Transcription of Life Insurance Application - Transpacific Financial Inc

1 Page 1 of 17 Return to Home OfficeLAPP-03-PA02(1/2018)1. Proposed Primary/First InsuredFirst NameMILast Name Male FemaleDate of BirthAgeSocial Security Number/TINHome Phone NumberAddress (street required)CityStateZIP CodeEmail AddressPlace of Birth (state and country) United States_____ Other_____Driver s License NumberState of IssueAnnual Earned Income$Annual Unearned Income$If married, spouse s Annual Income$Household Net Worth$Household Liquid Assets$Household Annual Expenses$Allianz Life Insurance Company of North AmericaPO Box 59060 Minneapolis, MN Insurance ApplicationEmployer s NameOccupation/DutiesLength of EmploymentIf less than 2 years, provide previous employer, occupation and length of employment:If self-employed, include the type of business.

2 Are you limited from working full-time? Yes No If Yes, provide details:Are there additional proposed insureds? Yes No If yes, complete Supplemental Life Insurance ApplicationHousehold Annual Income$Household Net Worth$Household Liquid Assets$Household Annual Expenses$If Trust, provide Trustee Name(s)Date of TrustAre there additional proposed owners? Yes No If yes, complete Supplemental Life Insurance Application2. Proposed Policy Owner Is proposed owner the same as proposed primary/first insured? Yes NoType of Owner: Individual Corporation Partnership Sole Proprietorship Trust JointNon-Individual Owner NameFirst NameMILast NameRelationship to proposed insured Male FemaleDate of BirthSocial Security Number/TINA ddress (street required)CityStateZIP CodeEmail AddressHome Phone NumberAlternate Phone Number (optional)Amount of Insurance Inforce on proposed policy owner $Page 2 of 17 Return to Home OfficeLAPP-03-PA02(1/2018)5.

3 Purpose of Insurancea. What is the purpose of the Life Insurance /Death Benefit coverage for the proposed insured? Personal Insurance Business Insurance Income Replacement Final Expenses Deferred Compensation Buy/Sell Charitable Giving Retirement Planning Key Person Business Continuation Estate Conservation College Funding Split Dollar Executive Bonus Mortgage Protection Mortgage Amount $ Other (please explain): b. Please provide an explanation on how the face amount was determined: 4. Source of Funds Payments made with foreign currency or payments drawn on or originating from a foreign bank or other foreign source are prohibited. Funding through a Mortgage/Reverse Mortgage or Home Equity Loan is prohibited.

4 Earned Income Mutual Fund/Brokerage Account Money Market Fund Savings Loans Annuity Contract Other Life Insurance Policy Qualified Monies - IRA, Beneficial IRA, 401K, SEP, 403B (provide details): Inheritance (provide details): Other (provide details): Premium Financing - If financing will be used, please answer the following questions: a. Name of the company who is administering the premium finance: b. Name of lender providing the funds (include name of lender and address): c. What type of loan? .. Recourse Non-recourse d. Is the client obligated to repay the loan? .. Yes No3. Premium/Billing InformationFrequency Billed/Planned Premium Amount Single Premium Annual Semi-Annual Quarterly Monthly $If Monthly, complete EFT AuthorizationTotal Amount Submitted with the Application First Year Lump Sum Amount 1035 Exchange Amount$ $ $Is lump sum coming from a 1035 Exchange of a life Insurance policy?

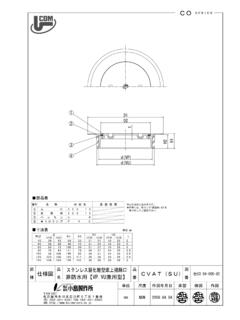

5 Ye s NoIf this is a replacement of a life Insurance policy, was that contract a Modified Endowment Contract (MEC)? .. Ye s NoThe Payor is: Proposed primary insured Proposed owner Other If other, complete Supplemental Life Insurance ApplicationPage 3 of 17 Return to Home OfficeLAPP-03-PA02(1/2018)6. Product Information Allianz Life Pro+ EliteSM Fixed Index Universal Life Insurance PolicySpecified Face Amount Risk Class Death Benefit Option (check one) A - Specified AmountIf no option is selected, Option A will be issued. B - Specified Amount plus Accumulation Value C - Specified Amount plus Total Premium PaidDefinition of Life Insurance Test (check one) Cash Value Accumulation Test (CVAT)If no option is selected, GPT will be issued.

