Transcription of Laird PLC Final results for the year ended 31 …

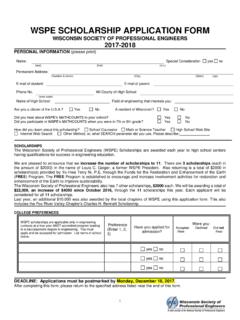

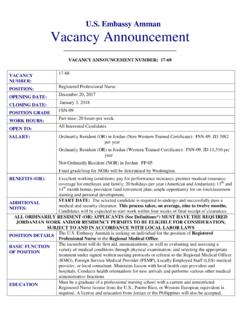

1 1 March 2018. Laird PLC. Final results for the year ended 31 December 2017 & Recommended Cash Acquisition Much improved results lay strong foundations for future 12 months to 12 months to Change 31/12/ 2017 31/12/2016. Revenue +17%. Underlying operating profit +24%. Operating profit / (loss) ( )m - Underlying profit before tax +32%. Profit / (loss) before tax ( )m - Underlying basic earnings per share * +6%. Basic earnings / (loss) per share* ( )p - Operating cash flow +84%. Cash generated from operations +10%. Net debt -52%. Dividend per share interim only -75%. Non-IFRS measures. For the definition and explanation of the use of this non-IFRS information, which is used throughout, and reconciliations to the most directly reconcilable IFRS line item, see the Appendix to this announcement. *2016 restated for the bonus element of the 2017 rights issue Recommended Cash Acquisition The Board is pleased to announce that it has reached agreement on the terms of a recommended cash acquisition of the entire issued and to be issued ordinary share capital of Laird , to be effected by means of a scheme of arrangement under Part 26 of the Companies Act Under the terms of the acquisition, shareholders will be entitled to receive 200p in cash for each Laird share held, representing a premium of approximately per cent to the closing price of Laird shares of on 28 February 2018.

2 The bidder is a wholly-owned indirect subsidiary of funds managed by Advent International Corporation See notice for further information Financial Summary Much improved Group financial performance, with continued progress across all three divisions Group revenue up 17% on a reported basis and up 10% on an organic constant currency basis Underlying profit before tax improved by 32% to driven by revenue growth and operating margin improvement Profit before tax was , improved from a loss of ( )m in 2016. Operating cash flow increased 84% to due to improved profitability and tight control of capital expenditure Net debt to Underlying EBITDA was compared to at last year-end following successful completion of 185m rights issue in April and improved cash generation 1. As a result of today's announcement on the recommended cash acquisition, no Final dividend is currently proposed Operational Highlights New divisional structure has brought efficiencies and enabled a greater focus on complementary markets and technologies Significantly strengthened the Executive Committee and Divisional leadership teams Ongoing investment in engineering capability and new products to support future revenue and earnings growth The Group continues to deliver the planned cost savings identified as part of our operating model re- design with over $15m of benefits seen in 2017 and a further $5m of benefits expected in 2018.

3 Short-Term Outlook The Group has started the year with good underlying trading momentum across the majority of the business with new business wins and new product launches expected to support future growth During 2018, on an organic constant currency basis , this growth is expected to more than offset possible challenges in the premium smartphone market Recent volatility in foreign exchange rates (particularly the strengthening of Sterling against the US. Dollar and the strengthening of Renminbi against the US Dollar) currently presents a significant headwind in 2018, given our reporting currency is Sterling Tony Quinlan, Chief Executive, commented: Laird has made significant progress and delivered a much improved performance in 2017 . In my first year as CEO, we've simplified structures, enhanced the quality of the leadership and focussed on improving the efficiency and profitability of all Laird 's operations. These actions have delivered much improved results , and have built strong foundations for the future.

4 We expect to demonstrate continued progress in underlying financial performance in 2018, despite currency headwinds given our reporting currency is Sterling.. Laird is a high quality business, as our 2017 results demonstrate. This quality has been recognised by Advent International and their cash offer for the Group represents good value and certainty for shareholders. Laird 's history goes back almost 200 years and the business has evolved over that time into the global engineering company of today. I believe for its next chapter, Laird will benefit from private ownership as it further strengthens its business model and looks to the future.. Divisional Highlights Performance Materials (PM). Good revenue growth of 8% on an organic constant currency basis and 14% on a reported basis, albeit against a weak comparative in the prior year Revenue growth in all parts of the Division, but particularly Precision Metals and Thermal Materials The focus on increasing productivity, improving our internal processes and correcting our commercial inefficiencies has started to deliver better results 2.

