Transcription of Lecture Notes in Macroeconomics - University of Houston

1 Lecture Notes in MacroeconomicsJohn C. DriscollBrown University and NBER1 December 21, 20031 Department of Economics, Brown University , Box B, Providence RI 02912. Phone(401) 863-1584, Fax (401) 863-1970, web:http:\\ \ Copyright John C. Driscoll, 1999, 2000, 2001. All rightsreserved. Do not reproduce without permission. Comments welcome. I especiallythank David Weil, on whose Notes substantial parts of the chapters on Money andPrices and Investment are based. Kyung Mook Lim and Wataru Miyanaga provideddetailed corrections to typographical errors.

2 Several classes of Brown students haveprovided suggestions and corrections. All remaining errors are Money and Definitions .. Prices .. Money .. The History of Money .. The Demand for Money .. The Baumol-Tobin Model of Money Demand .. Money in Dynamic General Equilibrium .. Discrete Time .. Continuous Time .. Solving the Model .. The optimum quantity of money .. The Quantity Theory of Money .. Seigniorage, Hyperinflation and the Cost of Inflation .. Problems .. 212 Nominal Rigidities and Economic Old Keynesian Economics: The Neoclassical Synthesis.

3 Open Economy .. Aggregate Supply .. Disequilibrium Economics .. Setup .. The Walrasian Benchmark Case .. Exogenously Fixed Price .. Exogenously Fixed Nominal Wage .. Both prices and wages inflexible .. Analysis of this model .. Imperfect Information Models .. New Keynesian Models .. Contracting Models .. Predetermined Wages .. Fixed Wages .. Imperfect Competition and New Keynesian Economics .. Macroeconomic Effects of Imperfect Competition .. Imperfect competition and costs of changing prices.

4 Dynamic Models .. Evidence and New Directions .. Problems .. 583 Macroeconomic Rules v. Discretion .. The Traditional Case For Rules .. The Modern Case For Rules: Time Consistency .. Fischer s Model of the Benevolent, Dissembling Government Monetary Policy and Time Inconsistency .. Reputation .. The Lucas Critique .. Monetarist Arithmetic: Links Between Monetary and Fiscal Policy Problems .. 804 The Classical Approach .. Adjustment Costs and Investment:qTheory .. The Housing Market: After Mankiw and Weil and Poterba Credit Rationing.

5 Investment and Financial Markets .. The Effects of Changing Cashflow .. The Modigliani-Miller Theorem .. Banking Issues: Bank Runs, Deposit Insurance and Moral Hazard Investment Under Uncertainty and Irreversible Investment .. Investment Under Uncertainty .. Problems: .. 1105 Unemployment and Coordination Efficiency wages, or why the real wage is too high .. Solow model .. The Shapiro-Stiglitz shirking model .. Other models of wage rigidity .. Search .. Setup .. Steady State Equilibrium.

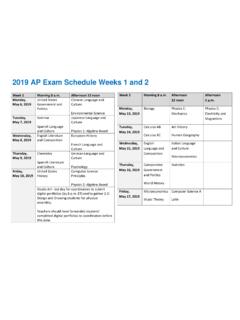

6 Coordination Failure and Aggregate Demand Externalities .. Model set-up .. Assumptions .. Definitions .. Propositions .. Problems .. 127 Continuous-Time Dynamic Optimization131 CONTENTSvStochastic Calculus133 IntroductionCourse Mechanics Requirements: Two exams , each 50% of grade, each covers half of materialin class. First exam: on Tuesday, March 12th. Second and final exam: onTuesday, April 30th. Problem sets: will be several, which will be handed in and corrected, butnot graded. Good way to learn macro, good practice for exams and core.

7 On the reading list: It is very ambitious. We may well not cover every-thing. That is fine, as not everything is essential. I may cut material as Igo along, and will try to give you fair warning when that happens. The lectures will very closely follow my Lecture Notes . There are twoother general textbooks available: Romer, which should be familiar andBlanchard and Fischer. The latter is harder but covers more Lecture Notes combine the approaches of and adapt materials in bothbooks. References in the Notes refer to articles given on the reading list.

8 Withfew exceptions, the articles are also summarized in Romer or Blanchardand Fischer. It is thus not necessary to read all or even most of the ar-ticles on the list. Since articles are the primary means through whicheconomists communicate, you should read at least one. Some of the ar-ticles are in the two recommended volumes by Mankiw and Romer, NewKeynesian Economics, both of which will eventually be in the about all articles prior to 1989 are available via the internet at thesite , provided one connects through a computer connectedto Brown s network.

9 I would ask that everyone not individually print outevery article, since that would take a lot of paper, energy and computingpower. Students considering Macroeconomics as a field are strongly encouragedto attend the Macroeconomics Workshop, on Wednesdays from 4:00-5:30in Robinson the handout labeled The First Measured Century. It presents graphsfor the of the three most important macroeconomic statistics, output, un-employment and inflation, since 1900. Essentially, Ec 207 tried to explain whythe graph of real GDP sloped upwards.

10 It also tried to explain why there werefluctuations around the trend, via real business cycle theory, but was much lessviCONTENTS successful. This course will explain the trend in and growth rates of inflationand unemployment, and fluctuations in real GDP. It will also explain why thesevariables move together- that is, unemployment tends to be low when outputgrowth is high, and inflation is often (but not always) low when output growthis low.[Omitted in Spring 2002: An important distinction that I have made implic-itly above is the separation of variables into atrendcomponent and acyclicalcomponent.]