Transcription of Local sales & use tax rates and changes

1 Local sales & use tax rates and changesLocal sales /use tax changes (Effective January 1, 2022)(Effective January 1, 2022) City of Bainbridge Island sales and use tax within the City of Bainbridge Island will increase one-tenth of one percent (.001). The tax will be used for housing and related services. City of PaterosSales and use tax within the City of Pateros will increase two-tenths of one percent (.002). The tax will be used for transportation of PoulsboSales and use tax within the City of Poulsbo will increase one-tenth of one percent (.001). The tax will be used for housing and related CountySales and use tax within Skagit County, except for Anacortes, will increase one-tenth of one percent (.)

2 001). The tax will be used for housing and related changes (annexations)(Effective January 1, 2022)(Effective January 1, 2022)The following locations have annexations/boundary changes this quarter. To look up a specific address please see our tax rate lookup tool at for details. Effective January 1 - March 31, 2022 Washington State Dept. of RevenueNew call center hoursOur call center s hours have recently changed. The Department s general tax and licensing call center hours are now as follows:Monday, Tuesday, Thursday and Friday 8 to 5 9 to 5 main numbers are:360-705-6741 Business licensing360-705-6705 Tax Assistance360-705-6706 Espa ol (impuestos y licencias)360-704-5900 Remote sales and consumer use tax360-534-1502 Unclaimed propertySmall Business Requirements and Resources Webinars Attend a webinar with business-friendly representatives from the Washington state Departments of Revenue, Employment Security, Labor & Industries, and the Governor s Office of Regulatory Innovation and Assistance.

3 We ve teamed up to bring important information to businesses. Choose from one of the following webinars: Start a Business in Washington state. Grow your business in Washington now at Dates for 2022 will be added soon. Can t wait for the next session? You ll also find recorded ver-sion available for each trouble logging into My DOR?Check out our My DOR help pages. We have tips to help if you re having issues logging into My education videos availableTo help educate businesses, we provide videos covering various topics including: My DOR help - Learn the basics of our secure portal, My DOR. Administrative review and hearings process - A video series that provides an overview of the appeals process.

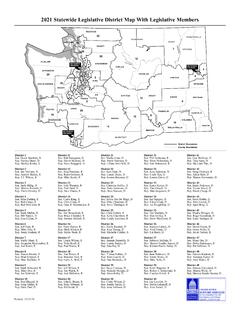

4 Tax information for the construction industry - If you re a contractor, this video will help you determine your state tax can find these videos and others at CountyRitzvilleBenton CountyKennewick Prosser RichlandChelan County Wenatchee Clark CountyCamas Ridgefield Washougal Franklin County PascoGrant County MattawaKing CountyEnumclaw EverettOkanogan County WinthropPacific CountyRaymond Pierce CountyPuyallup Pend Oreille County NewportSkagit CountySedro Woolley Snohomish CountyLake Stevens SultanSpokane County Liberty Lake Thurston CountyLaceyWalla Walla CountyWalla WallaWhatcom CountyEverson Whitman CountyPullman Yakima CountyGrandviewReminders and notifications Want to receive reminders and notifications via email or text?

5 Read about our service and sign up at Already subscribed? We have several new topics that you might interest you. Update your subscriber preferences on that same web page, or click the Manage subscriptions or Unsubscribe link in the footer of any bulletin you ve received from us. (11/15/21)- 1 -(11/15/21)- 2 -LocationSales/Use TaxCounty/City Loc. CodeLocal RateState RateCombined sales Tax (1)ADAMSU nincorp. Areas .. Areas .. (City) .. Areas .. PTBA* .. City .. Richland .. Areas .. (City) .. Areas .. Angeles .. Areas .. PTBA* .. Ground .. Center .. Areas .. TaxCounty/City Loc. CodeLocal RateState RateCombined sales Tax (1)COWLITZU nincorp.