6 Guideline Premium Test (GPT)AllocationsSelect the following allocations in increments of 1 . The minimum allocation is 1% and the total must equal 100%.Optional Riders Supplemental Term Rider Amount $ (Minimum greater than $25,000/maximum 5 times or 10 times the Base Specified Amount based on age and risk class) Child Term Rider units ($1,000 per Minimum 5 units/maximum 10 units.) Complete Supplemental Life Insurance Application Other Insured Term Rider Amount $ Complete Supplemental Life Insurance Application Waiver of Specified Premium Rider Amount $ Enhanced Liquidity Rider (check one) .. 50% 100%Standard Indexed AllocationsAllianz True BalanceSM annual sum %S&P 500 Index annual point-to-point %S&P 500 Index monthly sum %Blended index annual point-to-point %Fixed Allocation %Bonused Indexed AllocationsAllianz True BalanceSM annual sum %Bloomberg US Dynamic Balance Index IIannual point-to-point %PIMCO Tactical Balanced Indexannual point-to-point %S&P 500 Index annual point-to-point %S&P 500 Index monthly sum %S&P 500 Index trigger method %Blended index annual point-to-point %Blended index monthly average %Page 4 of 17 Return to Home OfficeLAPP-03-PA02(1/2018)6.

7 Product Information (continued) Allianz Life Pro+ SurvivorSM Fixed Index Universal Life Insurance PolicySpecified Face Amount Risk Class Death Benefit Option (check one) A - Specified AmountIf no option is selected, Option A will be issued. B - Specified Amount plus Accumulation Value C - Specified Amount plus Total Premium PaidDefinition of Life Insurance Test (check one) Cash Value Accumulation Test (CVAT)If no option is selected, GPT will be issued. Guideline Premium Test (GPT)AllocationsSelect the following allocations in increments of 1 . The minimum allocation is 1% and the total must equal 100%. Bloomberg US Dynamic Balance Index IIFixed Allocation % annual point-to-point with annual floor %Blended index annual point-to-point % S&P 500 Index annual point-to-point %Blended index annual point-to-point with annual floor % S&P 500 Index monthly sum %Blended index monthly average % S&P 500 Index trigger method %Optional Riders Enhanced Liquidity Rider (check one).

8 50% 100% Estate Protection Rider Waiver of Specified Premium Rider for proposed first insured Amount $ Waiver of Specified Premium Rider for proposed second insured Amount $ First to Die Rider Amount $ First to Die Rider Beneficiary(s) Information (Complete each beneficiary section for each respective proposed insured):Proposed first insured beneficiary - Type of beneficiary: Individual Trust CorporationFirst Name/Trust or Corporation Name MI Last NameDate of Birth/Date of Trust Social Security Number/TIN Relationship to proposed insuredAddress (street required) City State ZIP CodePhone Number Trustee Name(s) Type Percentage Primary ContingentProposed second insured beneficiary - Type of beneficiary.

9 Individual Trust CorporationFirst Name/Trust or Corporation Name MI Last NameDate of Birth/Date of Trust Social Security Number/TIN Relationship to proposed insuredAddress (street required) City State ZIP CodePhone Number Trustee Name(s) Type Percentage Primary Contingent Page 5 of 17 Return to Home OfficeLAPP-03-PA02(1/2018) Allianz Asset Pro+SM Fixed Index Universal Life Insurance PolicySpecified Face Amount Risk Class Death Benefit Option (check one) A - Specified AmountIf no option is selected, Option A will be issued. B - Specified Amount plus Accumulation Value C - Specified Amount plus Total Premium PaidDefinition of Life Insurance Test (check one) Cash Value Accumulation Test (CVAT)If no option is selected, GPT will be issued.

10 Guideline Premium Test (GPT)AllocationsSelect the following allocations in increments of 1 . The minimum allocation is 1% and the total must equal 100%.Fixed Allocation % Bloomberg US Dynamic Balance Index IIAllianz True BalanceSM annual sum % annual point-to-point %Blended index annual point-to-point % S&P 500 Index annual point-to-point %Optional Riders Additional Term Rider Amount $ (Minimum $25,000/maximum 6 times the Base Specified Amount) Child Term Rider units ($1,000 per Minimum 5 units/maximum 10 units.) Complete Supplemental Life Insurance Application Enhanced Liquidity Rider (check one) .. 50% 100% Other Insured Term Rider Amount $ Complete Supplemental Life Insurance Application Waiver of Specified Premium Rider Amount $ 6.