Transcription of LB&I International Practice Service Transaction Unit

1 LB&I International Practice Service Transaction Unit IPS Level Number Title UIL Code Number Shelf N/A Individual Outbound Volume 11 Foreign Corporations Level 1 UIL 9433 Part Individuals with Investments in a CFC Level 2 UIL Chapter Taxability of income from the CFC Level 3 UIL Sub-Chapter Subpart F Income Unit Name Overview of Subpart F Income for Individual shareholders Document Control Number (DCN) (2013)b Date of Last Update 10/7/2015 Note: This document is not an official pronouncement of law, and cannot be used, cited or relied upon as such. Further, this document may not contain a comprehensive discussion of all pertinent issues or law or the IRS's interpretation of current law. 2 Table of Contents (View this PowerPoint in Presentation View to click on the links below) General Overview Issue and Transaction Overview Transaction and Fact PatternSummary of Potential Issues Audit StepsTraining and Additional ResourcesGlossary of Terms and AcronymsIndex of Related Issues3 Issue and Transaction Overview Overview of Subpart F Income for Individual shareholders A foreign corporation is one type of entity through which foreign business operations may be conducted.

2 A major tax advantage to a United States taxpayer of using a foreign corporation to conduct business is income tax deferral: generally, tax on the income of a foreign corporation is deferred until the income is distributed as a dividend or otherwise repatriated by the foreign corporation to its shareholders . Prior to the enactment of Subpart F, many taxpayers achieved deferral of tax on certain kinds of movable income, such as dividends, interest, rents, and royalties, by earning such income through foreign corporations. In addition, by incorporating or locating these corporations in low- or no-tax jurisdictions, taxpayers were able to ensure the income was taxed at a very low rate (until it was repatriated to the ). Congress determined that this type of deferral was inappropriate and reacted by enacting Subpart F. The Subpart F provisions eliminate deferral of tax on certain categories of foreign income by taxing certain persons currently on their pro rata share of such income earned by their foreign corporations.

3 This approach is based on the principles underlying the United States' taxing jurisdiction. In general, the United States does not tax a foreign corporation if it neither receives source income nor engages in activities. However, the generally does tax all income, wherever derived, of persons. The Subpart F rules operate by treating a shareholder of a foreign corporation as if the shareholder actually received its proportionate share of certain categories of the corporation s current earnings and profits (E&P). The shareholder is required to report this income currently in the United States, whether or not the foreign corporation actually makes a distribution (IRC 951(a)). Subpart F, therefore, does not purport to tax the foreign corporation . Rather, its rules apply only to a person who owns, directly or indirectly, 10% or more of the voting stock of a foreign corporation that is controlled by shareholders .

4 The provisions of Subpart F are complex and contain numerous general rules, special rules, definitions, exceptions, exclusions, and limitations, all of which require careful consideration (and are covered in other Practice Units Subpart F Overview). This Practice Unit contains a general overview of the basic provisions of Subpart F for individual shareholders . Back to Table Of Contents4 Issue and Transaction Overview (cont d) Overview of Subpart F Income for Individual shareholders The Subpart F rules were first enacted as part of the Revenue Act of 1962. Since then, they have been amended numerous times. In particular, the Tax Reform Act of 1986 significantly expanded the coverage of Subpart F. Congress' continuing effort to define the parameters of Subpart F is evidence that the Subpart F policy -- denial of tax deferral for movable income earned through a controlled foreign corporation (CFC) formed in a low- or no-tax country remains as viable today as when the rules were first enacted in 1962.

5 Under Subpart F, certain types of income earned by a CFC are taxable to the CFC's shareholders in the year earned even if the CFC does not distribute the income to its shareholders in that year. Subpart F operates by treating the shareholders as if they had actually received the income from the CFC. The income of a CFC that is currently taxable to its shareholders under the Subpart F rules is referred to as "Subpart F income. Under IRC 951(a), a shareholder is required to include in income currently its pro rata share of the CFC s Subpart F income ("Subpart F inclusion"). There are many categories of Subpart F income. In general, it consists of movable income. For example, one major category of Subpart F income foreign personal holding company income, or FPHCI consists of investment income such as dividends, interest, rents and royalties. Other types of Subpart F income include income received by a CFC from the purchase or sale of personal property involving a related person ( , foreign base company sales income, or FBCSI) and from the performance of services by or on behalf of a related person ( , foreign base company services income, or FBC Services Income).