5 Connected Vehicle Solutions (CVS). Strong revenue growth of 18% on an organic constant currency basis and 26% on a reported basis Operating margin continues to be impacted by investments to drive long term growth New business wins in the year have lifetime revenues of around $750m, with revenues expected from 2019 to 2025. We continue to benefit from the very strong customer relationships we have in both the US and Europe Established a new R&D centre in Grand Blanc, Michigan, in the heart of the US automotive industry Wireless and Thermal Systems (WTS). Revenue growth of 4% on an organic constant currency basis , improving from flat in the first half, and 10% growth on a reported basis Benefits from operating model redesign have contributed to strong operating margin improvement Synergies from establishing and optimising the new divisional structure are being delivered This announcement contains inside information About Laird Laird is a global technology company providing systems, components and solutions that protect electronics from electromagnetic interference and heat, and that enable connectivity in mission critical wireless applications and antennae systems.

6 We are a global leader in the field of innovative radio frequency ( RF ). engineering. Enquiries: Laird PLC MHP. Tony Quinlan, Chief Executive Officer Reg Hoare Kevin Dangerfield, Chief Financial Officer Tim Rowntree Richard Harris, Head of Investor Relations Ollie Hoare Tel: +44 (0)20 7468 4040 Tel: +44 (0)20 3128 8100. results Presentation & Webcast An analyst presentation will be held today at at The Milton Suite, The Grange St. Paul's Hotel, 10. Godliman Street, London EC4V 5AJ. A live audio webcast of the presentation will be hosted on A replay of the webcast will also be available on our website for two weeks after the event. 3. GROUP PERFORMANCE REVIEW. Laird has made significant progress and delivered a much improved performance in 2017 , with continued progress across all three divisions, underpinned by our resolute focus on operational excellence. The new divisional structure has brought efficiencies and enabled a greater focus on complementary markets and technologies.

7 In creating the new Wireless and Thermal Systems Division, we have taken three technologies (Connectivity, Controls and Thermal) from what were four separate business units to form one division where the whole is greater than the sum of the parts. During the year we have significantly strengthened Laird 's Executive Committee and the Divisional leadership teams. Seven of the ten Executive Committee are either new to the business or new in role in the last 18 months and bring with them the skills necessary for the next stage of Laird 's development. We will continue to invest in our talent to continue our progress. We have continued to invest in engineering capability and new product development, particularly in Connected Vehicle Solutions and Wireless and Thermal Systems, to ensure we continue to offer new market-leading products that deliver on our customers' most demanding needs. This investment will continue over the next few years to ensure we build the pipeline of new business needed to drive future revenue and earnings growth.

8 In the year, we won new business valued at around $750m in CVS which is expected to generate revenue between 2019 and 2025. The Group continues to deliver the planned cost savings identified as part of our operating model re-design with over $15m of benefits delivered in 2017 . In particular, the operating margin growth seen in Wireless and Thermal Systems Division was driven by a consolidation in the number of our manufacturing sites. A. further $5m of incremental benefits is expected to be delivered in 2018. Finally, we successfully completed the rights issue in April 2017 , enabling the Group to reduce its borrowings under the existing revolving credit facilities. This significantly strengthened the Group's financial position, leaving Laird better placed to take advantage of the significant growth opportunities that exist in our end markets. Revenue Reported revenue increased by 17% to (2016: ), driven by growth in all three divisions and positive currency effects.

9 On an organic constant currency basis, revenue increased by 10%. Underlying operating profit /operating margin . Underlying operating profit increased 24% to (2016: ) with operating margin increasing to (2016: ). The revenue and underlying operating profit of the divisions and the Group as a whole is shown in the table below: 4. 12 months to 31 December PM CVS WTS Unallocated Total 2017 . Revenue ( m) - Underlying operating profit ( m) ( ) Underlying operating margin (%) ( )% 2016. Revenue ( m) - Underlying operating profit ( m) ( ) Underlying operating margin (%) ( )% Underlying profit before tax /profit before tax Underlying profit before tax increased 32% to (2016: ). Reported profit / (loss) before tax was (2016: ( )m). Dividend As a result of the recommended cash acquisition announced today, there is currently no Final dividend proposed. The total dividend for the year will therefore be equal to the interim dividend of (2016: ).

10 DIVISIONAL REVIEW. Performance Materials 12 months to 31 December 2017 2016 Change m m Revenue +13%. Underlying operating profit +11%. Underlying operating margin Performance Materials revenue increased 13% to (2016: ). Organic constant currency revenue increased by 8% versus the same period last year with particularly strong growth in Precision Metals and Thermal Materials. In Thermal Materials, strong performance in the automotive market has contributed to our revenue growth. The proliferation of electronics within the vehicle requires thermal and shielding solutions. Medical and absorber markets in the US are also delivering good results and remain promising focus areas for the future. In Precision Metals, sales growth was linked to the launch of new smartphone models in the second half of 2017 . The priority for the past year has been to stabilise financial performance after a disappointing 2016. The revenue growth in 2017 demonstrates that the actions taken to stabilise and improve our commercial and operational performance, along with our customer-obsessed mind-set and broad range of materials science solutions have delivered results .