Transcription of MAKE EVERY STEP COUNT. - Apollo Munich

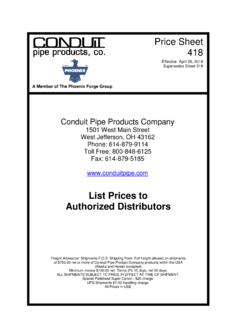

1 SAVE8%SAVE5%SAVE2%RATE CARDE njoy Stay Active benefit with Easy Health Individual Health Insurance EVERYSTEP Goods & Services Tax & Cess (if any)Staying healthy and saving money are now just a walk EVERY step count with Stay Active benefit and earn upto 8% discount on renewal our Stay Active you and your family can now walk your way to healthier and happier Stay Active and other Uncomplicated benefits, the Easy Health Insurance Plan not only helps you stay healthy but also financially protects you in illness. The Easy Health Plan comes in three variants with multiple sum insured options to choose from to suit your Individual Health Insurance Plan with attractive benefits*Premium rates only for renewalEASY HEALTH -STANDARDAge Band1 Lakh2 Lakhs3 Lakhs4 Lakhs5 Lakhs10 Lakhs15 Lakhs91 days -172,576 3,550 4,101 4,794 5,120 5,551 5,903 7,07518-353,184 4,241 4,900 5,727 6,117 7,234 8,147 9,76536-454,098 4,799 5,545 6,481 6,923 8,287 9,404 11,271 46-505,898 7,021 8,111 9,480 10,127 12,253 13,992 16,771 51-557,237 8,876 10,255 11,987 12,804 15,620 17,924 21,483 56-608,221 11,459 13,239 15,474 16,529 20,366 23,505 28,173 61-6511,416 15,913 18,385 21,489 22,954 28,565 33,156 39,740 66-70*15,752 21,958 25,368 29,651 31,673 39,595 46,077 55,228 71-75*19,030 26,528 30,647 35,822 38,264 48,140 56,220 67,386 76-80*22,836 31,833 36,777 42,987 45,917 58,178 68,210 81.

2 757 >80*26,262 36,608 42,293 49,435 52,804 67,788 80,048 95,946 EASY HEALTH -EXCLUSIVEAge Band3 Lakhs4 Lakhs5 Lakhs10 Lakhs15 Lakhs20 Lakhs25 Lakhs50 Lakhs91 days -174,3975,2256,1396,384 7,408 8,359 9,251 10,044 12,951 18-355,2536,2427,3358,813 10,226 11,538 12,769 13,864 17,877 36-455,9457,0648,30010,172 11,803 13,317 14,738 16,002 20,634 46-508,69610,33412,14215,134 17,560 19,814 21,928 23,808 30,699 51-5510,99513,06515,35219,388 22,496 25,382 28,091 30,499 39,328 56-6014,19416,86719,81925,425 29,501 33,286 36,839 39,996 51,574 61-6519,71123,42327,52235,863 41,613 46,952 51,963 56,417 72,748 66-70*27,19832,32037,97549,841 57,832 65,252 72,216 78,406 101,102 71-75*32,85839,04645,87860,812 70,562 79,616 88,113 95,665 123,358 76-80*39,43046,85555,05473,781 85,610 96,595 106,904 116,067 149,665 >80*45,34453,88463,31286,587 100,469 113,361 125,458 136,212 175,642 EASY HEALTH -PREMIUMAge Band4 Lakhs5 Lakhs10 Lakhs15 Lakhs20 Lakhs25 Lakhs50 Lakhs91 days -176,4717,6047,9079,175 10,077 10,969 11,762 14,669 18-357,7319,08410,91512,665 13,910 15,141 16,235 20,249 36-458,74910,28012,59814,618 16,054 17,475 18,739 23,371 46-5012,79815,03818,74421,749 23,886 26,001 27,880 34,772 51-5516,18219,01324,01227,862 30,599 33,308 35,716 44,545 56-6020,89124,54631,48936,538 40,128 43,680 46,838 58,415 61-6529,01034,08744,41751,538 56,602 61,613 66,067 82,398 66-70*40,02947,03461,72971,626 78,664 85,627 91,817 114,514 71-75*48,36056,82275,31887,393 95,980 104,476 112,029 139,721 76-80*58,03268,18691,380106,031 116,449 126,757 135,920 169,519 >80*66,73778,414107,240124,434 136,660 148,758 159,511 198.

