing percent tax (MRNA) which will expire March 31, The city approved a new percent tax (SARG) to replace the existing percent tax (SACG) which will expire March 31, The city approved a new percent tax (SMPG) to replace the existing percent tax (SMAG) which will expire March 31, The city approved a new tax of percent (in addition to the Sonoma countywide increase of percent listed in the countywide table).

7 7 These new taxes apply in the unincorporated area of the county only. They do not affect the rate that applies in incorporated cities within these counties. 8 The Yuba County Unincorporated Area tax is subject to pending litigation. Information regarding this tax will be updated if necessary.