6 Areas .. Rock .. Areas .. PTBA* .. Wenatchee .. Island .. Areas .. Areas .. PTBA* .. Areas .. Areas .. City .. Coulee .. Lake .. City .. Lake .. Creek .. sales and use tax ratesTax changes are blue and boldedEffective January 1 - March 31, 2022(We update tax rates every quarter. Please visit for current rates .)Note: For footnote information, please see the bottom of page 6.(11/15/21)- 3 -LocationSales/Use TaxCounty/City Loc. CodeLocal RateState RateCombined sales Tax (1)GRAYS HARBORU nincorp. Areas .. Tribes - Unincorp. Areas .. Tribes - Oakville .. Shores .. Areas .. Harbor .. Areas .. Tribe - Unincorp. Jefferson County .. (Eff. 1/1/22)Unincorp.

7 Areas .. Non-RTA .. Non-RTA .. Arts Village .. Non-RTA .. Diamond .. Moines .. Way .. Tribe - Federal Point .. Non-RTA .. Non-RTA .. Forest Park .. TaxCounty/City Loc. CodeLocal RateState RateCombined sales Tax (1)KING (cont.)Maple Valley .. Island .. Non-RTA .. Park .. Bend .. Non-RTA .. Non-RTA .. Non-RTA .. Non-RTA .. Point .. (Eff. 1/1/22)Unincorp. Areas .. Island .. Orchard .. Tribe - Unincorp. Kitsap County .. Areas .. Elum .. (City) .. Cle Elum .. Areas .. Salmon .. Areas .. Tribes - Unincorp. Areas .. (11/15/21)- 4 -LocationSales/Use TaxCounty/City Loc. CodeLocal RateState RateCombined sales Tax (1)LEWIS (cont.)Mossyrock.

8 Ell .. Areas .. Areas .. Tribe - Unincorp. Areas .. (Eff. 1/1/22)Unincorp. Areas .. PTBA* .. Dam .. City .. (City) .. Areas .. Beach .. Bend .. OREILLEU nincorp. Areas .. Tribe - Pend Oreille County .. TaxCounty/City Loc. CodeLocal RateState RateCombined sales Tax (1)PEND OREILLE (cont.)Metaline Falls .. (Eff. 1/1/22)Unincorp. Areas .. Areas Non-RTA.. Areas Non-RTA HBZ .. PTBA* .. PTBA* Non-RTA . PTBA* HBZ .. Tribe - Unincorp. Areas RTA .. Tribe - Unincorp. Areas Non-RTA .. Tribe - Unincorp. Areas Non-RTA .. Tribe - Unincorp. Areas PTBA* RTA .. Lake .. Lake Non-RTA.. Tribe - .. Tribe - Fife .. Harbor .. Harbor HBZ .. Tribe - Milton.

9 Tribes - .. Tribe - Puyallup .. Prairie .. Tribe - Tacoma Place .. JUANU nincorp. Areas .. Harbor .. (11/15/21)- 5 -LocationSales/Use TaxCounty/City Loc. CodeLocal RateState RateCombined sales Tax (1)SKAGIT (Eff. 1/1/22)Unincorp. Areas .. Areas PTBA* .. Conner .. Vernon .. Tribe - La Tribe - Skagit County .. Tribe - Skagit County PTBA* .. Areas .. Bonneville .. Areas .. Areas Non-RTA .. PTBA* .. PTBA* Non-RTA . Tribes - Unincorp. PTBA Non-RTA .. Bar .. Falls .. Stevens .. Tribes - Marysville .. Creek .. Terrace .. (City) .. Areas .. PTBA* .. TaxCounty/City Loc. CodeLocal RateState RateCombined sales Tax (1)SPOKANE (cont.)Airway Heights.

10 Park .. Tribe - Airway .. Lake .. Lake .. (City) .. Valley .. Areas .. Falls .. Areas .. PTBA* .. Tribes - Unincorp. Areas .. Tribes - Unincorp. Areas .. Tribes - Unincorp. Areas PTBA* .. Tribes - Unincorp. Areas .. Tribes - Lacey .. Tribes - Tumwater .. Areas .. WALLAU nincorp. Areas .. PTBA* .. Place .. Walla (City) .. (11/15/21)- 6 -LocationSales/Use TaxCounty/City Loc. CodeLocal RateState RateCombined sales Tax (1)WHATCOMU nincorp. Areas .. PTBA* .. Unincorp. Areas .. John .. Areas .. City .. Gap .. (City) .. : (1) Combined sales tax includes the state rate, the Local rate, and Regional Transit Authority (RTA) rate. If you have rate questions, go to our web site at , or call 360-705-6705.