3 941 Annual Premium for National Capital Region and Mumbai Metropolitan Region(Excluding Goods & Services Tax & Cess (if any) in INR)*Premium rates only for renewalEASY HEALTH -STANDARDAge Band1 Lakh2 Lakhs3 Lakhs4 Lakhs5 Lakhs10 Lakhs15 Lakhs91 days -17 1,874 2,797 3,496 4,335 4,755 5,257 5,668 6,793 18-35 2,316 3,341 4,177 5,179 5,680 6,858 7,822 9,376 36-45 2,980 3,781 4,727 5,861 6,428 7,859 9,029 10,822 46-50 4,290 5,531 6,914 8,574 9,403 11,620 13,435 16,102 51-55 5,264 6,994 8,742 10,840 11,889 14,815 17,209 20,627 56-60 5,979 9,029 11,286 13,994 15,349 19,319 22,568 27,050 61-65 7,983 12,056 15,070 18,686 20,495 26,058 30,610 36,689 66-70* 11,016 16,635 20,793 25,784 28,279 36,122 42,539 50,987 71-75* 13,308 20,097 25,121 31,150 34,164 43,921 51,903 62,212 76-80* 15,970 24,116 30,145 37,380 40,997 53,084 62,973 75,479 >80* 18,365 27,733 34,667 42,987 47,147 61,862 73,901 88.

4 579 EASY HEALTH -EXCLUSIVEAge Band3 Lakhs4 Lakhs5 Lakhs10 Lakhs15 Lakhs20 Lakhs25 Lakhs50 Lakhs91 days -173,8114,7255,7016,0367,1348,2799,1639, 94812,82818-354,5535,6456,8118,3329,8471 1,42812,64813,73217,70736-455,1526,3897, 7089,61711,36613,19014,59815,84920,43746 -507,5369,34511,27414,30916,91019,62521, 71923,58130,40751-559,52911,81614,25518, 33021,66325,14127,82430,20938,95356-6012 ,30115,25418,40324,03828,40832,96936,488 39,61551,08361-6516,42620,36824,57332,60 238,53044,71649,48853,73069,28366-70*22, 66528,10433,90745,31053,54862,14568,7777 4,67296,28871-75*27,38233,95340,96355,28 465,33575,82583,91791,1101,17,48376-80*3 2,85840,74449,15667,07479,26991,9951,01, 8131,10,5401,42,538>80*37,78746,85556,52 978,71593,0271,07,9631,19,4841,29,7261,6 7,278 EASY HEALTH -PREMIUMAge Band4 Lakhs5 Lakhs10 Lakhs15 Lakhs20 Lakhs25 Lakhs50 Lakhs91 days -175,8527,0617,4768,8359,98110,86411,650 14,52918-356,9928,43510,32012,19613,7771 4,99716,08120,05636-457,9129,54611,91114 ,07715,90117,30918,56023,14846-5011,5741 3,96417,72220,94423,65925,75327,61534,44 151-5514,63417,65522,70226,83030,30832,9 9135,37644,12056-6018,89222,79329,77235, 18539,74643,26446,39157,85961-6525,22630 ,43540,37947,72153,90758,67962,92178,474 66-70*34,80841,99456,11766,32174,91881,5 5087,4451,09,06171-75*42,05250,73468,471 80,92091,40999,5011,06,6941,33,06876-80* 50,46360,88183,07398,1771,10,9031,20,721 1,29,4481,61,446>80*58,03270,01397,4911, 15,2171,30,1521,41,6741,51,9161,89,468 Optional Benefit - Critical Illness (On Individual basis only)Annual Premium for Rest of India (Excluding Goods & Services Tax & Cess (if any) in INR)

5 Age Band1 Lakhs2 Lakhs3 Lakhs4 Lakhs5 Lakhs10 Lakhs91 days-17314661769211512215322930618-35116 1732312893474334625788661,15536-45354531 7088851,0621,3271,4151,7692,6543,53846-5 07761,1641,5521,9412,3292,9113,1053,8815 ,8227,76251-551,2791,9182,5573,1973,8364 ,7955,1146,3939,59012,78656-602,0203,030 4,0405,0506,0607,5758,08010,10015,15020, 20061-653,0114,5176,0227,5289,03311,2921 2,04415,05522,58330,11166-70*4,9827,4739 ,96412,45514,94618,68319,92824,91137,366 49,821>70*10,97616,46321,95127,43932,927 41,15943,90254,87882,3171,09,756 Discounts 2 Year Premium : Discount on premium if Insured Person is paying premium of 2 years in advance For example :(1) Proposed Insured Age 33 years opting for Easy Health Individual Standard (Rest of India) 2 year policy with Sum Insured of Rs 2 Lakhs. Calculation 3341X 2 X = Rs. 6182/- plus taxes. (2) Proposed Insured Age 35 years opting for Easy Health Individual Standard (Rest of India)2 year policy with Sum Insured of Rs 2 Lakhs.