6 Note the rules for Subpart F Insurance Income, investments of earnings in property and foreign base company oil related income are not covered in this Practice Unit. Back to Table Of Contents5 Issue and Transaction Overview (cont d) Overview of Subpart F Income for Individual shareholders There are three basic requirements for the applicability of the Subpart F rules to a person that owns an interest in a foreign corporation : The Person must be a Shareholder as defined under IRC 951(b). The foreign corporation must be a CFC. The CFC must have Subpart F income. This Unit covers the last requirement, Subpart F Income. For the first two requirements, refer to the Practice Unit entitled Determination of Shareholder and CFC Status. An individual shareholder may elect under IRC 962 to be taxed at corporate rates on his/her Subpart F inclusion which also entitles them to claim indirect foreign tax credits under IRC 960 as if they were a domestic corporation .

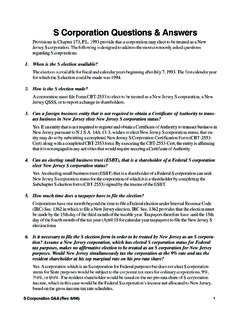

7 Back to Table Of Contents6 Transaction and Fact Pattern Overview of Subpart F Income for Individual shareholders Diagram of Transaction Facts US Ind A owns 100% of USCo, a domestic corporation . US Ind A owns 100% of CFC1 in Country B, 100% of CFC2 in Country C, and 100% of CFC3 in Country D. CFC1, CFC2 and CFC3 are Controlled Foreign Corporations for purposes of applying the Subpart F rules CFC1 performs services for USCo outside of Country B (the services are completely unrelated to CFC2 s sales of widgets). CFC2 purchases widgets from unrelated parties and sells them (without any further modification or manufacturing) to USCo. CFC3 earns interest on cash deposited in an unrelated bank. NOTE: If USCo were Ind A s sole proprietorship or disregarded entity instead of a domestic corporation , the federal tax results throughout this Practice unit would be the same because CFC1 and CFC2 would still be transacting with a related person, US Ind A.

8 Back to Table Of Contents USCo CFC1 (Country B) CFC2 (Country C) 100% 100% 100% Unrelated bank Interest income Sells widgets Performs services Unrelated vendors Buys widgets 100% CFC3 (Country D) Ind A 7 Summary of Potential Issues [Enter the Unit Name Here] Issue 1 Whether Individual A has a Subpart F inclusion as a result of the services performed by CFC1. Issue 2 Whether Individual A has a Subpart F inclusion as a result of the sales of widgets by CFC2. Issue 3 Whether Individual A has a Subpart F inclusion as a result of the interest income earned by CFC3. Back to Table Of Contents8 All Issues, Step 1: Initial Factual Development Overview of Subpart F Income for Individual shareholders Taxpayer may be conducting activities through (or merely booking income to) a CFC to shift profits out of the into a country with a lower tax rate. Fact Element Resources 6103 Protected Resources US Individual A owns 100% of CFC1, CFC2, and CFC3.

9 The examiner should review the transactions engaged in by the CFCs to determine whether they generate FBCSI, FBC Services Income, or FPHCI. Some items an examiner can review are: Worldwide Tax and Legal Organizational Charts Contracts containing the critical facts of the transactions Product Flows and Transaction Flowcharts Form 5471, Schedule M Form 1120, Schedule M-3 DECISION POINT: The examiner should review the unrepatriated offshore E&P for each CFC. An inclusion under IRC 951(a) is limited to current E&P; see IRC 952(c)(1)(A). IRC 9 52(c)(1)(A)? Back to Table Of Contents9 Issue 1, Step 2: Review Potential Issues Overview of Subpart F Income for Individual shareholders Issue 1 Whether A has a Subpart F inclusion as a result of the services performed by CFC1. Fact Element Resources 6103 Protected Resources One area of potential abuse is where a Service corporation is separated from the activities of a related corporation and organized in another country primarily to obtain a lower rate of tax for the Service income.

10 Subpart F addresses this abuse by requiring the shareholder to include its pro rata share of the CFC s FBC Services Income in income currently. FBC Services Income consists of income derived by a CFC in connection with the performance of technical, managerial, engineering, architectural, scientific, skilled, industrial, commercial or like services outside the CFC s country of incorporation for or on behalf of any related person. IRC 954(e) Treas. Reg. TMFEDPORT No. 928-3rd: CFCs - Foreign Base Company Income (Other than FPHCI) Back to Table Of Contents10 Issue 1, Step 2: Review Potential Issues (cont d) Overview of Subpart F Income for Individual shareholders Issue 1 Whether A has a Subpart F inclusion as a result of the services performed by CFC1. Fact Element Resources 6103 Protected Resources When a CFC performs services, you should determine whether the Transaction meets the following two requirements for FBC Services Income: Related person requirement Place of performance requirement IRC 954(e) Treas.