6 Calculation (3341+3781) X = Rs. 6589/- plus taxes. Family Discount :Family discount of 5 % if 2 members are covered and 10% if 3 or more family members are covered under Easy Health Individual Health Insurance Plan Family discount illustration incase of 2 members and 3 members. Stay ActiveUpto 8% discount on renewal premium subject to insured member achieving the average number of steps prescribed in the policy wordings by either walking or running regularly to keep fit. The discount will be accrued by the customer at defined time intervals and cumulated at the end of the policy period and offered as a discount on renewal ,833 5,490 18-357,767 8,947 36-4511,698 13,286 46-5018,115 20,584 51-5520,395 23,181 56-6022,434 25,500 61-6524,385 27,717 66-70*25,494 28,977 71-75*26,708 30,357 76-80*26,708 30,357 >80*26,708 30,357 Critical Advantage Rider Premiums (INR)Points to Remember The rider will be issued for a period of 1 or 2 year(s) period depending on policy tenure of base policy, the sum insured & benefits will applicable on Policy Year basis.

7 This rider can be issued on individual Sum Insured basis. This rider will be offered with Easy Health policy where base Sum Insured is Lakhs & BandUSD 250,000 USD 500,000 *Premium rates only for renewal(Goods & Services Tax & Cess (if any) to be charged as applicable)a. M r. A (husband) aged 32 and Mrs B (wife) aged 30 have applied for individual policy for 2 Lakhs sum insured, the premium calculation will be as followsPremium 4241 + 4241= 8482 Further 5% discount will be offered as family discount8482 - = + taxesb. Mr. A (husband) aged 32, Mrs B (wife) aged 30 and Baby C (child) aged 4 years have applied for individual policy for 2 Lakhs sum insured, the premium calculation will be as followsPremium 4241+ 4241 + 3550 = 12032 Further 10% discount will be offered as family discount12032 - = + taxesApollo Munich Health Insurance Co.

8 Processing Center, 2nd & 3rd Floor, iLABS Centre, Plot No. 404-405, Udyog Vihar, Phase-III, Gurgaon - 122 016, Haryana Corp. Off: 1st Floor, SCF -19, Sector - 14, Gurgaon - 122 001, Haryana. Regd. Off: Apollo Hospitals Complex, 8-2-293/82/J III/DH/900, Jubilee Hills, Telangana, Hyderabad - 500 Free Number: 1800 103 0555 Tel: +91 124 4584333 Fax : +91 124 4 5 8 4111 Website: more details on risk factors, terms and conditions please read sales brochure carefully before concluding a sale. Tax laws are subject to change. IRDAI Reg. No.: - 131 CIN: U66030TG2006 PLC051760 UIN: IRDAI/HLT/AMHI/P- may apply a risk loading on the premium payable (based upon the declarations made in the proposal form and the health status of the persons proposed for insurance). The maximum risk loading applicable for an individual shall not exceed above 100% per diagnosis/ medical condition and an overall risk loading of over 150% per person.

9 These loadings are applied from commencement date of the policy including subsequent renewal with us or on the receipt of the request of increase in sum insured (for the increased Sum Insured). We will inform you about the applicable risk loading through a counter offer letter. You need to revert to us with consent and additional premium (if any), within 15 days of the receipt of such counter offer letter. In case, you neither accept the counter offer nor revert to us within 15 days, we shall cancel your application and refund the premium paid within next 7 days. Please note that we will issue policy only after getting your consent and additional premium, if : All the above Premiums are excluding Taxes and applicable cess. Premium rates as per policy terms and conditions are for standard healthy individuals. These may change post underwriting of proposer based on medical test and information provided on Proposal Form.

10 Please visit our nearest branch to refer our underwriting guidelines if required. The premium under individual coverage will be charged on the completed age of the individual insured member. The Sum Insured of the dependent insured members should be equal to or less than the Sum Insured of the Primary Insured member. In case where two or more children are covered, the Sum insured for all the children must be same. Sum insured of all Dependent Parents and Dependent Parent in law must be same. The premium for the policy will remain the same for the policy period as mentioned in the policy schedule Premium rates are subject to change with prior approval from IRDAI. Your premium at renewal may change due to a change in your age or changes in the applicable tax rate. The premium will be computed basis the city of residence provided by the insured person in the application form.